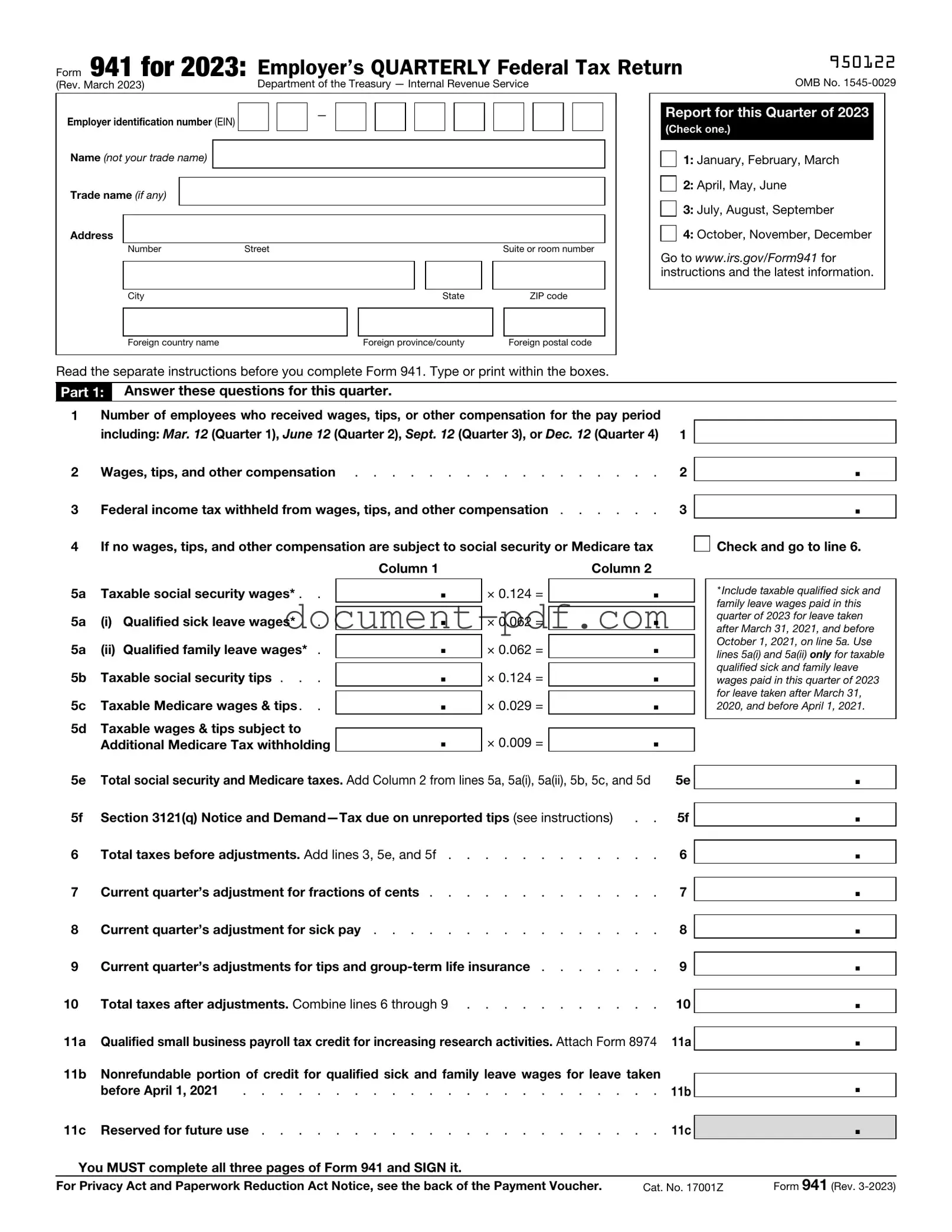

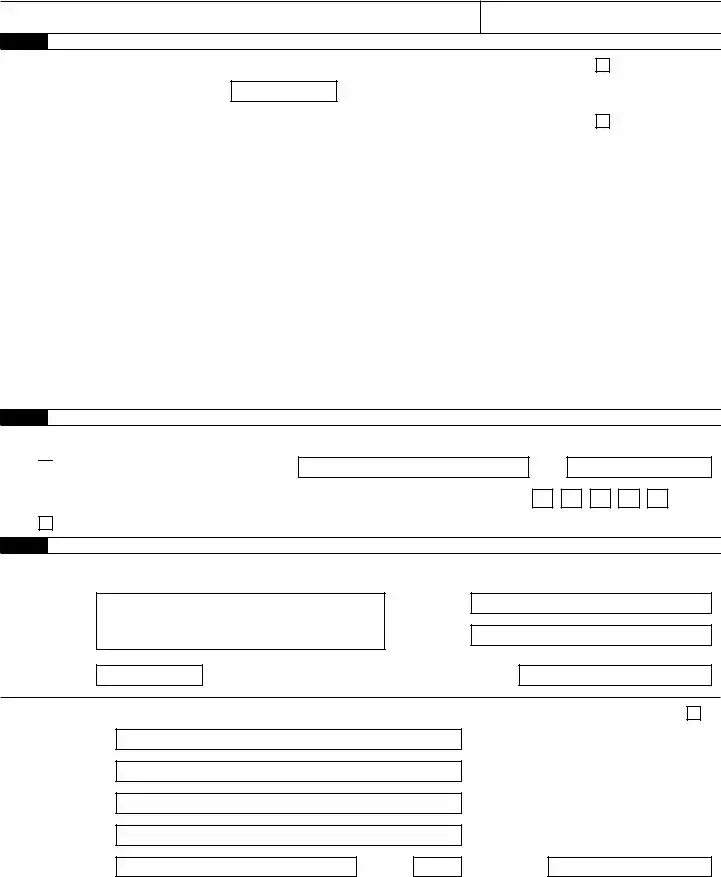

Blank IRS 941 PDF Form

The IRS 941 form is a quarterly tax form that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for businesses to ensure compliance with federal tax regulations. For