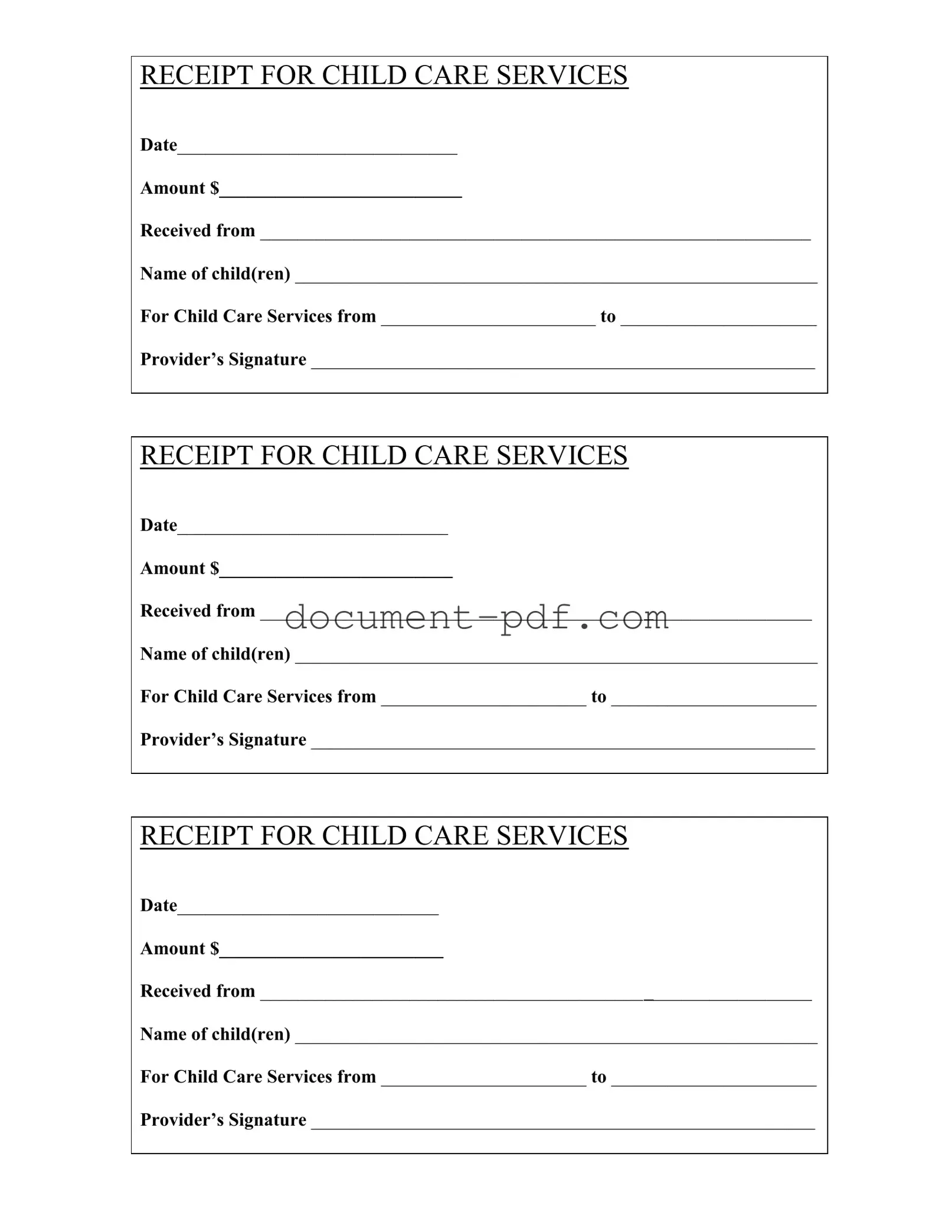

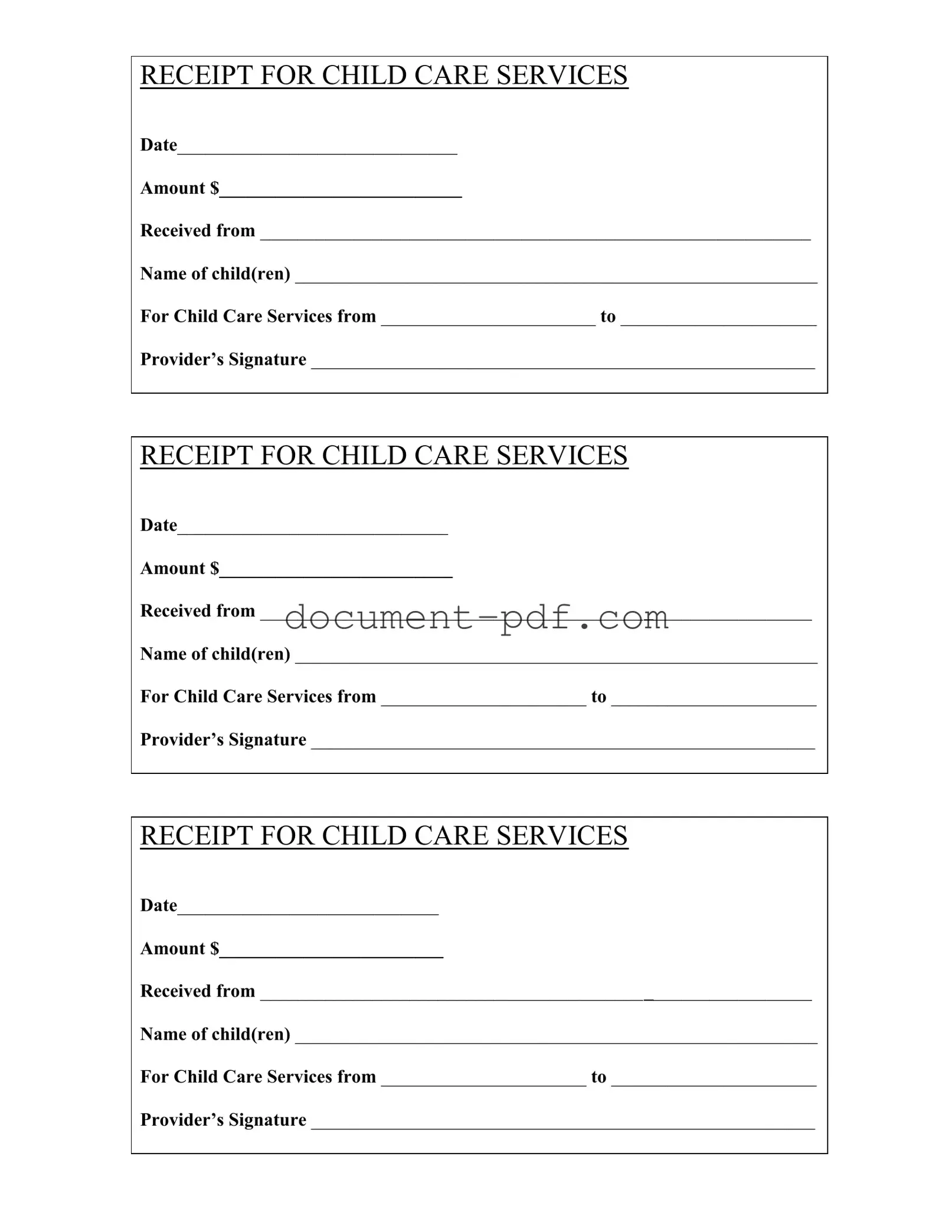

The Childcare Receipt form shares similarities with the Tuition Receipt form. Both documents serve as proof of payment for services rendered, detailing the amount paid and the recipient of the funds. Each form includes spaces for the date of payment and the name of the individual or entity providing the service, ensuring clarity and accountability in financial transactions. The structure is straightforward, which makes it easy for parents and service providers to understand the information presented.

Another document akin to the Childcare Receipt form is the Medical Receipt form. Like the childcare receipt, this document confirms payment for services, specifically in the healthcare sector. It typically includes the date, amount, and details about the patient receiving care. Both forms are essential for record-keeping and may be required for reimbursement purposes, making them vital for individuals managing their finances.

The Payment Receipt form also bears resemblance to the Childcare Receipt form. This document serves as a general acknowledgment of payment for various goods and services. It includes similar sections for the date, amount, and recipient's name. Both forms function to provide proof of payment, which can be used for personal records or tax purposes, thus enhancing their importance in financial documentation.

In addition, the Rental Receipt form shares characteristics with the Childcare Receipt form. This document is used to confirm payment for rental services, such as housing or equipment. It includes essential information, such as the date of payment and the amount received. Both forms help establish a clear record of transactions, which can be beneficial in disputes or for future reference.

