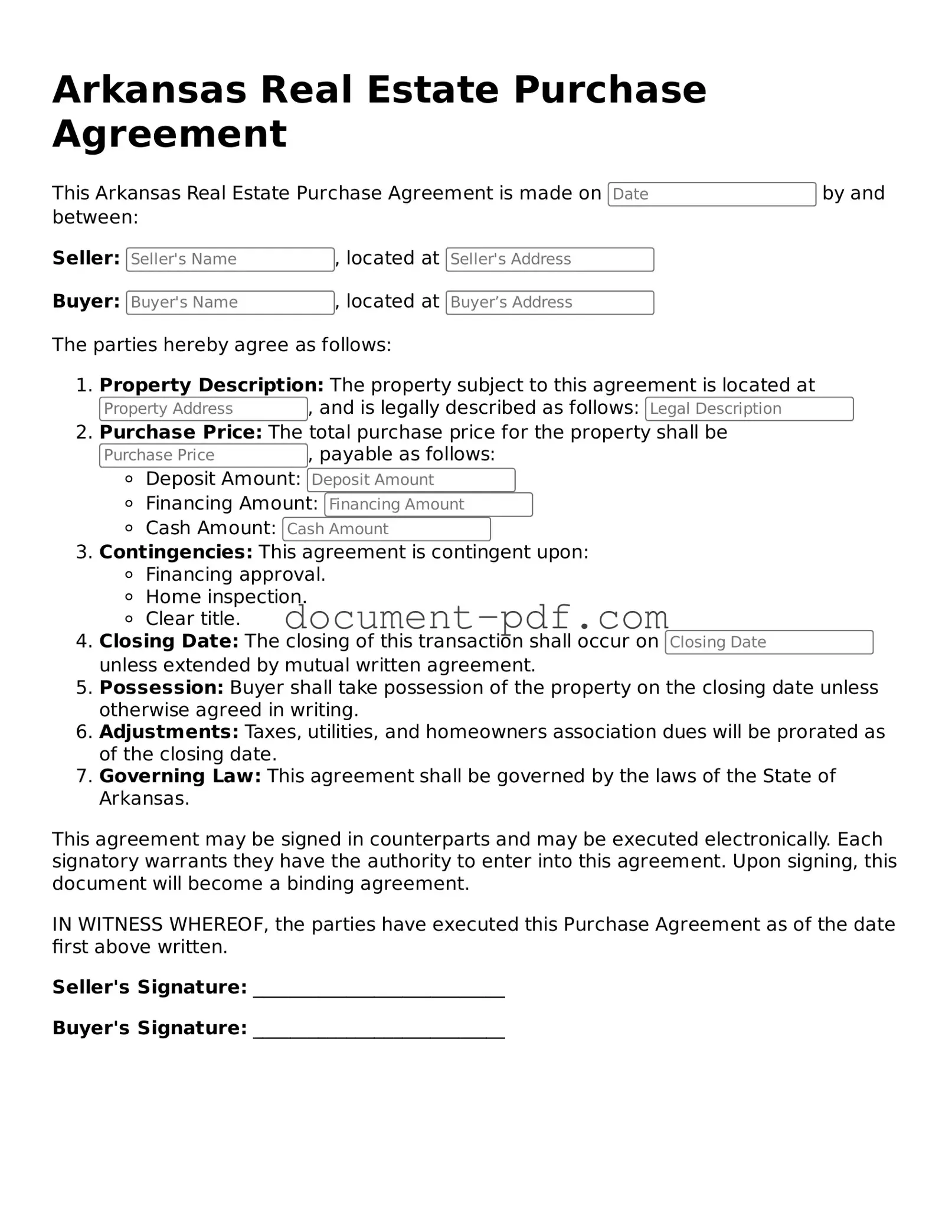

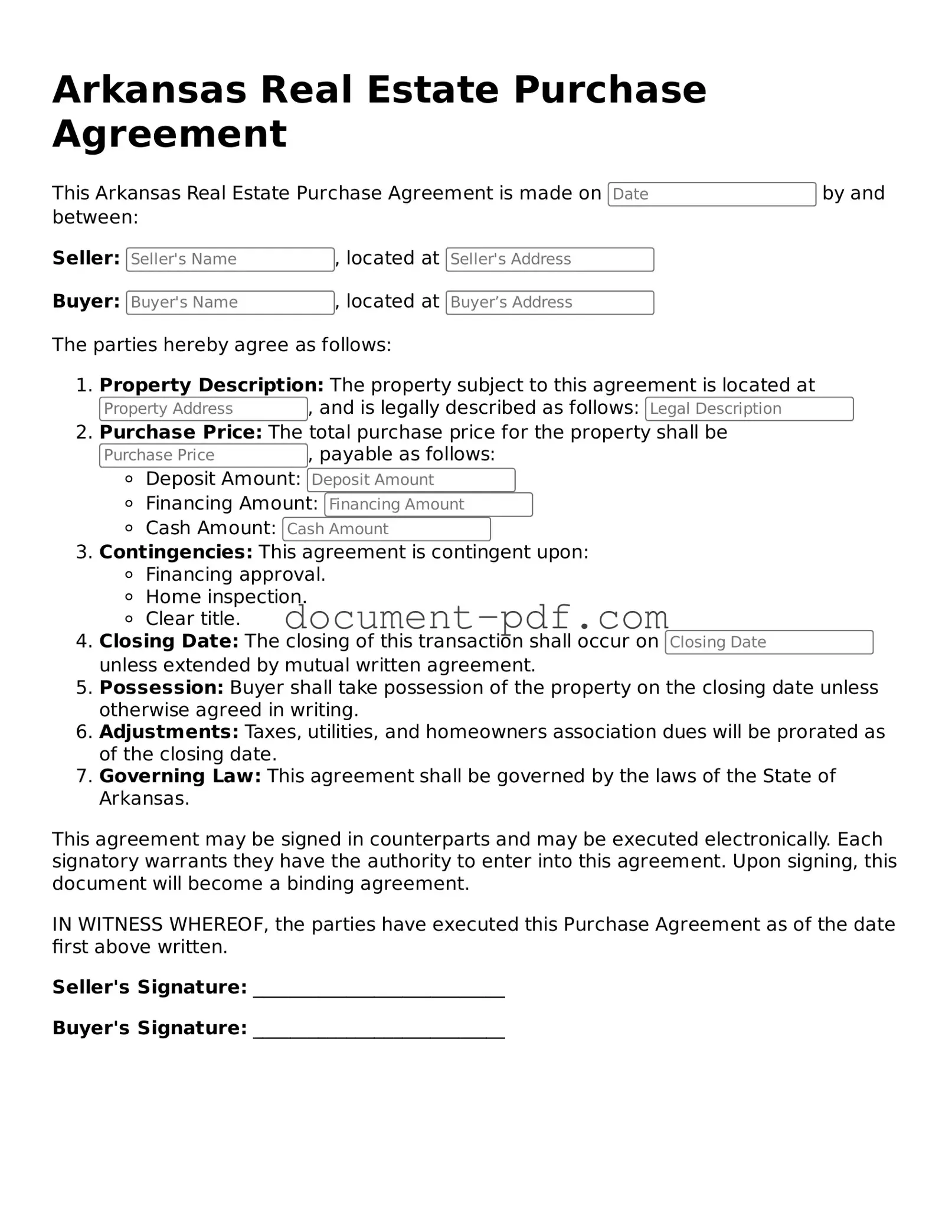

The Arkansas Real Estate Purchase Agreement is similar to the Residential Purchase Agreement. Both documents outline the terms and conditions under which a buyer agrees to purchase residential property. They detail the purchase price, financing arrangements, and contingencies, ensuring that both parties have a clear understanding of their obligations and rights. Each agreement serves as a binding contract once signed, protecting the interests of both the buyer and seller.

Another comparable document is the Commercial Purchase Agreement. This form is used for transactions involving commercial properties. Like the Residential Purchase Agreement, it specifies the terms of the sale, including price and contingencies. However, it also addresses unique elements relevant to commercial real estate, such as zoning laws and business operations, making it essential for commercial transactions.

The Lease Purchase Agreement shares similarities with the Arkansas Real Estate Purchase Agreement. This document allows a tenant to rent a property with the option to purchase it later. It outlines the rental terms and conditions while also specifying the purchase price and timeline for the sale. This agreement provides flexibility for buyers who may need time to secure financing or improve their credit before committing to a purchase.

For those navigating the complexities of retirement benefits, understanding the necessary forms is essential; the NYCERS F266 form specifically caters to members in Tier 3 and Tier 4 of the New York City Employees' Retirement System who aim to secure their Vested Retirement Benefit. This process necessitates the submission of a “notice of intention” form, which confirms the member’s choice to vest benefits after departing from City service. To gain more insights into this process, you can visit New York PDF Docs for detailed guidance and support.

