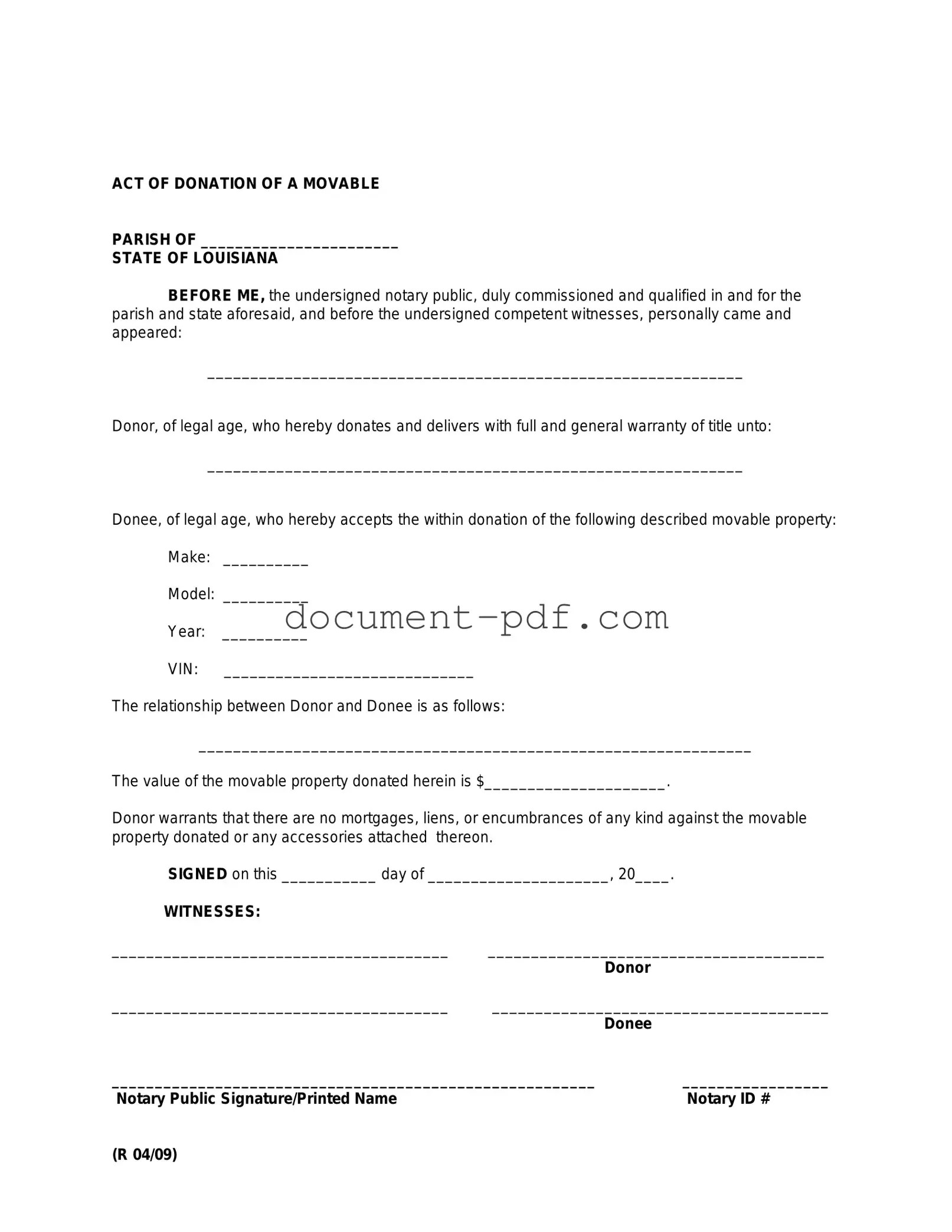

Blank Louisiana act of donation PDF Form

The Louisiana Act of Donation Form is a legal document used to formally transfer ownership of property or assets from one individual to another without any exchange of payment. This form ensures that the intentions of the donor are clearly documented, providing a record of the donation for both parties. If you are considering making a donation, it is essential to complete this form accurately to avoid any potential disputes in the future.

