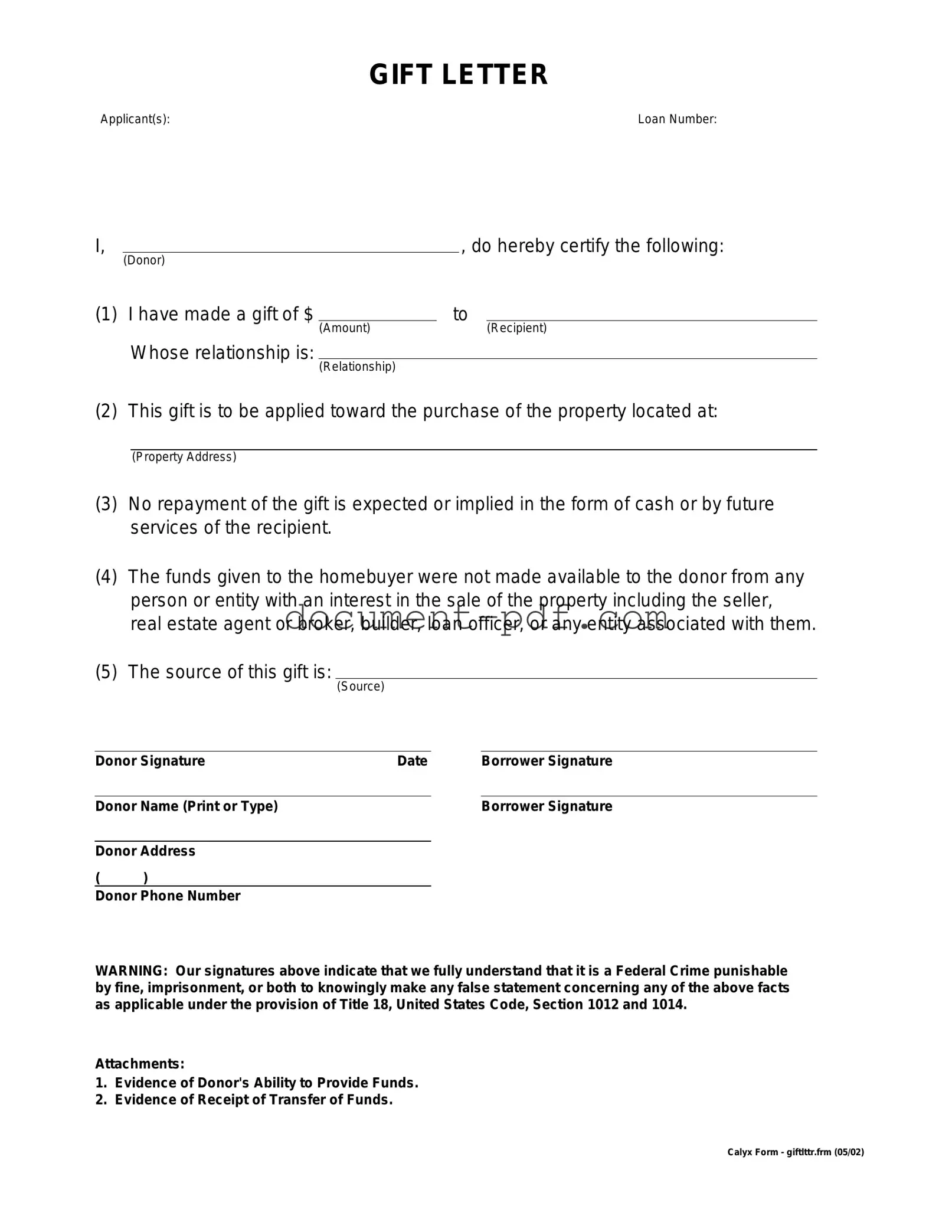

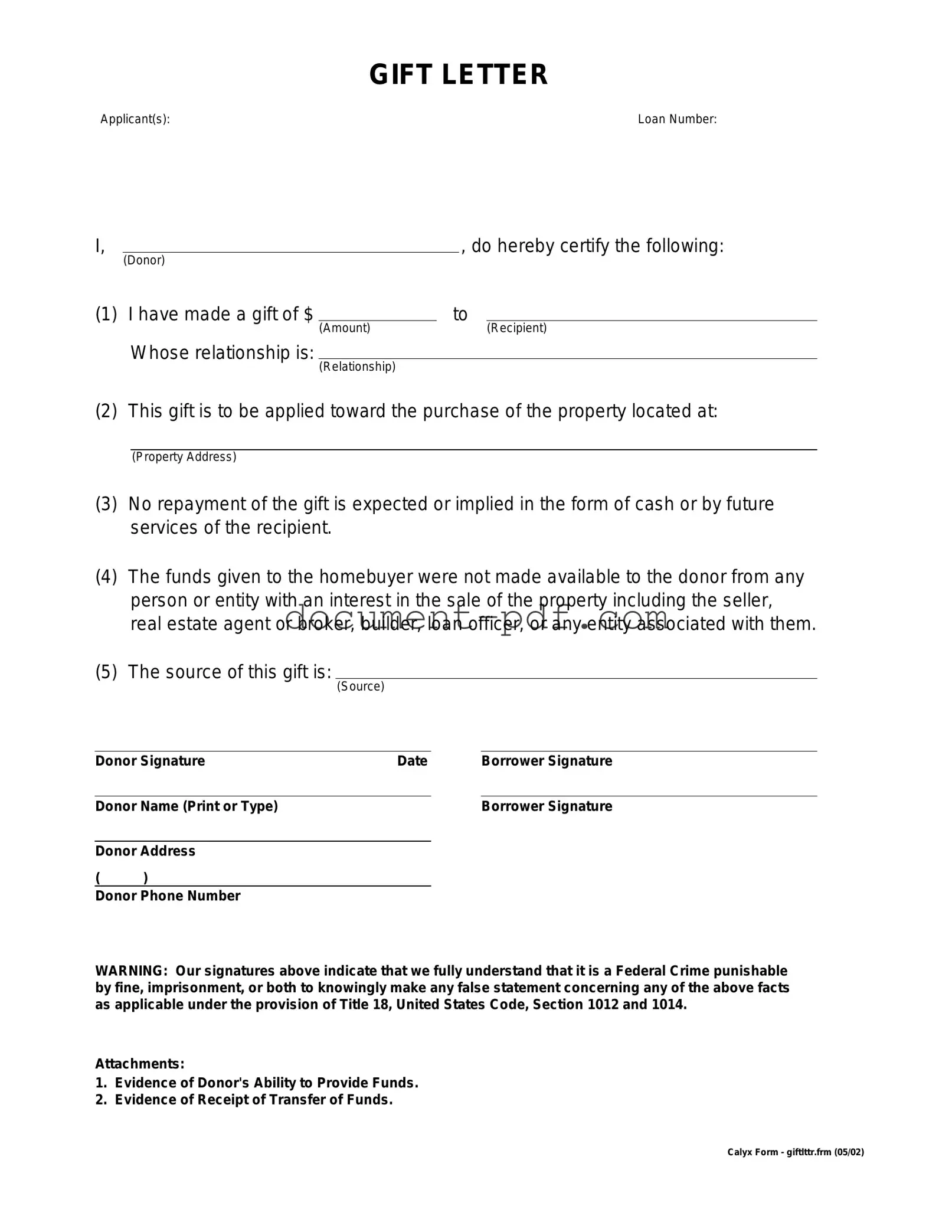

The Gift Letter form is similar to a Loan Agreement in that both documents outline the terms of a financial transaction. A Loan Agreement typically details the amount borrowed, interest rates, repayment terms, and obligations of the borrower and lender. Similarly, a Gift Letter specifies the amount of money being gifted, the relationship between the giver and recipient, and confirms that the funds do not need to be repaid. Both documents serve to clarify financial arrangements, though one involves a repayment obligation while the other does not.

The Texas Certificate of Insurance (COI) is an essential document that verifies compliance with state regulations for Master Plumbers acting as Responsible Master Plumbers (RMPs). It confirms that the RMP maintains the necessary insurance coverage while performing plumbing services, thereby protecting both the plumber and the public from potential liabilities. To better understand the importance and obtain a template for this document, you can visit https://texasformsonline.com/free-texas-certificate-insurance-template.

Another document akin to the Gift Letter is the Affidavit of Support. This form is often used in immigration cases where a sponsor agrees to financially support an immigrant. Like the Gift Letter, it requires the sponsor to affirm their financial commitment. However, the Affidavit of Support is legally binding and may have implications for the sponsor's finances if the immigrant requires public assistance. Both documents demonstrate financial support but differ in their legal obligations and contexts.

