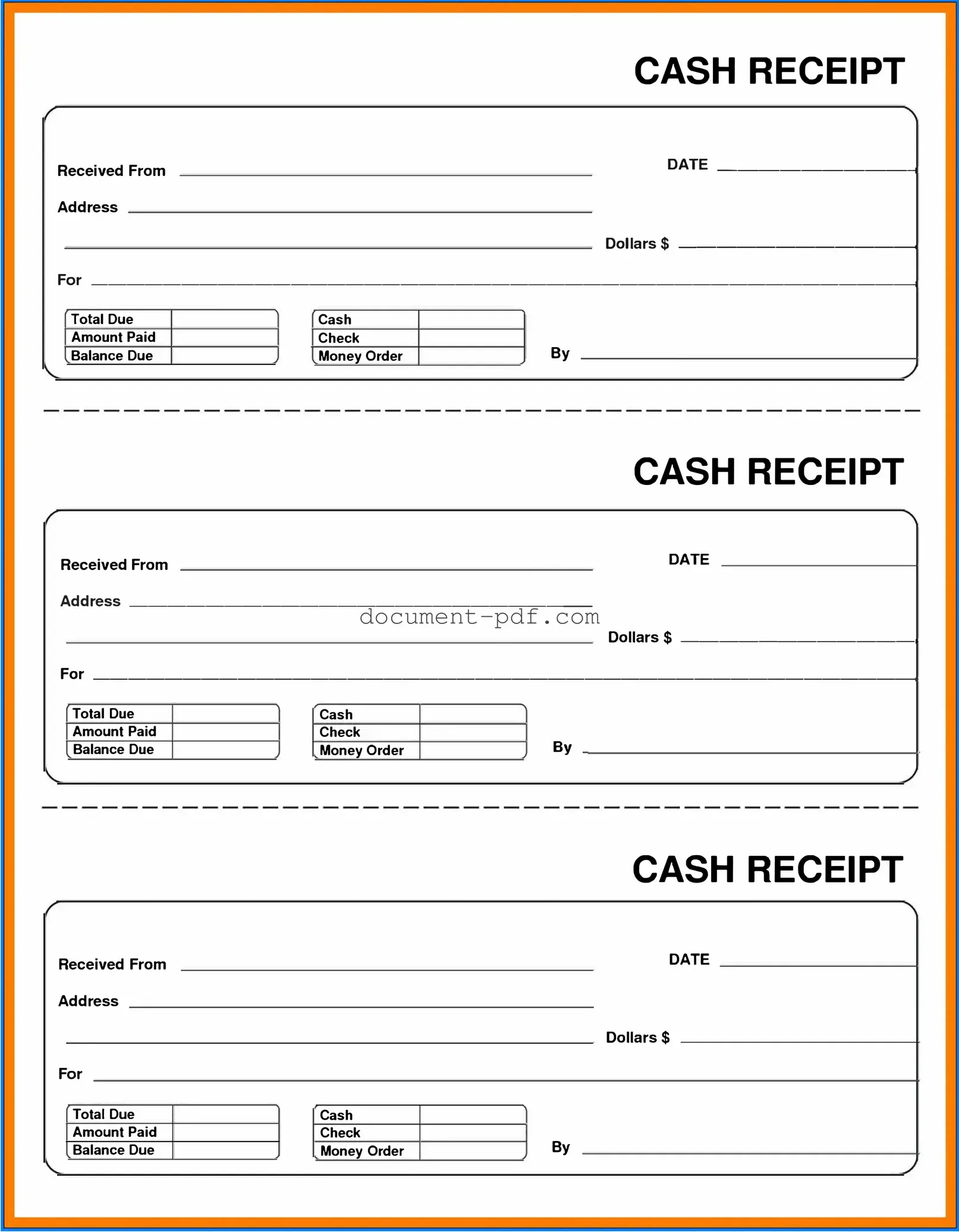

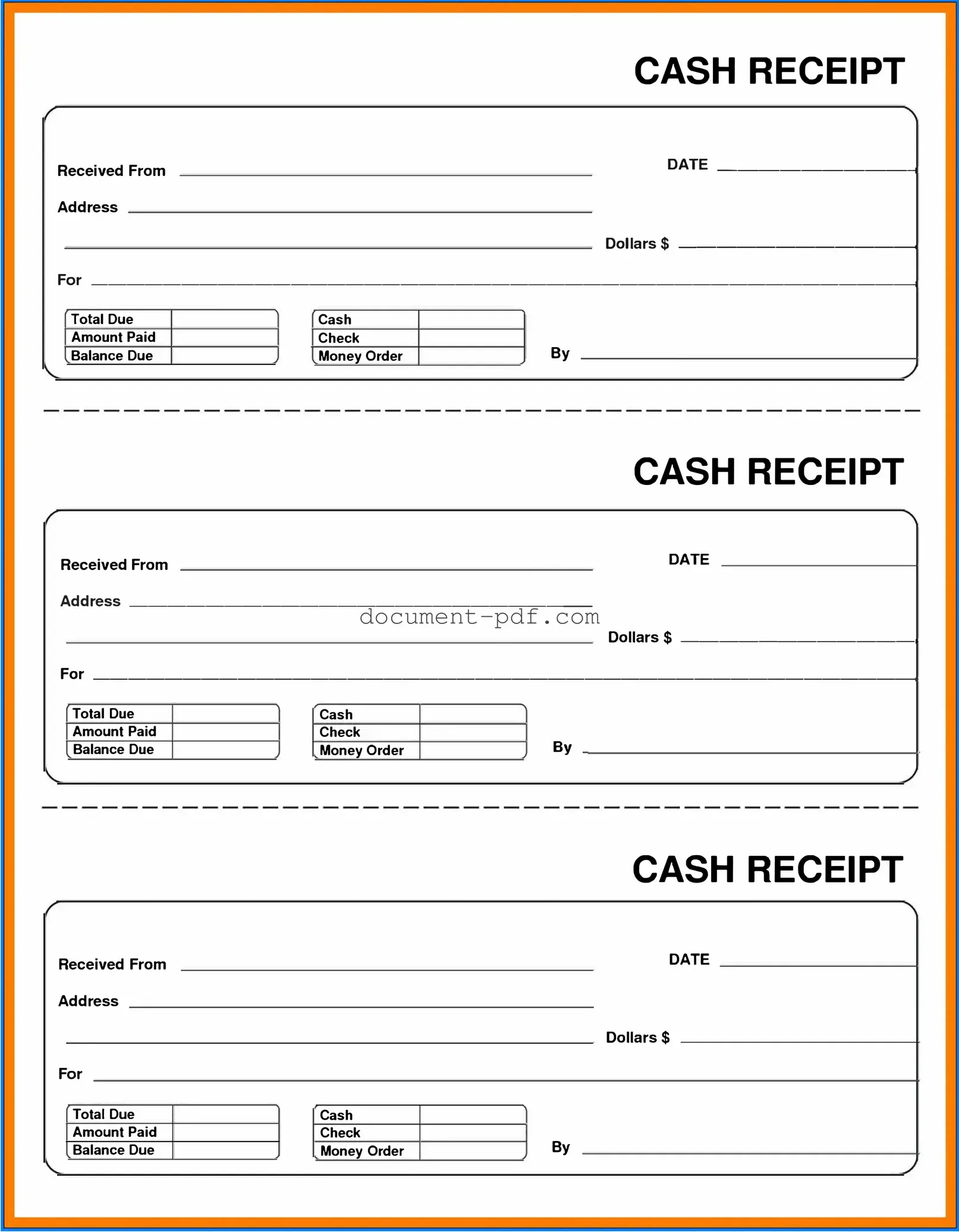

The Cash Receipt form serves as a vital document for recording cash transactions. Similar to the Invoice, which outlines the details of a sale and requests payment, the Cash Receipt confirms that payment has been received. Both documents include essential information such as the date, amount, and parties involved in the transaction. However, while an Invoice is sent to the customer, a Cash Receipt is issued after payment has been made, providing proof of the transaction.

Another document similar to the Cash Receipt form is the Payment Voucher. A Payment Voucher is used to authorize and document a payment made to a vendor or supplier. Like the Cash Receipt, it includes details about the transaction, such as the date and amount. However, the Payment Voucher typically requires additional approvals before payment is processed, whereas a Cash Receipt is generated post-payment.

The Deposit Slip also shares similarities with the Cash Receipt form. Both documents serve as proof of a transaction involving cash. A Deposit Slip is used when depositing cash into a bank account, detailing the amount being deposited and the account information. In contrast, the Cash Receipt confirms that cash has been received for goods or services, serving as a record for both the payer and payee.

The Sales Receipt is another document that closely resembles the Cash Receipt form. A Sales Receipt is issued to customers at the point of sale, providing them with proof of purchase. Both documents include similar details, such as the date, amount, and description of the transaction. The key difference lies in the timing; a Sales Receipt is given immediately after a purchase, while a Cash Receipt may be issued later, especially in cases of payments made outside a retail environment.

Similarly, the Acknowledgment of Receipt document is akin to the Cash Receipt form. This document serves as a confirmation that a payment or item has been received. It is often used in various contexts, such as legal or business transactions. Both documents emphasize the receipt of funds, but the Acknowledgment of Receipt may not always specify the amount received, whereas the Cash Receipt explicitly states it.