The Donation Receipt form is another document similar to the Childcare Receipt form. It serves as proof of a charitable contribution, detailing the donor's name, the amount donated, and the date of the donation. Both receipts are important for tax purposes, allowing individuals to claim deductions for their contributions or payments. The structure and clarity of information in both forms help ensure that all parties are aware of the transaction details.

The Invoice Receipt form also resembles the Childcare Receipt form. This document provides a detailed account of services rendered and payments made, including the date, amount, and description of services. Both forms aim to document financial transactions, ensuring that both the provider and the recipient have a clear understanding of what has been paid for, which is crucial for maintaining accurate financial records.

Similarly, the Event Registration Receipt form shares similarities with the Childcare Receipt form. This document confirms payment for attending an event, detailing the amount paid and the registrant's information. Both forms serve to validate transactions and provide essential information for record-keeping, whether for personal use or for organizational purposes.

If you're looking to complete the necessary documentation for your motorcycle transaction in New York, consider utilizing the pdfdocshub.com for a streamlined process that ensures all required details are captured effectively.

The Sales Receipt form is another document that aligns with the Childcare Receipt form. It serves as proof of purchase for goods sold, including the date, amount, and item description. Both forms are essential for consumers and service providers, as they confirm that a transaction has occurred and can be used for returns, exchanges, or warranty claims.

Lastly, the Service Agreement Receipt form is comparable to the Childcare Receipt form. This document outlines the terms of service provided and confirms payment for those services. It includes similar elements such as the date and amount paid, ensuring that both parties have a clear understanding of the transaction. Both forms play a critical role in establishing the legitimacy of financial exchanges and can be referenced in case of disputes.