The Option to Purchase Agreement is another related document. This agreement grants a potential buyer the exclusive right to purchase a property within a specified time frame. It typically requires the buyer to pay an option fee, which can be credited toward the purchase price. Both agreements focus on defining the terms of the potential sale, protecting the buyer's interest in the property while allowing the seller to retain ownership until the option is exercised.

A Quitclaim Deed is also relevant in real estate transactions. While it does not serve as a purchase agreement, it allows a property owner to transfer their interest in a property to another party without guaranteeing that the title is clear. This document can be used in conjunction with a purchase agreement when a buyer is willing to accept the property "as-is," understanding that there may be title issues.

The Seller's Disclosure Statement is another important document in real estate transactions. While it is not a purchase agreement, it complements the Arkansas Real Estate Purchase Agreement by requiring the seller to disclose known issues with the property. This transparency helps buyers make informed decisions and can prevent disputes after the sale. Both documents work together to ensure that buyers are aware of the property's condition before finalizing the purchase.

Lastly, the Real Estate Listing Agreement is similar in that it facilitates the sale of a property. This document is signed between the seller and a real estate agent, granting the agent the authority to market the property. While it does not outline the terms of sale, it sets the stage for the eventual purchase agreement by detailing the responsibilities of the agent and the seller. Both agreements play crucial roles in the overall real estate transaction process.