The Acord 50 WM form, primarily used for workers' compensation insurance, shares similarities with the Acord 25 form. The Acord 25 is a general liability insurance application that collects essential information about the applicant and their business operations. Both forms require detailed information about the business, including its location, ownership structure, and types of coverage sought. This ensures that the insurer has a comprehensive understanding of the risks involved.

Another document that aligns closely with the Acord 50 WM form is the Acord 130 form. This form is utilized for commercial property insurance and requires information about the insured property, including its value and location. Like the Acord 50 WM, the Acord 130 also aims to assess risk and determine appropriate coverage levels, making it crucial for accurate underwriting.

The Acord 27 form, which is a business auto application, is similar in that it gathers information about vehicles used for business purposes. Both forms focus on risk assessment and require details about the insured’s operations. This helps insurers evaluate potential liabilities and establish appropriate premiums.

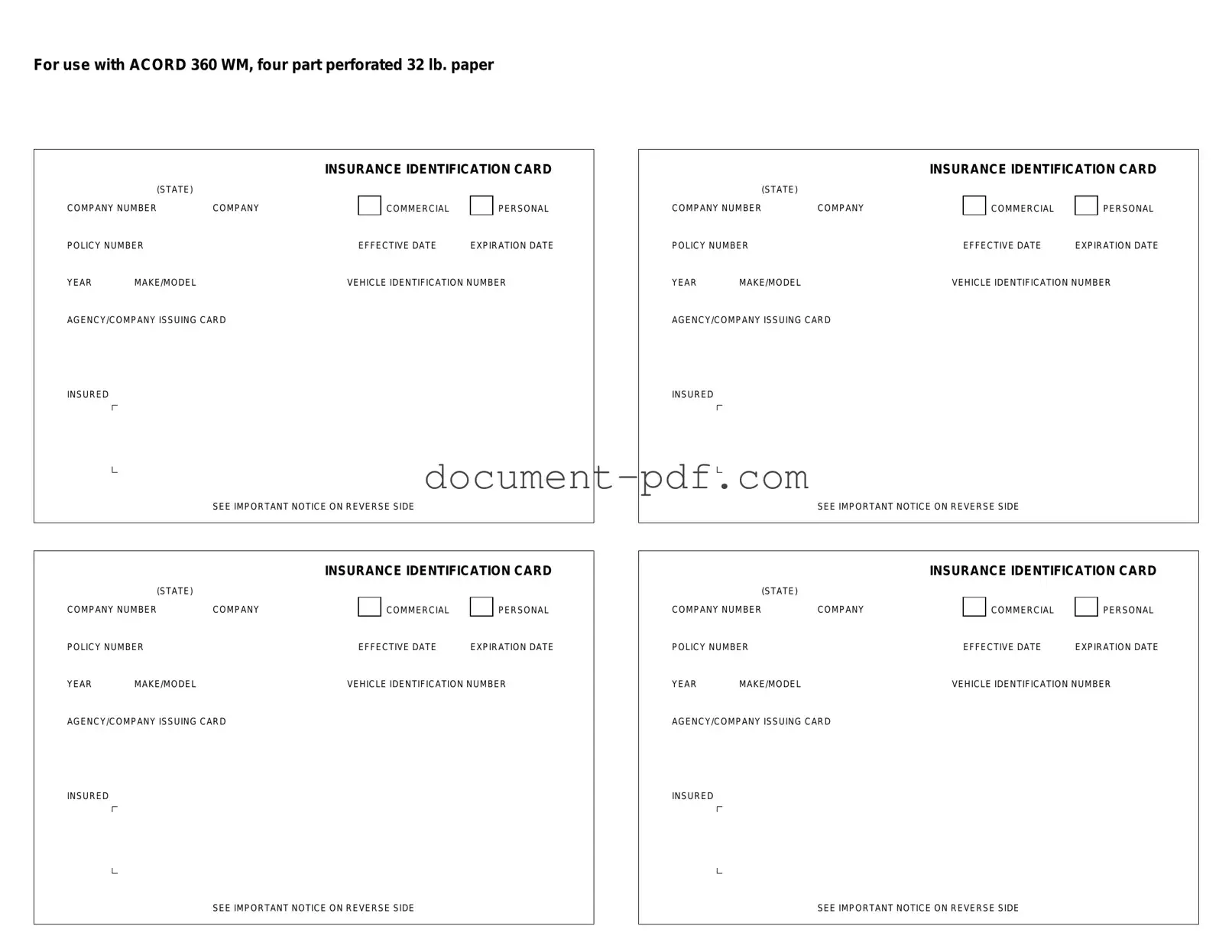

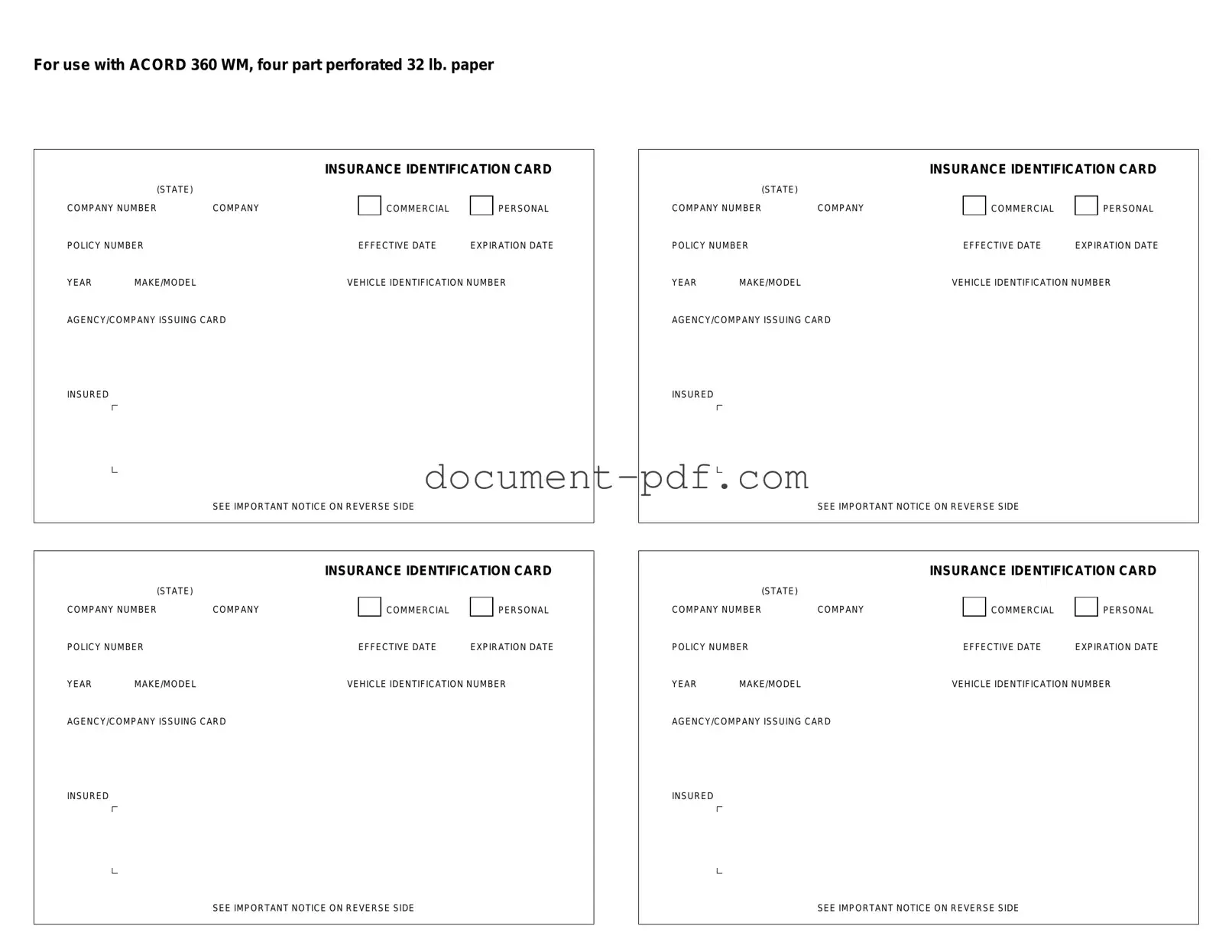

To effectively handle insurance-related transactions, it's important to have all necessary documentation in place. For those looking to understand and utilize essential forms like the Acord 50 WM, additional resources are available that provide comprehensive guidelines. For deeper insights and to aid in your documentation process, you can download the document in pdf to ensure you have the right forms and information at your fingertips.

In addition, the Acord 126 form, which is a commercial general liability application, shares a similar purpose with the Acord 50 WM. Both documents seek to collect vital information about the applicant’s business activities and risk exposure. This information is essential for determining coverage limits and exclusions in the policy.