To get started on your donation, please fill out the form by clicking the button below.

Access Louisiana act of donation Editor Here

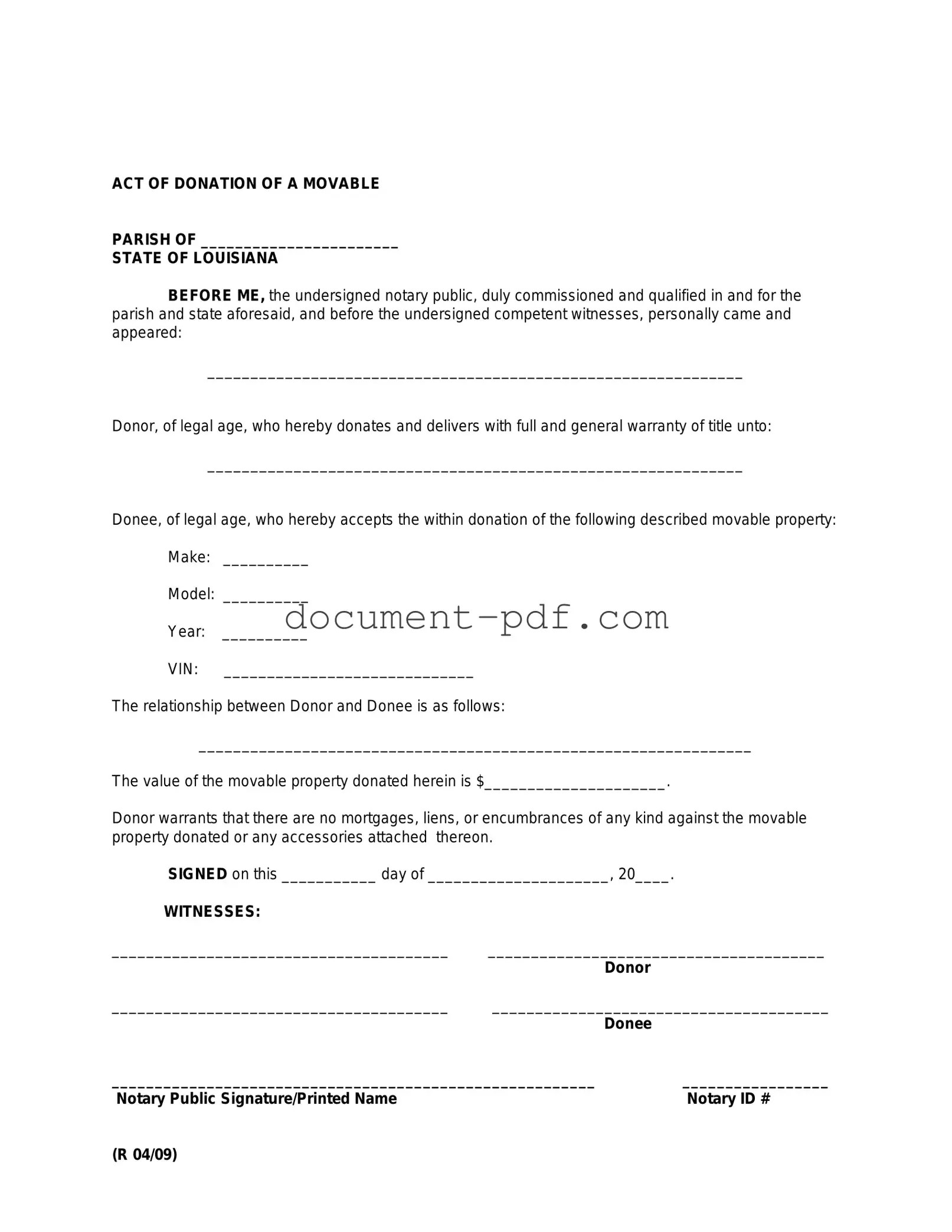

Blank Louisiana act of donation PDF Form

Access Louisiana act of donation Editor Here

Finish the form without slowing down

Edit your Louisiana act of donation online and download the finished file.

Access Louisiana act of donation Editor Here

or

Click for PDF Form