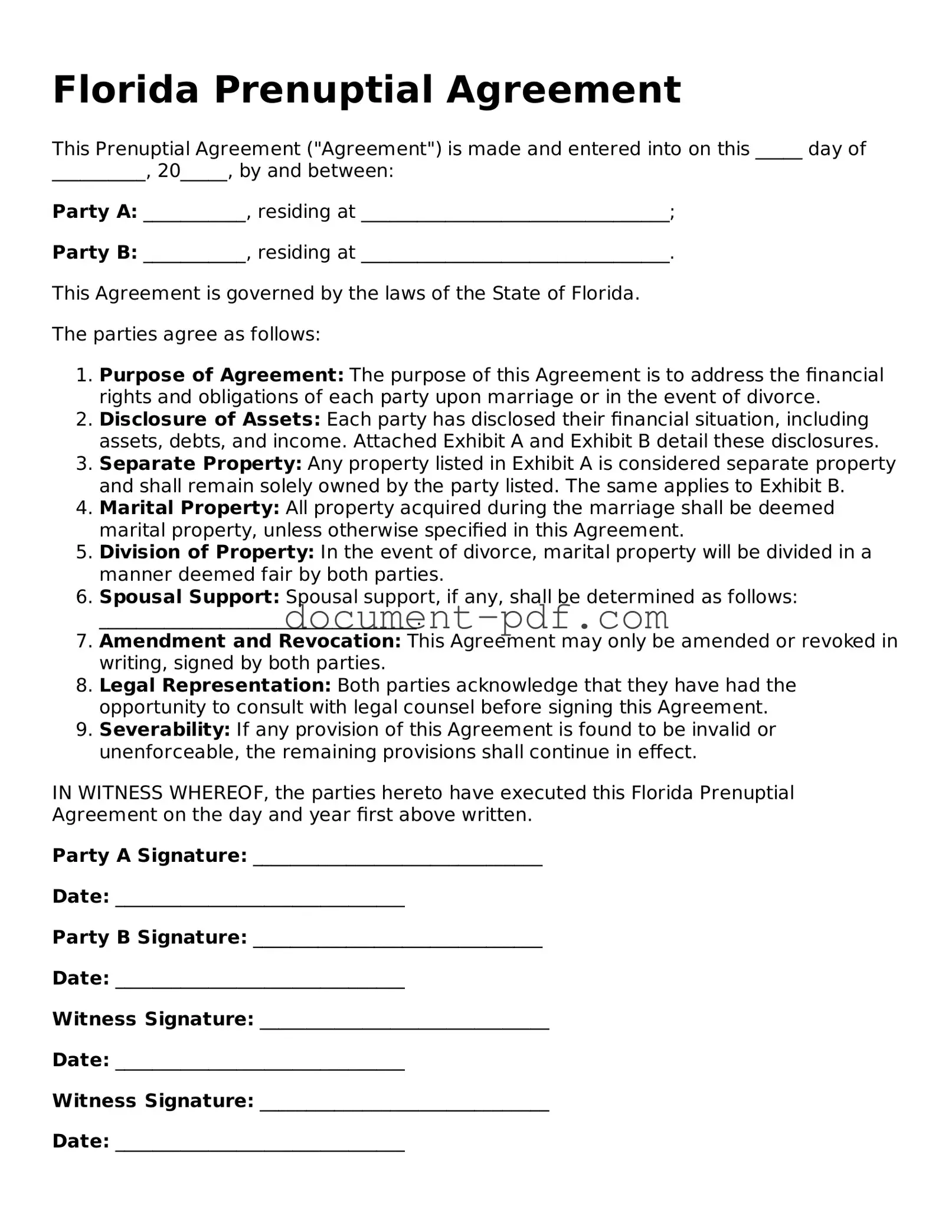

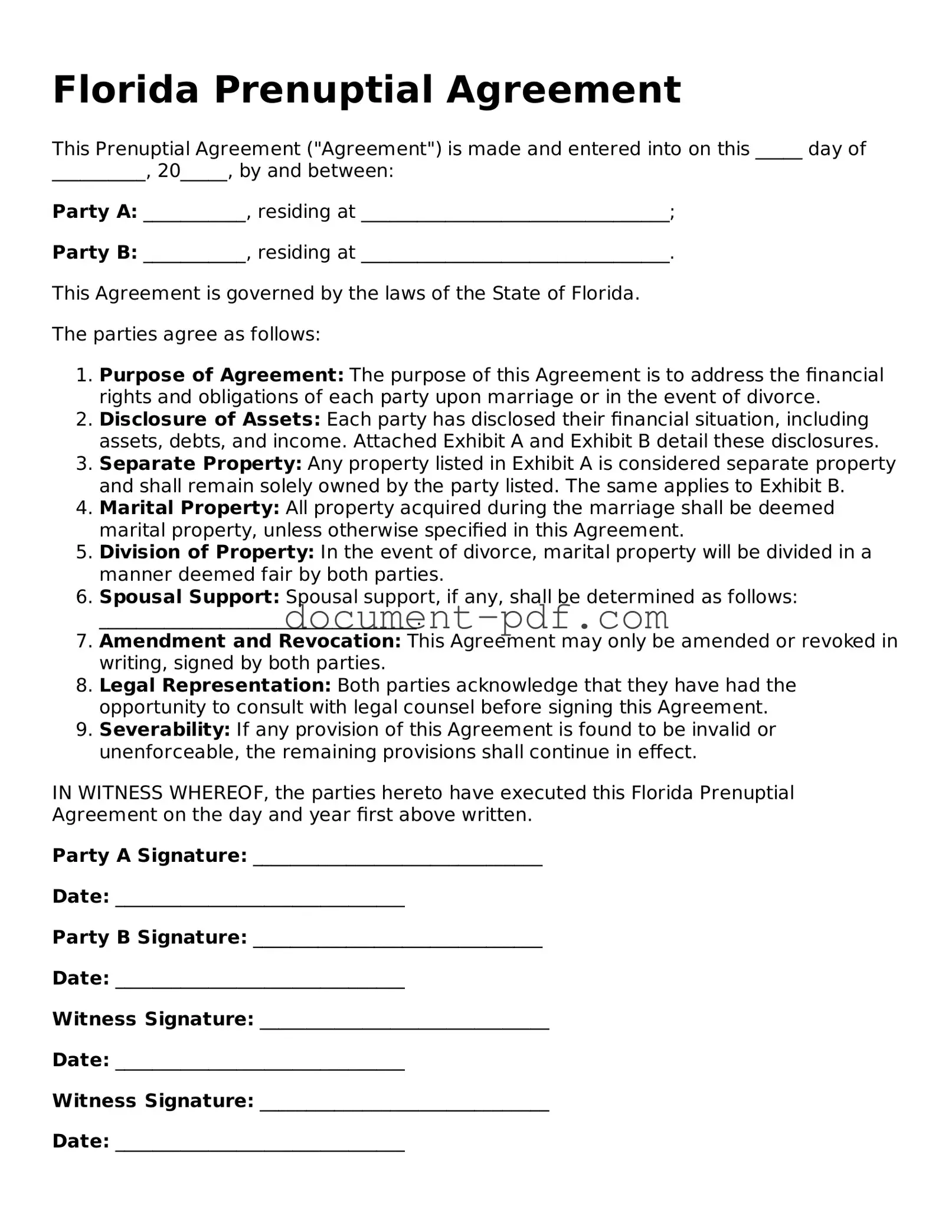

Attorney-Verified Florida Prenuptial Agreement Template

A Florida Prenuptial Agreement form is a legal document that outlines the financial and property arrangements between two individuals before they enter into marriage. This agreement can help protect assets and clarify financial responsibilities, ensuring both parties have a clear understanding of their rights. To begin the process, consider filling out the form by clicking the button below.

Access Prenuptial Agreement Editor Here

Attorney-Verified Florida Prenuptial Agreement Template

Access Prenuptial Agreement Editor Here

Finish the form without slowing down

Edit your Prenuptial Agreement online and download the finished file.

Access Prenuptial Agreement Editor Here

or

Click for PDF Form