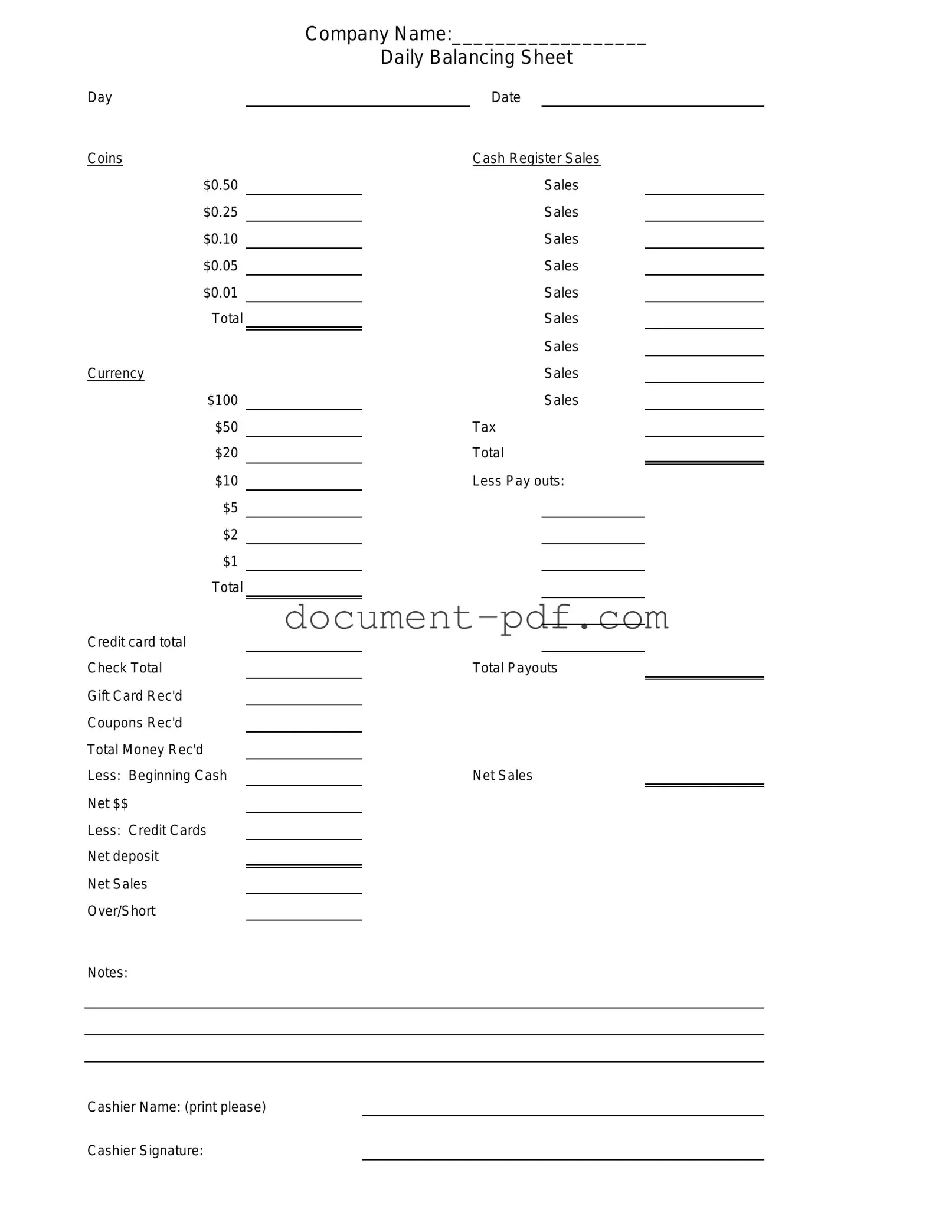

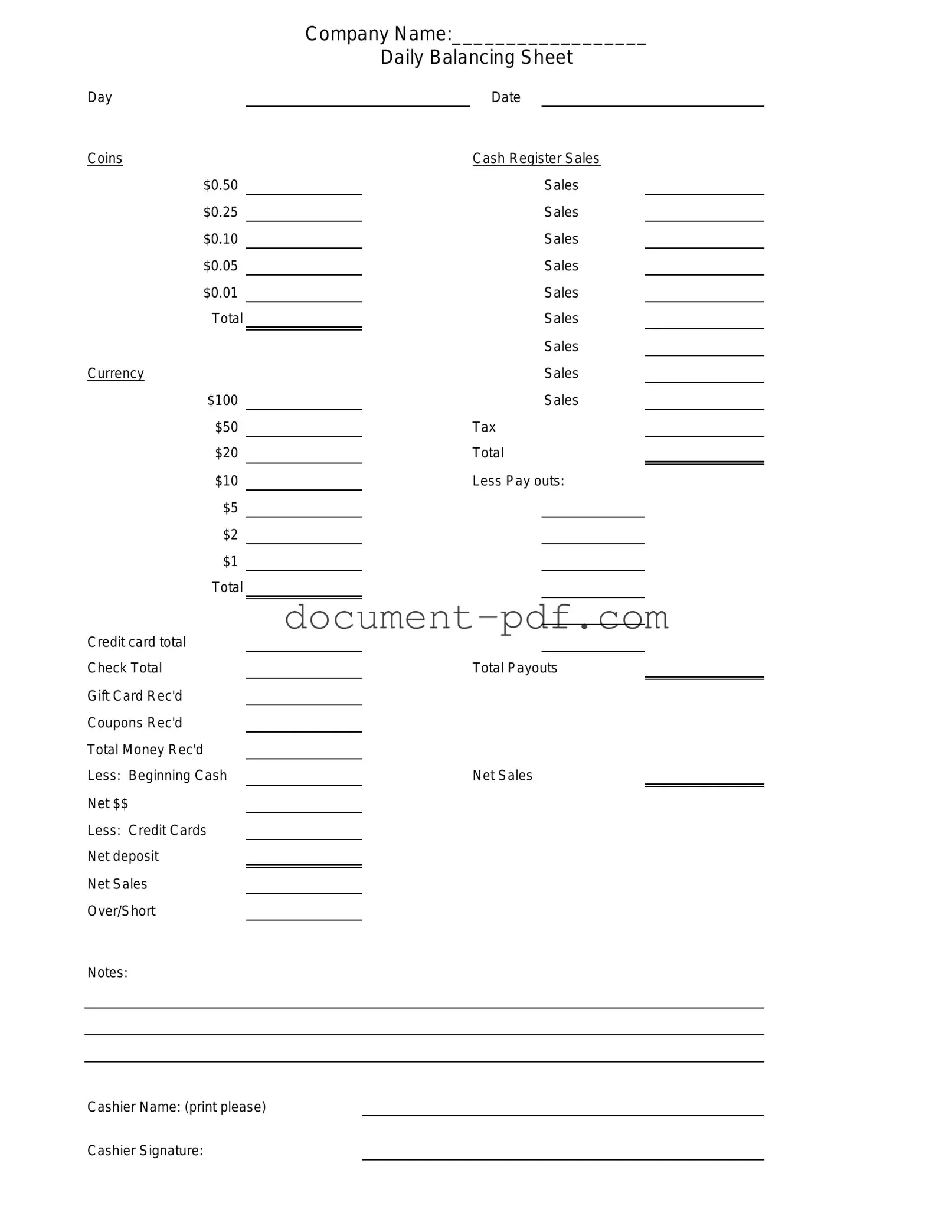

The Cash Register Reconciliation Sheet serves a similar purpose to the Cash Drawer Count Sheet. Both documents are used to ensure that the cash in the register matches the sales recorded during a specific period. While the Cash Drawer Count Sheet focuses on the physical count of cash in the drawer, the Reconciliation Sheet compares that count against the sales data to identify any discrepancies. This helps businesses maintain accurate financial records and detect potential errors or theft.

The Daily Sales Report is another document that aligns closely with the Cash Drawer Count Sheet. This report summarizes all sales transactions for a given day, providing a snapshot of revenue generated. While the Cash Drawer Count Sheet captures the actual cash present, the Daily Sales Report reflects the total sales, whether in cash, credit, or other forms. Together, they provide a comprehensive view of daily financial activity, ensuring that cash flow is properly managed.

The Petty Cash Log is also akin to the Cash Drawer Count Sheet. This document tracks small cash expenditures made for day-to-day operations. Similar to counting the cash in a drawer, the Petty Cash Log requires regular reconciliation to ensure that the amount spent aligns with the recorded transactions. Both documents help maintain accountability and transparency in cash handling practices.

The Bank Deposit Slip shares similarities with the Cash Drawer Count Sheet, as both involve cash handling. The Deposit Slip records the amount of cash being deposited into a bank account, while the Cash Drawer Count Sheet details the cash available at the end of a shift. Both documents are essential for accurate cash management, ensuring that funds are properly accounted for and securely transferred to the bank.

