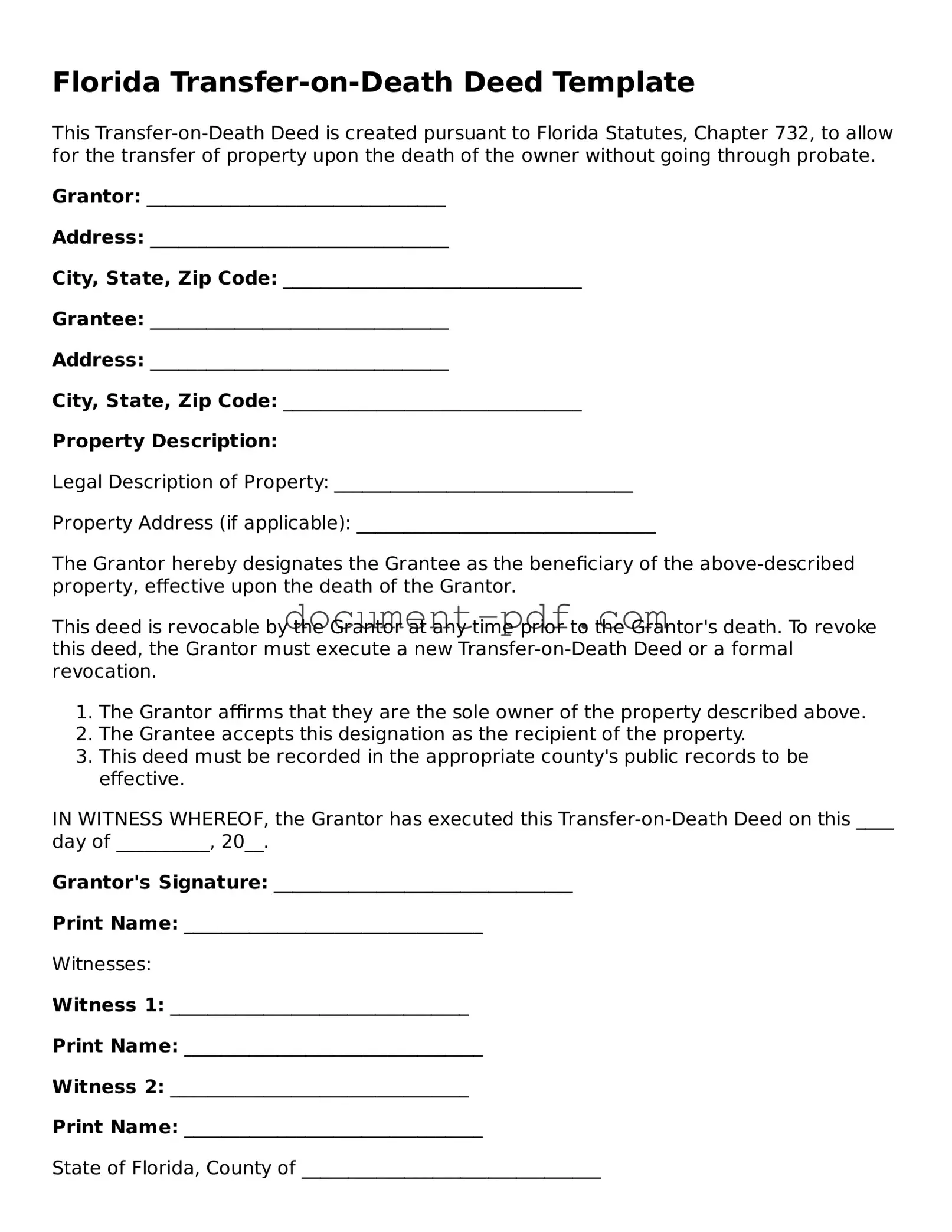

Attorney-Verified Florida Transfer-on-Death Deed Template

The Florida Transfer-on-Death Deed form allows property owners to transfer their real estate to designated beneficiaries upon their death, bypassing the probate process. This legal tool can simplify estate planning and ensure a smoother transition of assets. For those considering this option, it is crucial to understand the requirements and implications involved.