The Promissory Note shares similarities with the Gift Letter as it also pertains to financial transactions. A Promissory Note is a written promise to pay a specified sum to another party, often with interest. While a Gift Letter indicates that the funds are a gift and do not require repayment, a Promissory Note clearly establishes a debtor-creditor relationship. Both documents aim to formalize financial agreements, but they represent opposite ends of the financial spectrum regarding repayment expectations.

In addition, the Financial Statement can be compared to the Gift Letter. A Financial Statement provides a comprehensive overview of an individual's financial situation, including assets, liabilities, and income. While the Gift Letter focuses on a specific transaction, the Financial Statement may include the gift as part of a broader financial picture. Both documents are used to assess financial stability but serve different purposes in financial planning and transactions.

The Affidavit of Gift is another document that closely resembles the Gift Letter. This affidavit is a sworn statement confirming that a gift has been made, often used for tax purposes or to document the transfer of property. Like the Gift Letter, it affirms the intent of the giver to make a gift without expectation of repayment. However, the Affidavit of Gift may carry additional legal weight and is often used in real estate transactions, whereas the Gift Letter is more commonly associated with personal gifts.

Lastly, the Declaration of Gift is similar to the Gift Letter in that it serves to declare the intent to give a gift. This document typically includes details about the gift, the donor, and the recipient. While both documents express the donor's intent, the Declaration of Gift may be more formalized and may require notarization. Both aim to clarify the nature of the gift, ensuring that all parties understand the terms of the transaction.