The Credit Memo is another document that can be compared to the Cash Receipt form. A Credit Memo is issued to adjust a previous invoice or to provide a refund to a customer. While a Cash Receipt confirms payment received, a Credit Memo indicates a reversal of that transaction, thereby documenting a credit rather than a cash inflow. Both documents are essential for maintaining accurate financial records.

The Expense Report also shares some characteristics with the Cash Receipt form. An Expense Report is used to document and request reimbursement for business-related expenses incurred by employees. Both documents require detailed information about the transaction, including amounts and dates. However, the Cash Receipt focuses on confirming payment received, while the Expense Report is concerned with tracking expenditures.

For those managing plumbing services, understanding the importance of documentation is essential, including the Texas Certificate of Insurance (COI), which serves as a verification of necessary insurance coverage for Master Plumbers. To learn more about this crucial document, visit https://texasformsonline.com/free-texas-certificate-insurance-template/.

Another similar document is the Receipt for Payment, which serves as a formal acknowledgment that a payment has been received. Like the Cash Receipt, it includes pertinent details such as the date, amount, and purpose of the payment. The primary distinction is that the Receipt for Payment may be used in various contexts, including services rendered, while the Cash Receipt is more specific to cash transactions.

Finally, the Bank Statement can be compared to the Cash Receipt form. A Bank Statement provides a summary of all transactions in a bank account over a specific period, including deposits and withdrawals. While the Cash Receipt documents a single cash transaction, the Bank Statement reflects the cumulative effect of multiple transactions, serving as a broader financial overview for account holders.