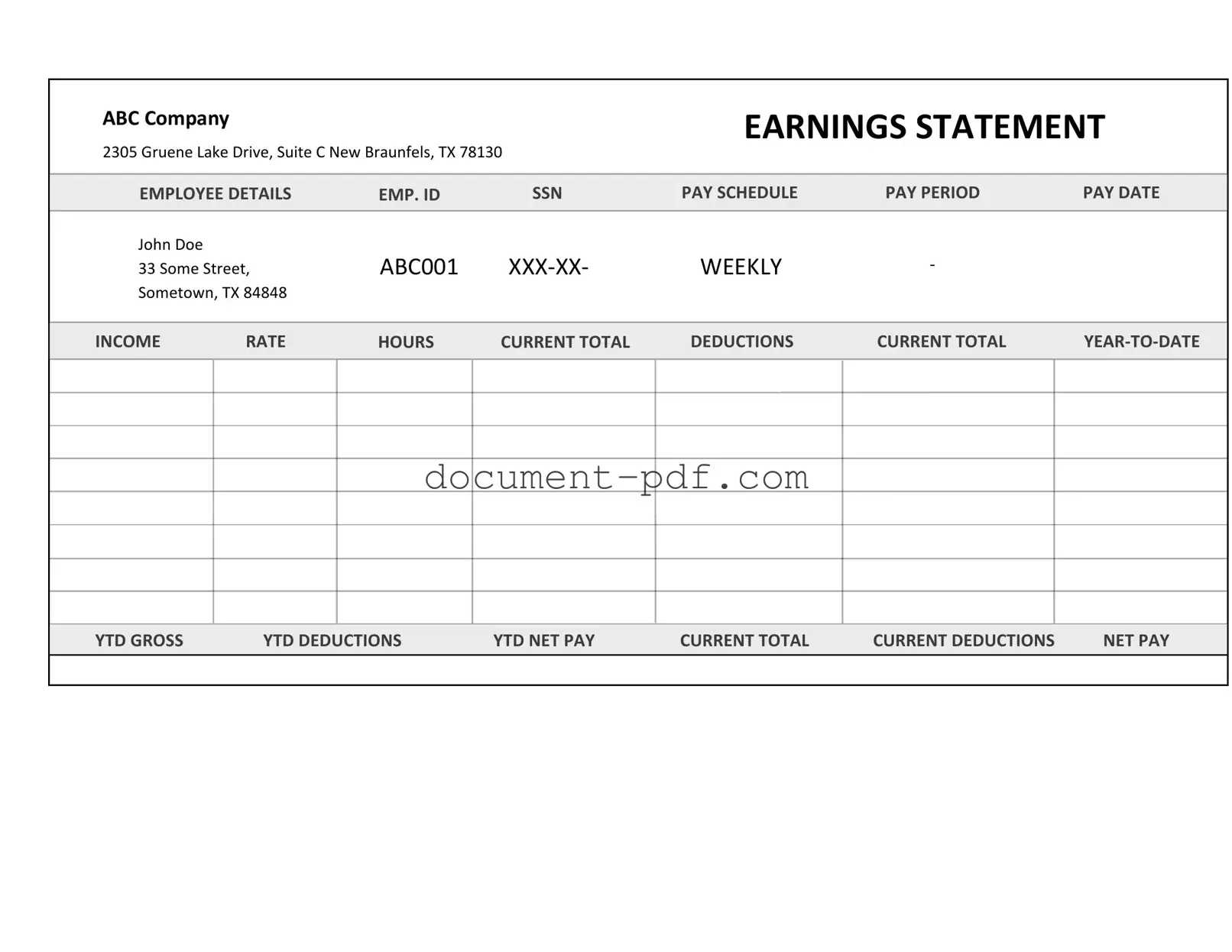

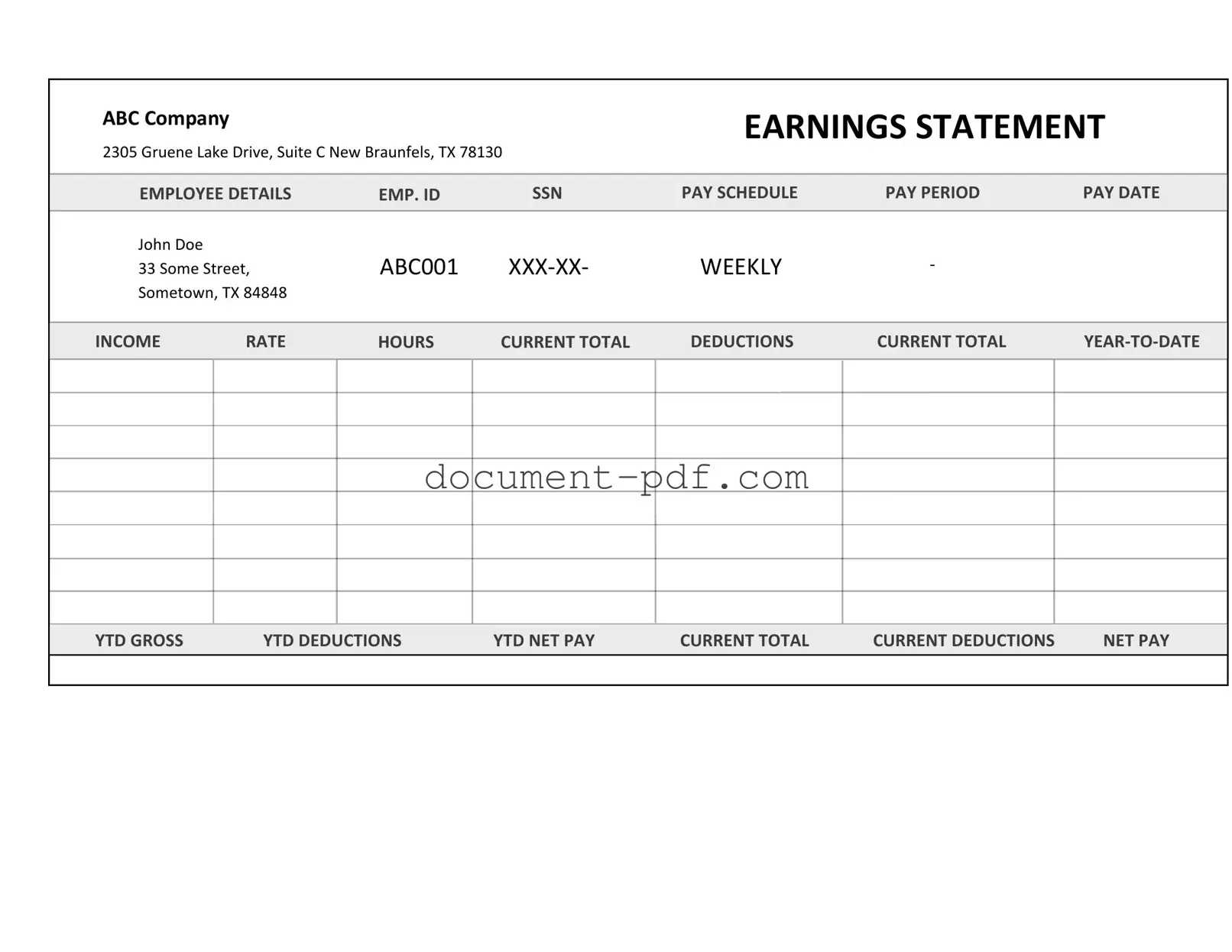

The Independent Contractor Pay Stub form shares similarities with the Employee Pay Stub. Both documents serve the purpose of detailing compensation for work performed. They typically include information such as hours worked, pay rate, and any deductions. While the employee pay stub outlines taxes and benefits that are withheld from a paycheck, the independent contractor pay stub focuses more on the total amount earned without the complexities of employee benefits. This distinction highlights the different relationships between the worker and the employer.

Another document akin to the Independent Contractor Pay Stub is the Invoice. Invoices are used by independent contractors to request payment for services rendered. Like pay stubs, invoices itemize the work completed and the amount due. However, invoices are more formal requests for payment, while pay stubs serve as a record of payment already made. Both documents are essential for tracking earnings and ensuring accurate financial records.

Understanding the importance of proper documentation in business operations is crucial, and utilizing a New York Operating Agreement can significantly streamline your processes. Having a clear structure can help avoid disputes among members and ensure compliance with applicable laws. For more information on creating this essential document, visit https://pdfdocshub.com.

