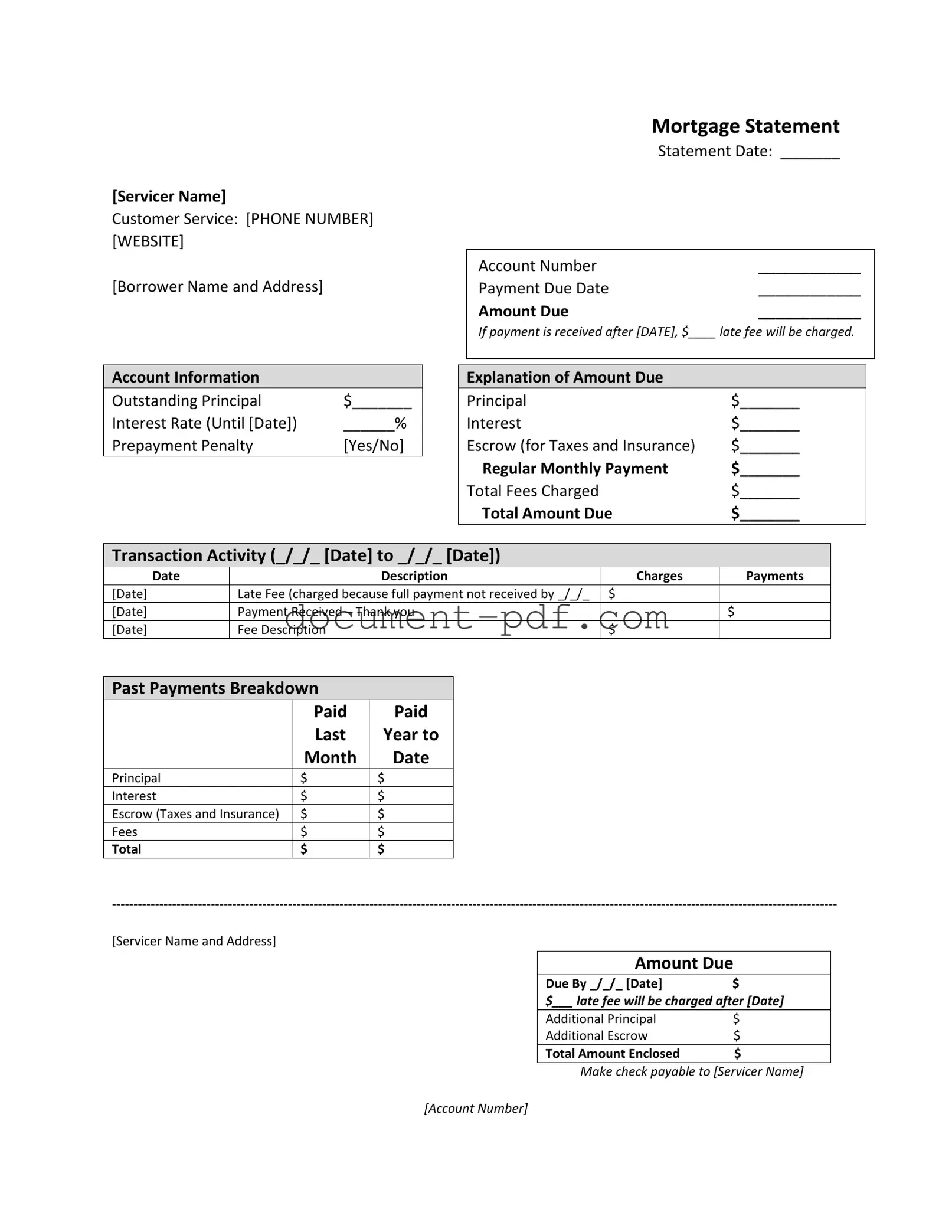

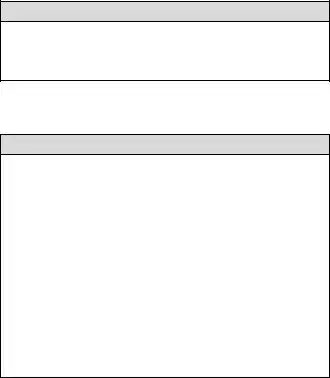

Blank Mortgage Statement PDF Form

A Mortgage Statement form is a document that outlines the details of your mortgage account, including payment history, outstanding balance, and any fees incurred. This form is essential for understanding your financial obligations and ensuring you stay on track with your payments. To get started on filling out your Mortgage Statement, click the button below.

Access Mortgage Statement Editor Here

Blank Mortgage Statement PDF Form

Access Mortgage Statement Editor Here

Finish the form without slowing down

Edit your Mortgage Statement online and download the finished file.

Access Mortgage Statement Editor Here

or

Click for PDF Form