assistance in filling out the form, click the button below.

Access IRS 941 Editor Here

Blank IRS 941 PDF Form

Access IRS 941 Editor Here

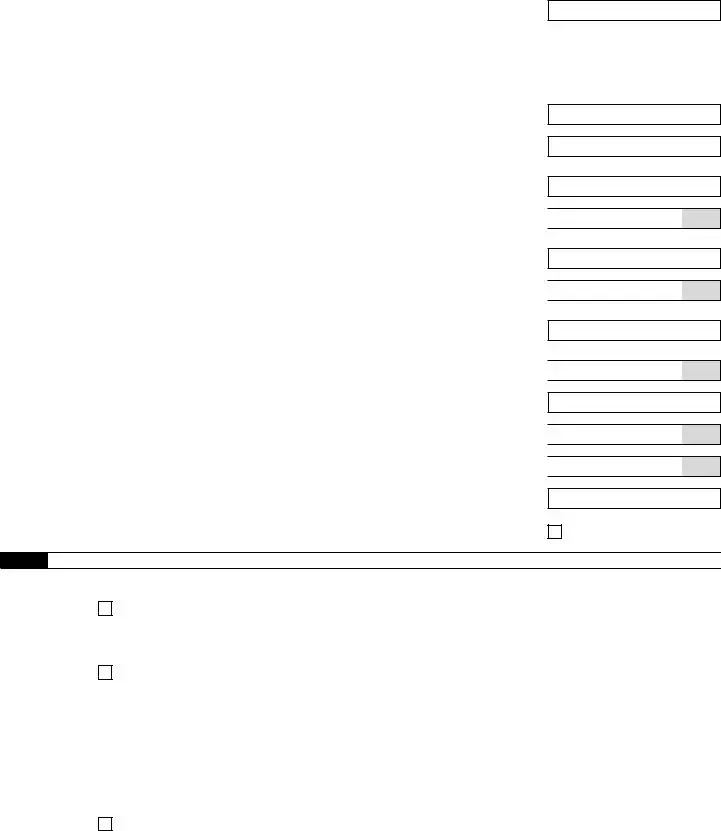

Finish the form without slowing down

Edit your IRS 941 online and download the finished file.

