The first document that shares similarities with the Auto Insurance Card is the Vehicle Registration Card. This card is issued by the Department of Motor Vehicles (DMV) and serves as proof that a vehicle is legally registered in the state. Like the Auto Insurance Card, it contains essential details such as the vehicle identification number (VIN), make, model, and year of the vehicle. Both documents must be kept in the vehicle and presented when required, especially during traffic stops or accidents.

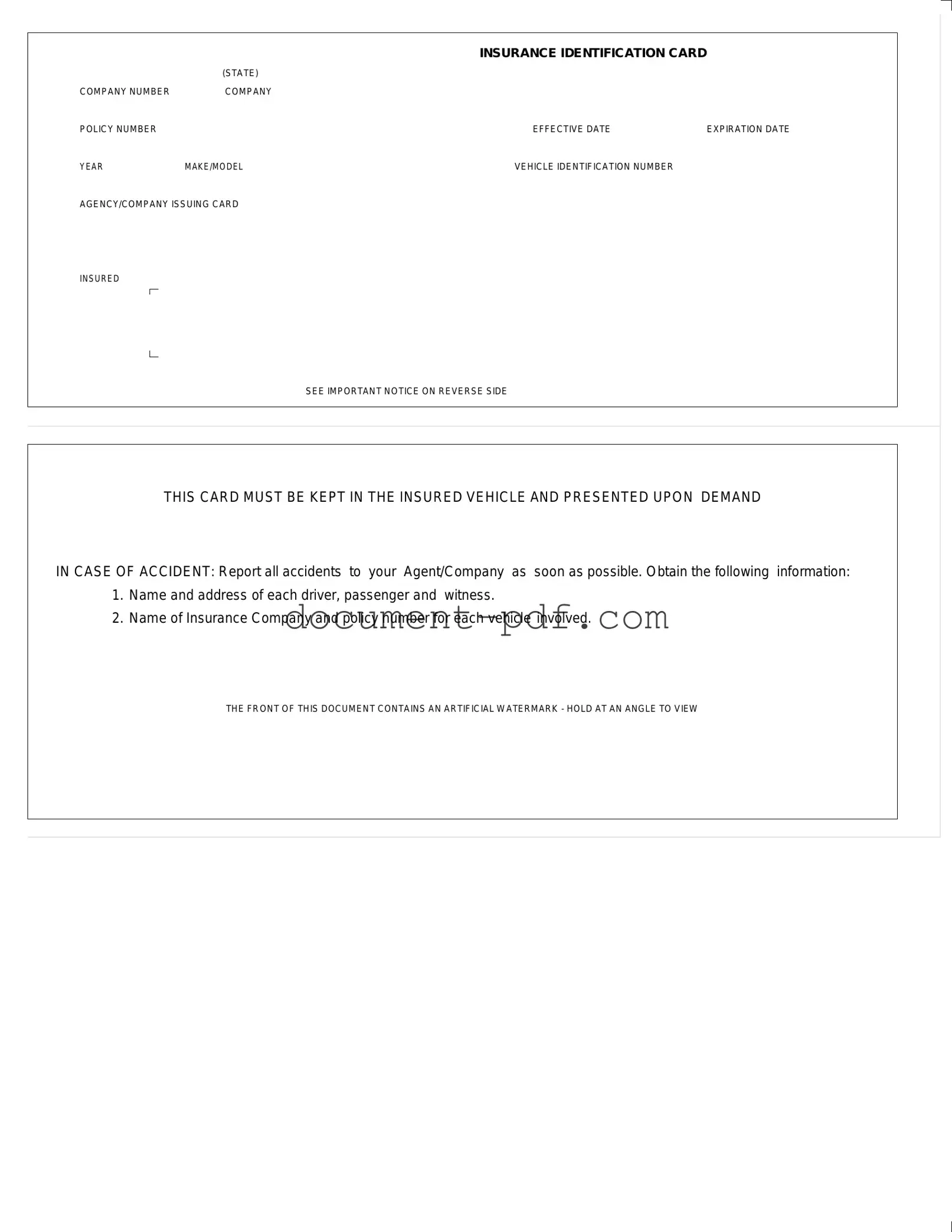

Another comparable document is the Proof of Insurance Certificate. This certificate is often provided by the insurance company and serves as verification that the vehicle is insured. Similar to the Auto Insurance Card, it includes the policy number, the effective and expiration dates of the coverage, and details about the insured vehicle. It is crucial to carry this document while driving, as it may be requested by law enforcement or in the event of an accident.

The New York Residential Lease Agreement is a pivotal document in the rental process that delineates the expectations and responsibilities of both landlords and tenants. This contract is essential for avoiding misunderstandings and ensuring a clear rental experience. For those looking to conveniently obtain this agreement online, resources like pdfdocshub.com offer accessible templates that cater to the specific needs of New York rental situations.

The Driver's License is also akin to the Auto Insurance Card in that it is an official identification document required for operating a vehicle. While the Auto Insurance Card provides information about the vehicle’s insurance coverage, the Driver's License includes personal details about the driver, such as name, address, and date of birth. Both documents must be presented when requested by law enforcement and are essential for legal driving.

A Roadside Assistance Card shares similarities with the Auto Insurance Card as well. This card provides information about a service that can assist drivers in case of breakdowns or emergencies. Like the Auto Insurance Card, it includes a policy number and contact information for the service provider. While the Auto Insurance Card focuses on liability coverage, the Roadside Assistance Card ensures drivers have help readily available should they encounter vehicle issues.

The Rental Car Agreement is another document that bears resemblance to the Auto Insurance Card. When renting a vehicle, this agreement outlines the terms of the rental, including insurance coverage options. Similar to the Auto Insurance Card, it contains critical information such as the rental company’s details, vehicle identification number, and the duration of the rental. Drivers must keep this agreement accessible during the rental period, especially if they need to provide proof of insurance or verify rental terms.

Lastly, the Title of the Vehicle is a document that can be compared to the Auto Insurance Card. The title serves as legal proof of ownership and includes information about the vehicle, such as the VIN and the owner's name. While the Auto Insurance Card focuses on insurance coverage, the title is essential for establishing ownership, and both documents are vital for any transactions involving the vehicle, such as selling or transferring ownership.