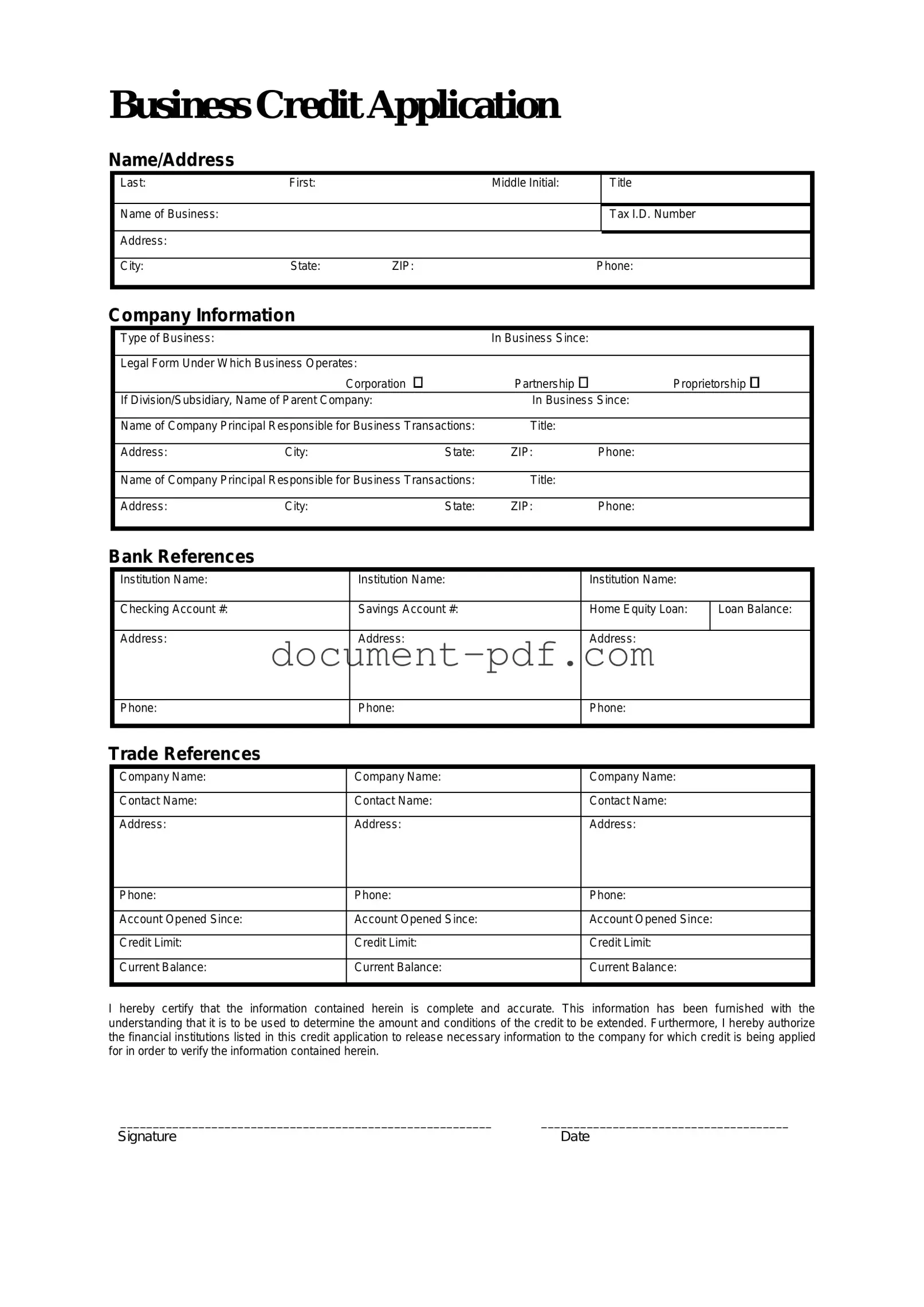

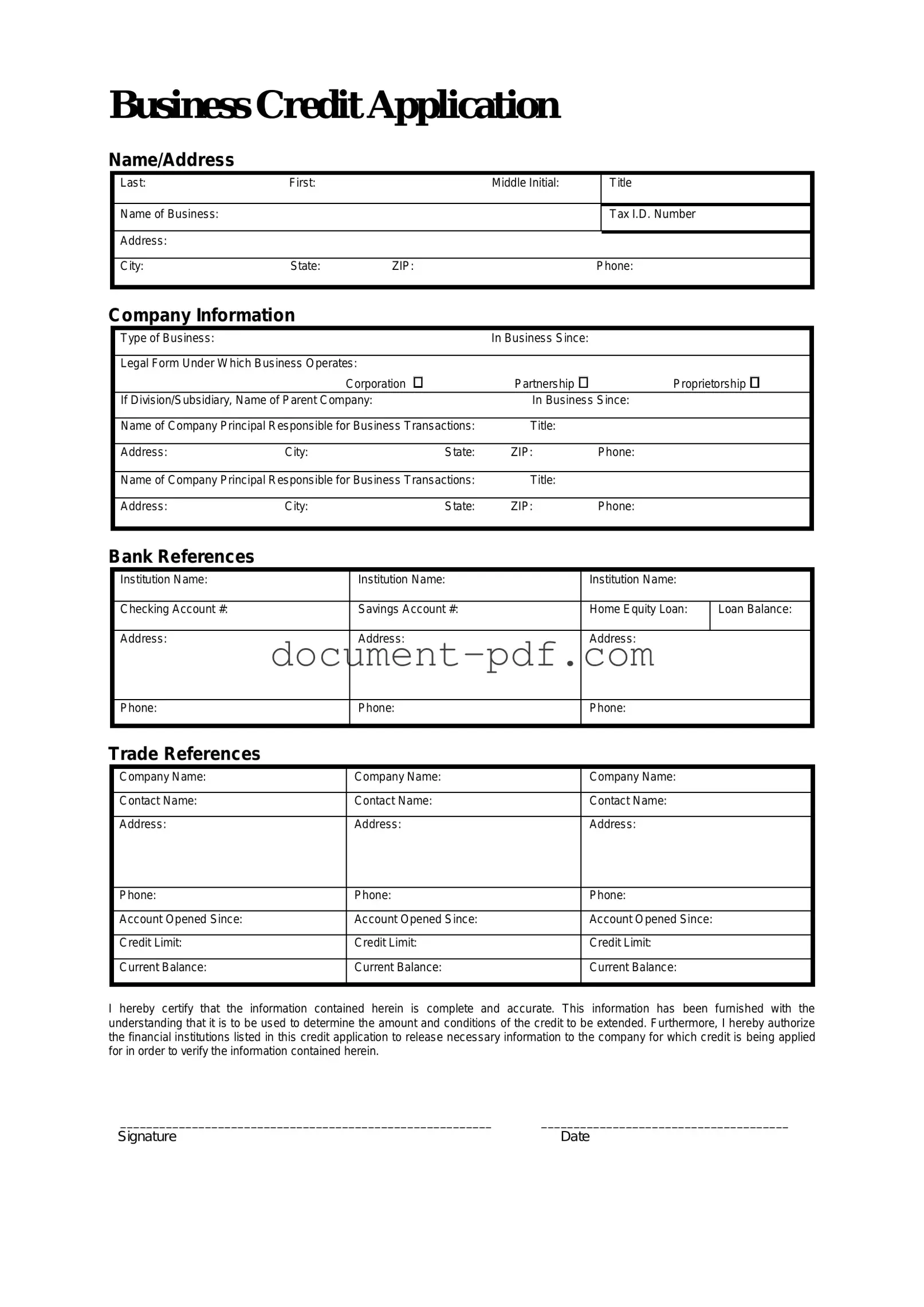

The Business Credit Application form shares similarities with the Personal Credit Application form. Both documents serve the purpose of assessing creditworthiness, but while the Business Credit Application focuses on a company's financial history and stability, the Personal Credit Application evaluates an individual's financial background. Information such as income, debts, and credit history is gathered in both forms to help lenders make informed decisions about extending credit.

Another document akin to the Business Credit Application is the Loan Application form. This form is often used when businesses seek financing for specific projects or expansions. Just like the Business Credit Application, it requires detailed information about the business’s finances, including assets, liabilities, and revenue. Both documents aim to provide lenders with a comprehensive view of the applicant's financial situation.

The Vendor Credit Application is also similar to the Business Credit Application. This document is typically used by suppliers to evaluate a business's creditworthiness before extending credit terms. Both forms ask for similar financial details, such as trade references and payment history, to determine if the applicant can meet payment obligations.

The Lease Application form bears resemblance to the Business Credit Application as well. When a business seeks to lease property or equipment, this form collects information about the company's financial standing. Both applications require financial statements and other relevant documents to assess the applicant's ability to fulfill lease obligations.

Additionally, the Business Loan Request form aligns closely with the Business Credit Application. This document is specifically designed for businesses seeking loans and requires detailed financial information to justify the request. Similar to the Business Credit Application, it assesses the overall financial health of the business to gauge the risk involved in lending.

The Partnership Agreement can also be compared to the Business Credit Application. While this document outlines the terms of a partnership, it often includes financial information about the partners and the business. Both documents require transparency about financial conditions, helping all parties involved understand the financial implications of their agreements.

The Financial Statement is another document that parallels the Business Credit Application. A financial statement provides a snapshot of a business’s financial health, including income, expenses, and net worth. Just like the Business Credit Application, it is essential for lenders to evaluate a company's ability to repay debts and manage credit effectively.

For those in need of a reliable means to document ownership transfer, the comprehensive Motorcycle Bill of Sale is essential for ensuring a smooth transaction. You can access the form here.

Lastly, the Corporate Resolution document is similar in that it often accompanies a Business Credit Application. This document confirms that the individuals signing the credit application have the authority to do so on behalf of the business. Both forms work together to ensure that the lender is protected and that the business is legally represented in its credit dealings.