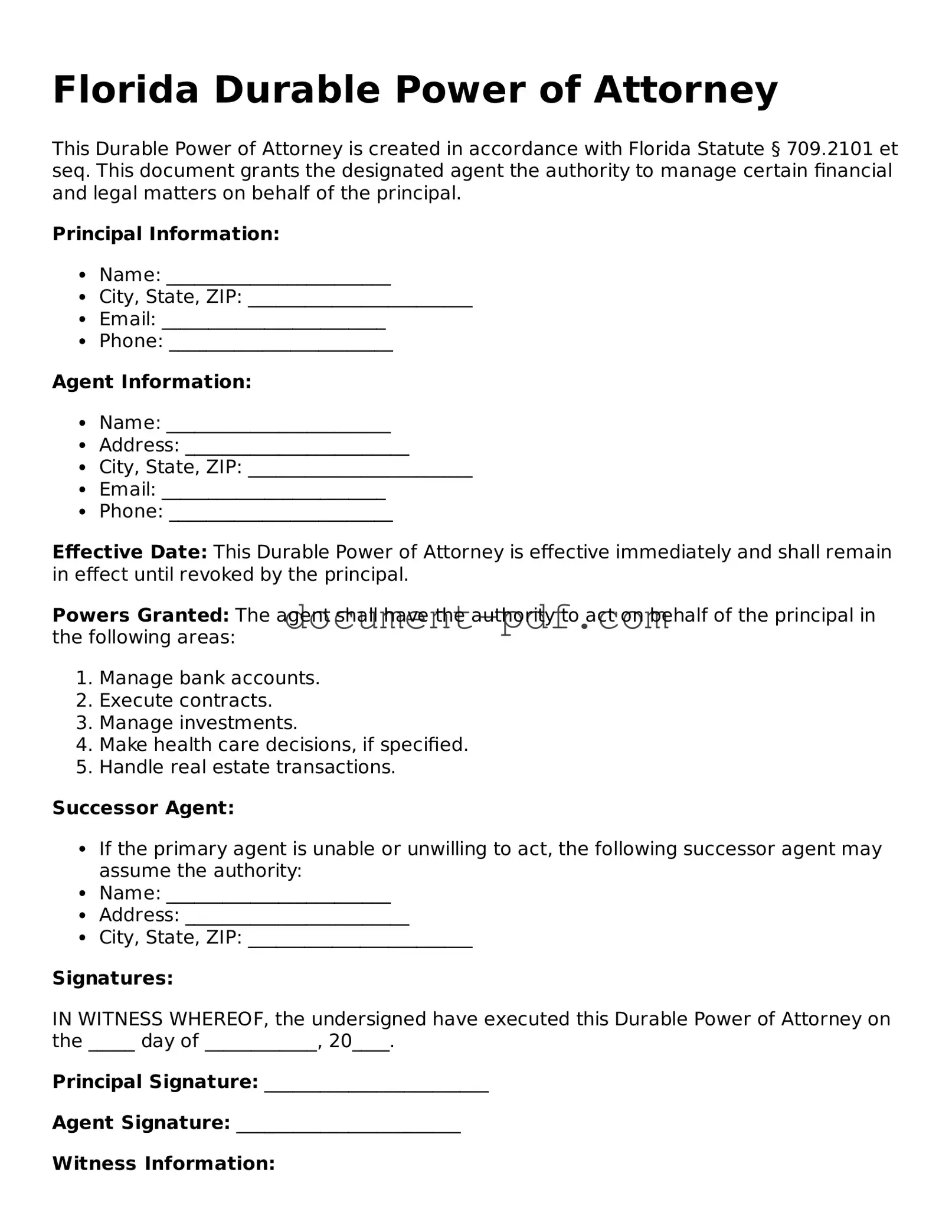

Attorney-Verified Florida Durable Power of Attorney Template

A Florida Durable Power of Attorney form is a legal document that allows an individual, known as the principal, to designate someone else, called an agent, to make financial and legal decisions on their behalf. This form remains effective even if the principal becomes incapacitated, ensuring that their affairs can be managed without interruption. If you’re ready to take control of your future, fill out the form by clicking the button below.

Access Durable Power of Attorney Editor Here

Attorney-Verified Florida Durable Power of Attorney Template

Access Durable Power of Attorney Editor Here

Finish the form without slowing down

Edit your Durable Power of Attorney online and download the finished file.

Access Durable Power of Attorney Editor Here

or

Click for PDF Form