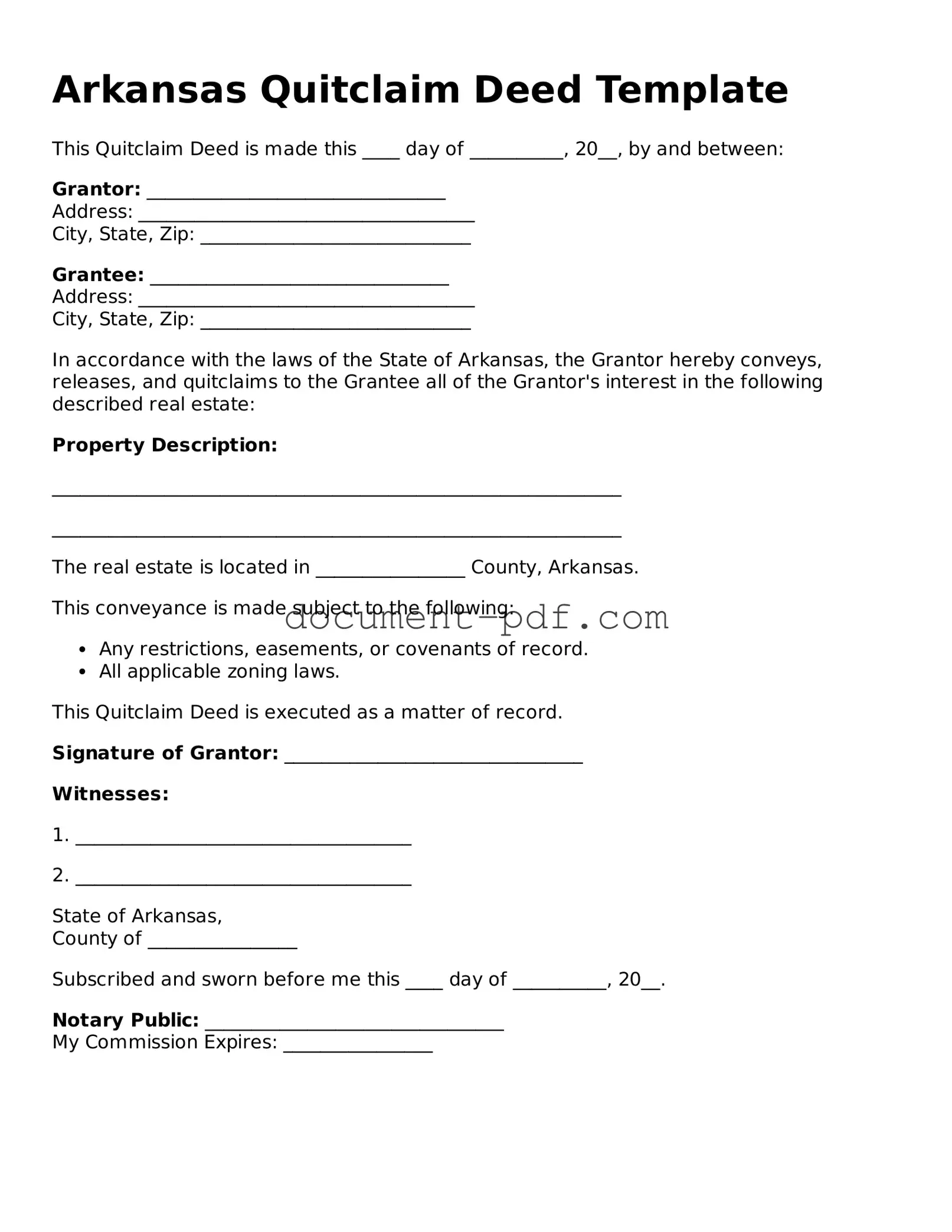

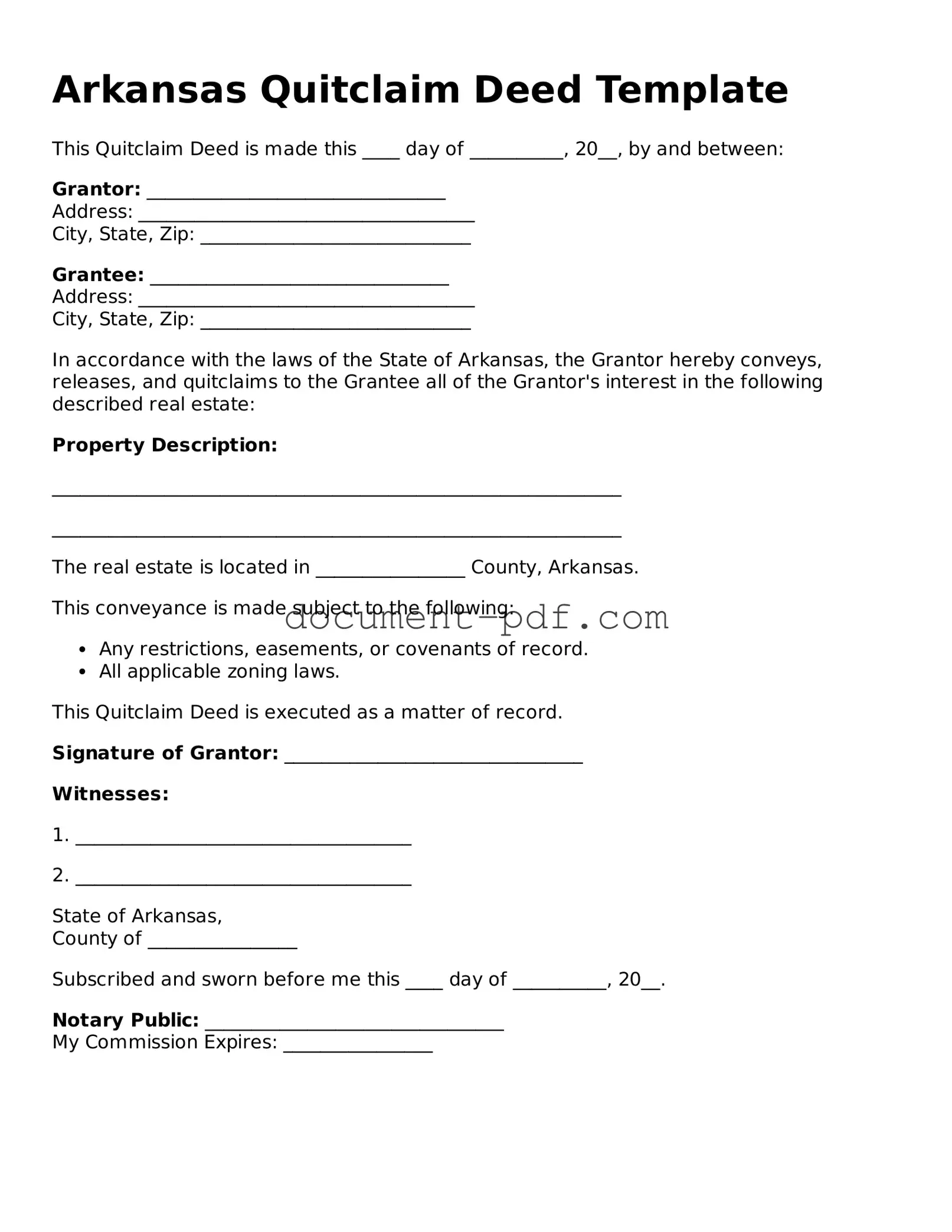

Attorney-Verified Arkansas Quitclaim Deed Template

A Quitclaim Deed is a legal document used in Arkansas to transfer ownership of real estate from one party to another without guaranteeing the title's validity. This form allows the granter to relinquish any claim to the property, making it a straightforward option for property transfers, particularly among family members or in situations where the title's history may not be fully clear. To get started with your property transfer, fill out the form by clicking the button below.

Access Quitclaim Deed Editor Here

Attorney-Verified Arkansas Quitclaim Deed Template

Access Quitclaim Deed Editor Here

Finish the form without slowing down

Edit your Quitclaim Deed online and download the finished file.

Access Quitclaim Deed Editor Here

or

Click for PDF Form