The Acord 81 form, used for personal lines insurance, also bears resemblance to the Acord 50 WM. While the Acord 81 focuses on personal property and liability coverage, both forms require detailed personal information and descriptions of the insured’s assets. This ensures that the insurer can assess risk accurately and offer appropriate coverage options.

Furthermore, the Acord 855 form, which is a certificate of insurance, is another document that shares similarities with the Acord 50 WM. Both forms are designed to convey important information about coverage and limits to third parties. The Acord 855, however, serves as proof of insurance rather than an application for coverage.

The Acord 140 form, which is a commercial package policy application, also aligns with the Acord 50 WM. Both documents require comprehensive information about the business and its operations. This ensures that insurers can evaluate the risk and tailor coverage to meet the specific needs of the business.

The Acord 125 form, which is a commercial general liability application, is similar in its intent to gather information about the applicant's business activities. Both forms focus on risk exposure and require detailed descriptions of operations, which assists insurers in determining appropriate coverage and premiums.

The Acord 2 form, a property application, shares a common goal with the Acord 50 WM in that both are used to assess risk and establish coverage levels. The Acord 2 focuses on property-related risks, while the Acord 50 WM is centered around workers' compensation. However, both require detailed information about the insured entity.

Lastly, the Acord 51 form, which is specifically for professional liability insurance, also has similarities to the Acord 50 WM. Both forms collect critical information about the applicant's business and its potential liabilities. This is essential for insurers to evaluate risk and determine appropriate coverage limits.