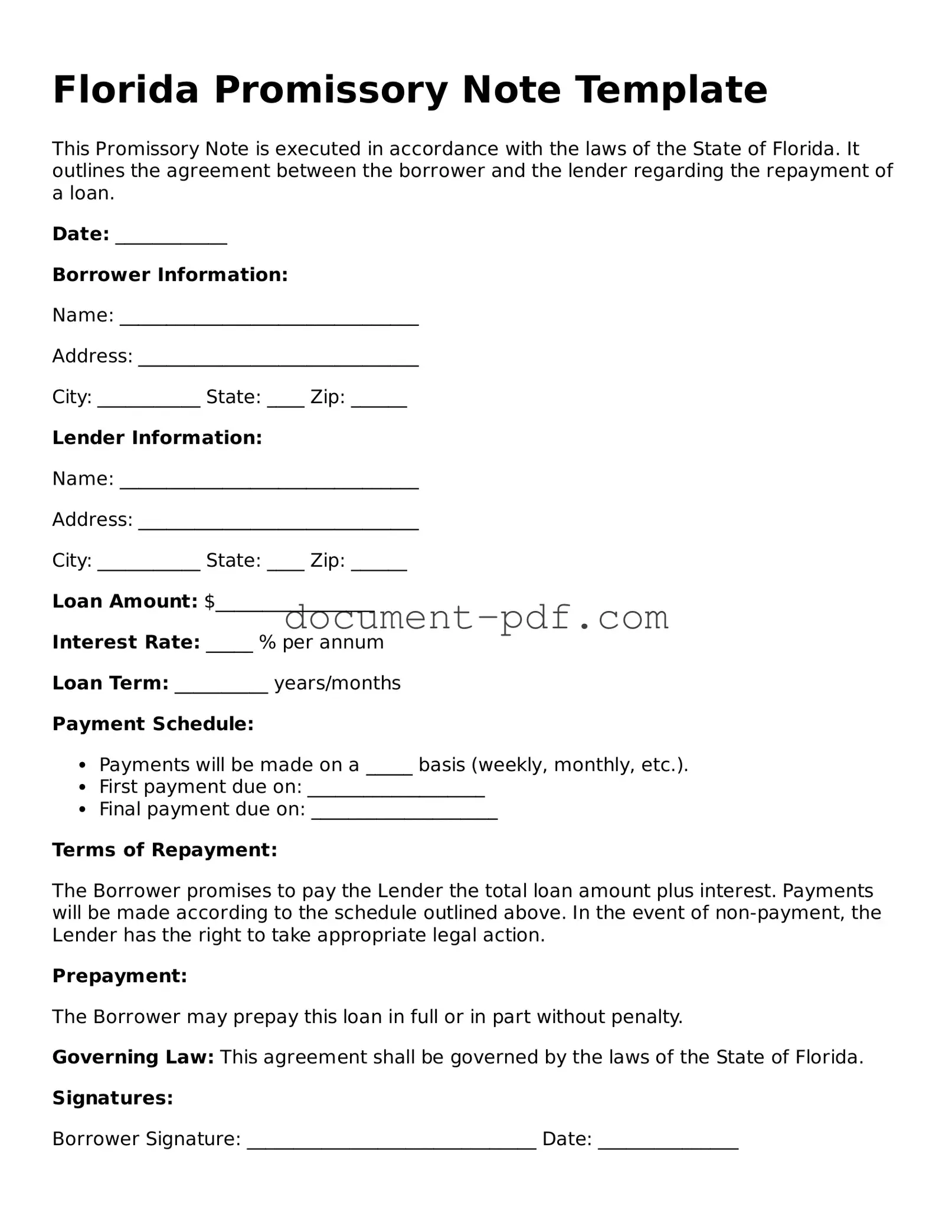

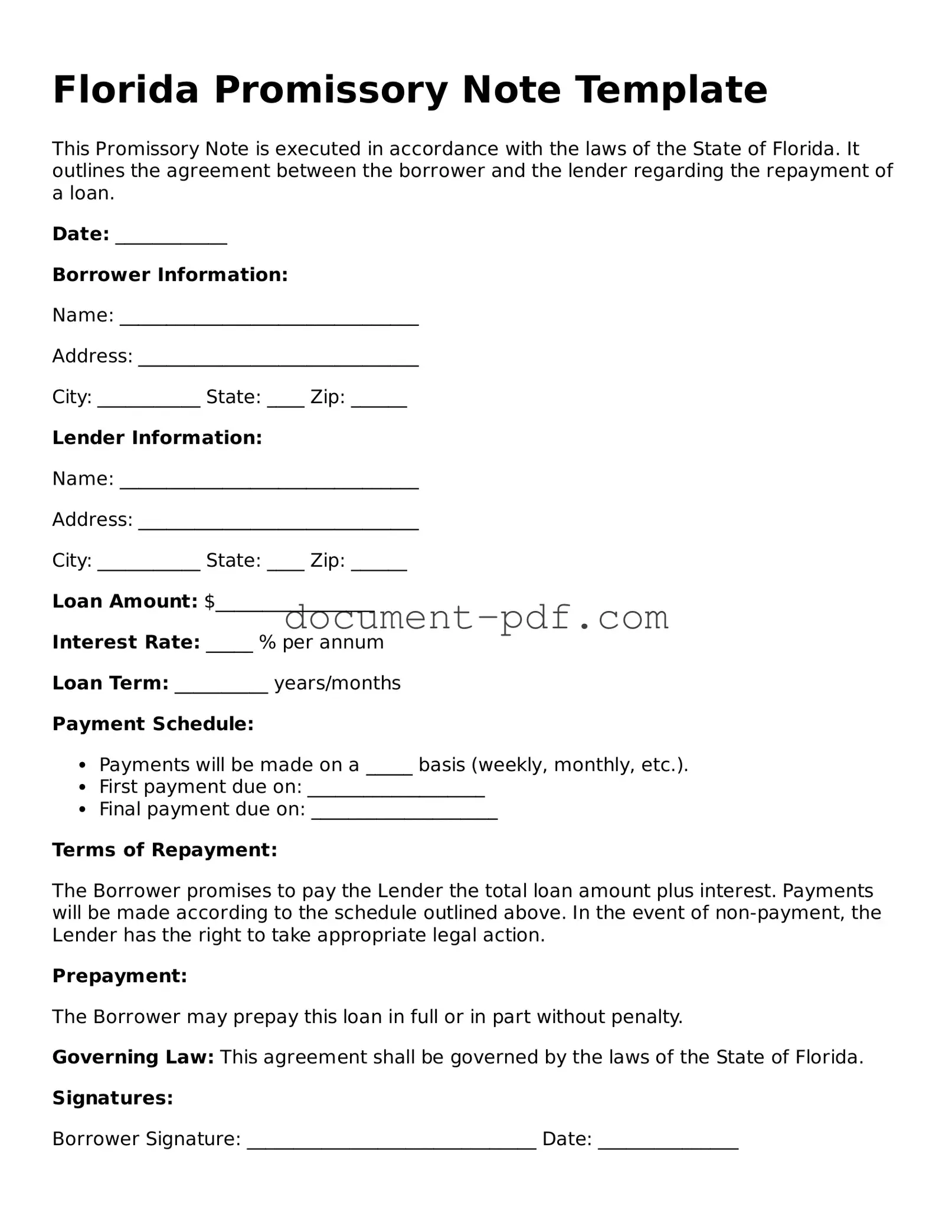

Attorney-Verified Florida Promissory Note Template

A Florida Promissory Note is a legally binding document that outlines a borrower's promise to repay a specific amount of money to a lender under agreed-upon terms. This form serves as a critical tool for both parties, detailing the loan amount, interest rate, repayment schedule, and any penalties for late payments. Understanding the nuances of this form is essential for ensuring a smooth lending process; fill out the form by clicking the button below.

Access Promissory Note Editor Here

Attorney-Verified Florida Promissory Note Template

Access Promissory Note Editor Here

Finish the form without slowing down

Edit your Promissory Note online and download the finished file.

Access Promissory Note Editor Here

or

Click for PDF Form