The 1099 Form is also similar to the Independent Contractor Pay Stub in that it reports income earned by independent contractors. While the pay stub provides details of a single payment, the 1099 summarizes all payments made to a contractor over the course of a year. This form is crucial for tax reporting purposes, as it allows contractors to accurately report their income when filing taxes. Both documents emphasize the contractor’s earnings but serve different functions in financial documentation.

The Payroll Summary Report is another document that resembles the Independent Contractor Pay Stub. This report provides an overview of all payments made to employees or contractors during a specific period. It typically includes total hours worked, gross pay, and net pay. While the payroll summary is more comprehensive and often used for internal accounting purposes, the pay stub focuses on individual transactions, making it more personal for the contractor.

Additionally, the Payment Receipt can be compared to the Independent Contractor Pay Stub. A payment receipt confirms that a contractor has received payment for their services. Like the pay stub, it includes the amount paid and the date of payment. However, the payment receipt is usually issued after the payment has been made, while the pay stub may provide a breakdown of the payment before it is received. Both documents are important for maintaining financial transparency.

Lastly, the Contract Agreement itself bears similarities to the Independent Contractor Pay Stub. While the contract outlines the terms of engagement, including payment details, the pay stub serves as proof of payment for work completed under that agreement. Both documents are crucial for establishing a clear understanding between the contractor and the client. They ensure that all parties are on the same page regarding expectations and compensation.