Access IRS 941 Editor Here

or

Click for PDF Form

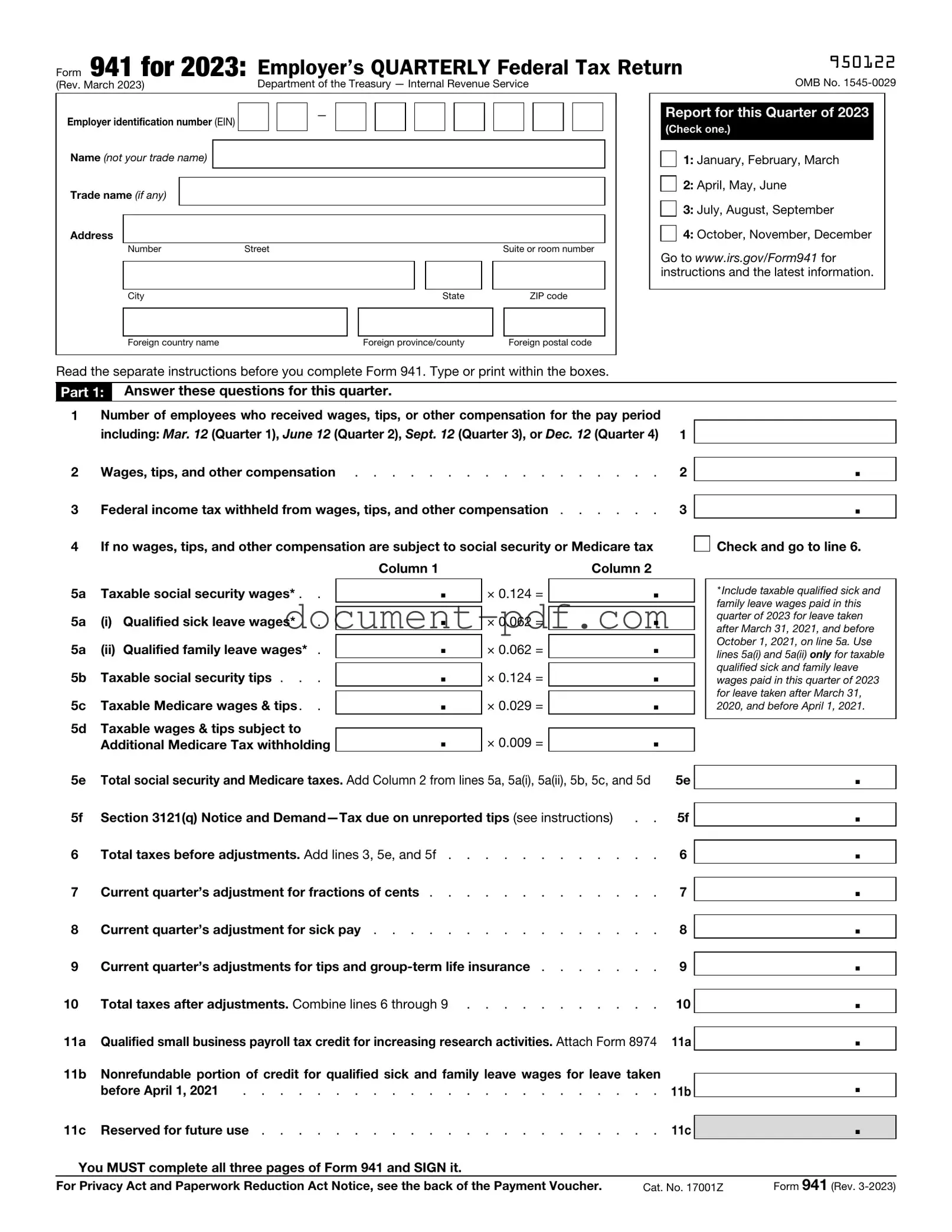

Check and go to line 6.

Check and go to line 6.

.

. .

. .

. .

. .

.

Yes. Designee’s name and phone number

Yes. Designee’s name and phone number