Ready to take the next step? Fill out the form by clicking the button below.

Access Transfer-on-Death Deed Editor Here

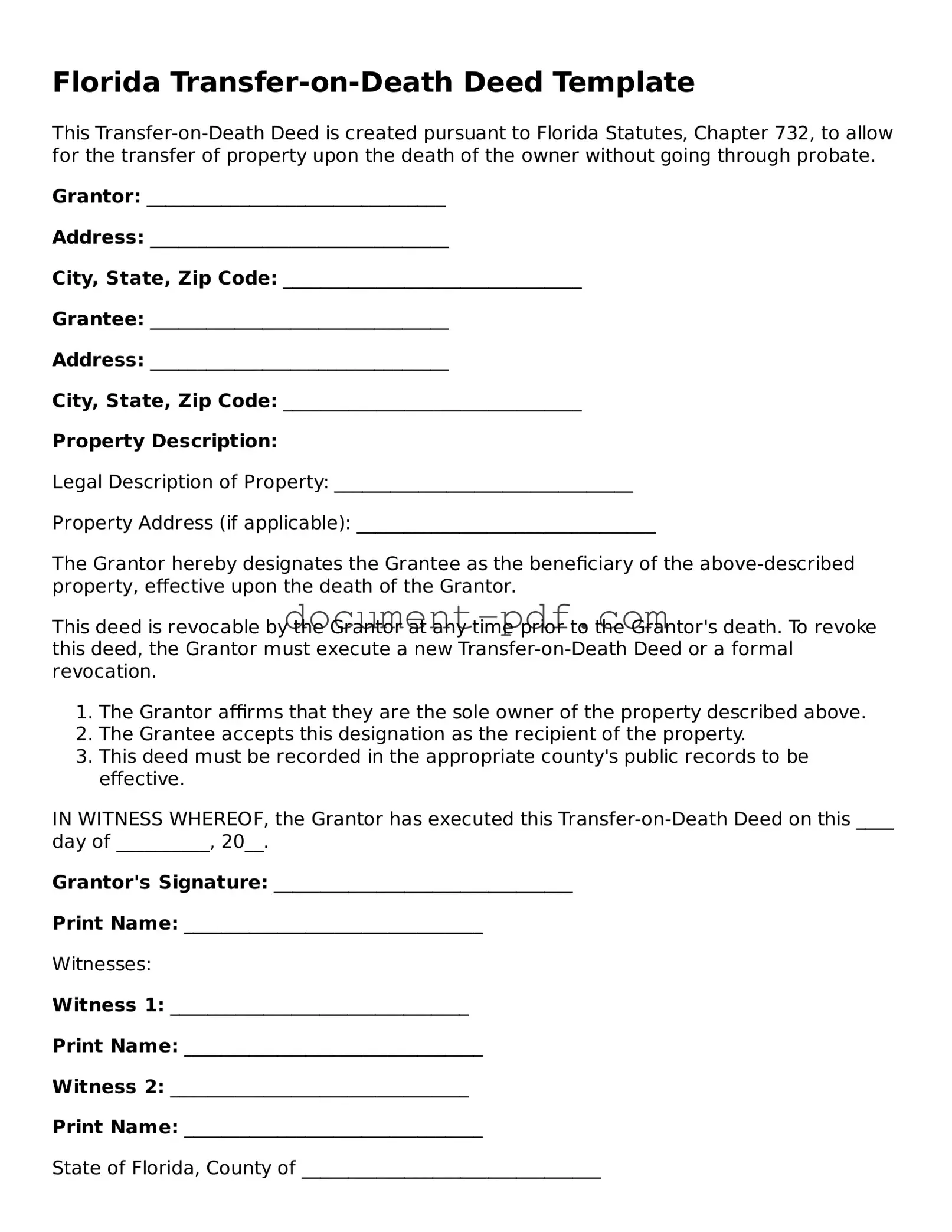

Attorney-Verified Florida Transfer-on-Death Deed Template

Access Transfer-on-Death Deed Editor Here

Finish the form without slowing down

Edit your Transfer-on-Death Deed online and download the finished file.

Access Transfer-on-Death Deed Editor Here

or

Click for PDF Form