The W-2 form is a document that employers provide to employees at the end of the year. It summarizes an employee's total earnings and tax withholdings for the year. Like the ADP Pay Stub, the W-2 shows gross income, federal and state tax deductions, and contributions to Social Security and Medicare. Employees use the W-2 to file their annual tax returns, making it an important document for understanding overall income and tax responsibilities.

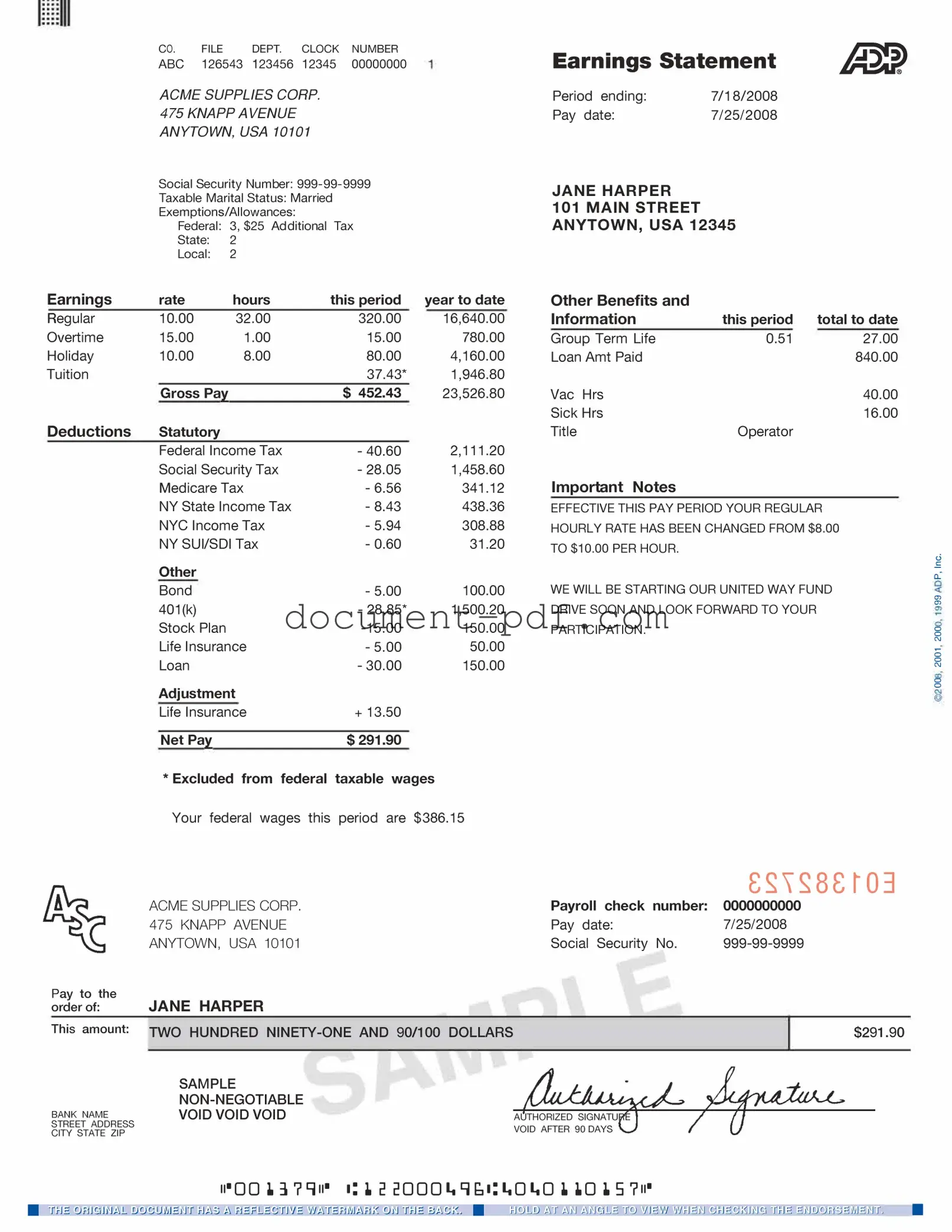

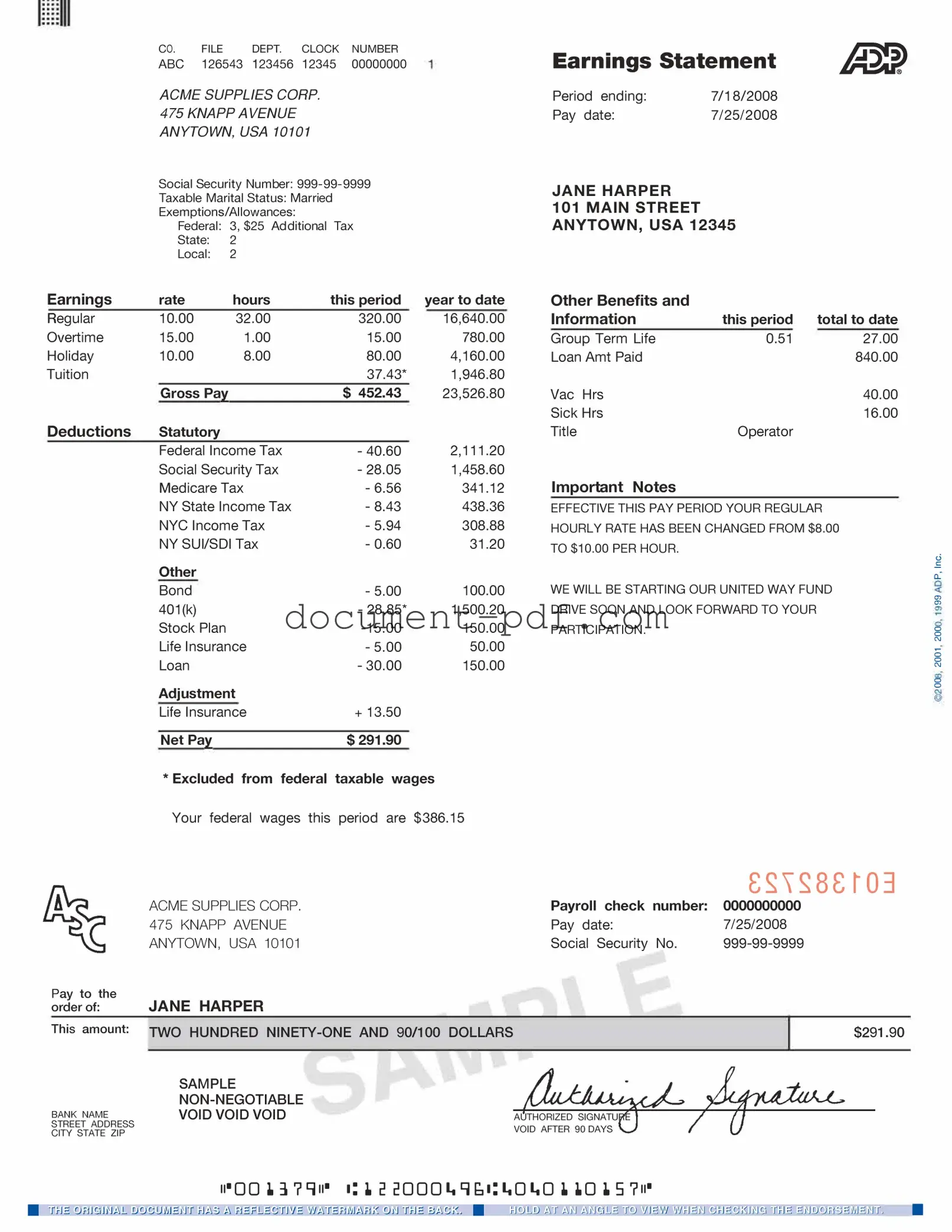

The pay statement from a different payroll service also serves a similar purpose. It details an employee’s earnings for a specific pay period, including hours worked, overtime, and deductions. This document, like the ADP Pay Stub, provides a breakdown of gross pay and net pay, allowing employees to track their earnings and deductions over time. Both documents help employees understand their compensation and any withholdings that affect their take-home pay.

The direct deposit receipt is another document that shares similarities with the ADP Pay Stub. When an employee receives their paycheck via direct deposit, a receipt is often provided that outlines the amount deposited into their account. This receipt typically includes details such as gross pay and deductions, similar to the information found on a pay stub. Both documents confirm the payment made to the employee and provide a record of earnings and deductions.

For those looking to transfer ownership, understanding the nuances of a trailer sale can be simplified by utilizing a relevant document. Ensure a smooth transaction by reviewing our guide on the essential elements of a comprehensive Trailer Bill of Sale, which details what information is needed for a successful transfer.

The 1099 form is issued to independent contractors and freelancers, summarizing their earnings for the year. While the ADP Pay Stub is used by employees of a company, the 1099 serves a similar function for non-employees. It details total income earned and any taxes withheld, allowing individuals to report their income accurately during tax season. Both documents highlight earnings and tax implications, though they cater to different employment situations.

The employment contract may also be considered similar in that it outlines the terms of employment, including salary and payment frequency. While it does not provide a breakdown of earnings like the ADP Pay Stub, it establishes the agreed-upon compensation structure. Both documents are important for understanding an employee's financial relationship with their employer, ensuring clarity regarding pay and expectations.