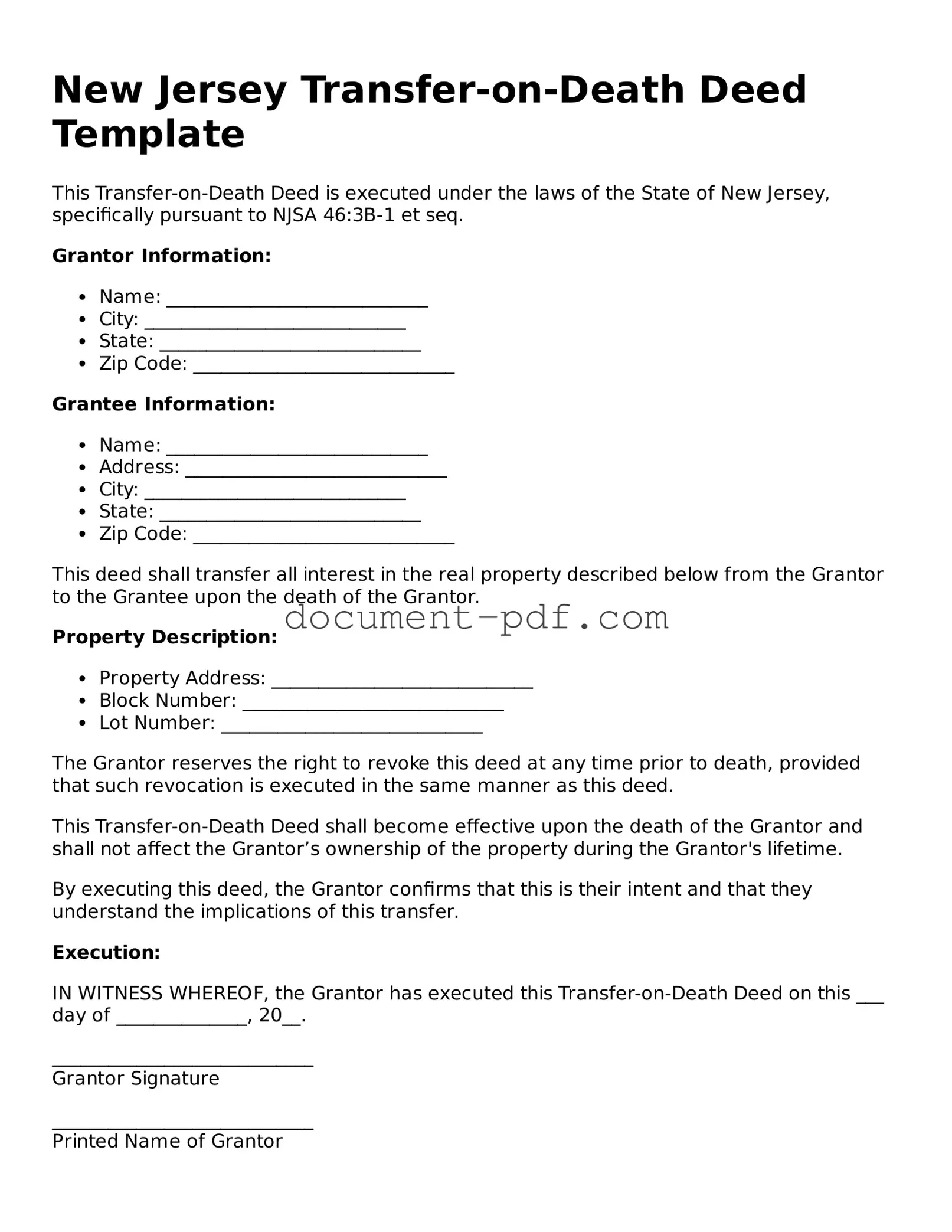

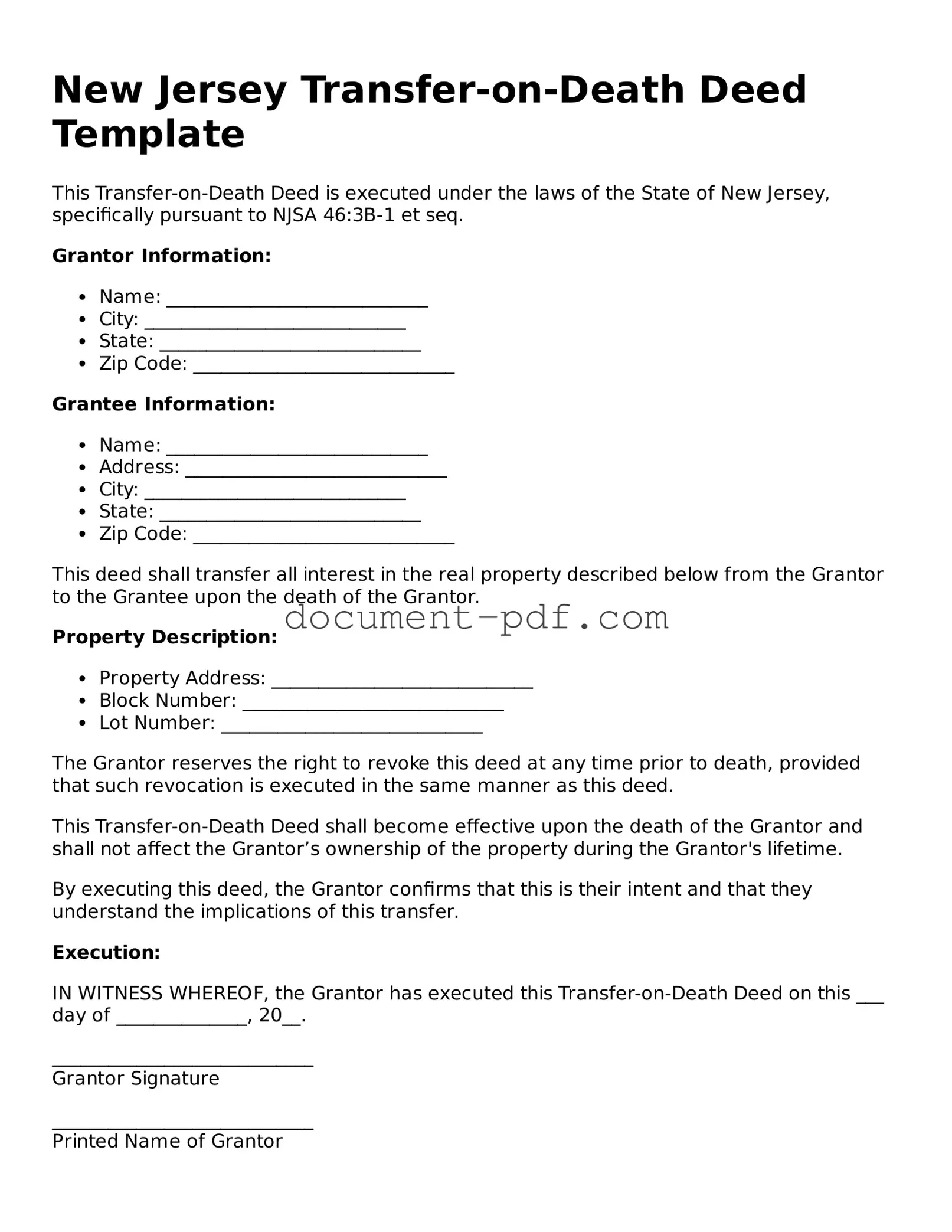

Attorney-Verified New Jersey Transfer-on-Death Deed Template

The New Jersey Transfer-on-Death Deed form allows property owners to designate a beneficiary who will automatically receive their property upon their death, without the need for probate. This legal tool simplifies the transfer process, ensuring that your wishes are honored while minimizing potential complications for your loved ones. Understanding this form can provide peace of mind, so consider filling it out by clicking the button below.

Access Transfer-on-Death Deed Editor Here

Attorney-Verified New Jersey Transfer-on-Death Deed Template

Access Transfer-on-Death Deed Editor Here

Finish the form without slowing down

Edit your Transfer-on-Death Deed online and download the finished file.

Access Transfer-on-Death Deed Editor Here

or

Click for PDF Form