The Cash Flow Statement is another relevant document. While it provides a broader overview of cash inflows and outflows over a period, it complements the Cash Drawer Count Sheet by detailing how cash generated from sales is utilized. Both documents are crucial for understanding a business's financial health, with the Cash Drawer Count Sheet offering a snapshot of cash on hand, while the Cash Flow Statement provides insights into overall cash management.

The Invoice Record is also comparable to the Cash Drawer Count Sheet. Invoices document sales transactions and the amounts owed by customers. While the Cash Drawer Count Sheet focuses on cash currently in hand, the Invoice Record tracks amounts that are expected to be collected. Together, they help businesses manage their revenue and ensure that cash flow remains steady.

In the realm of business transactions, it is critical to have thorough documentation to validate sales and manage finances effectively. One such document that aids in the transfer of ownership is the Texas Motor Vehicle Bill of Sale form, an essential legal record for vehicle transactions. This form serves a vital purpose by providing proof of ownership, which can be beneficial for future title transfers and registration. For those needing to create or access this document, resources like Texas PDF Templates can simplify the process.

Lastly, the Expense Report is similar in that it tracks money going out of the business. While the Cash Drawer Count Sheet focuses on incoming cash, the Expense Report details the expenditures that affect overall cash flow. Both documents play a vital role in financial management, allowing businesses to monitor their financial status and make informed decisions.