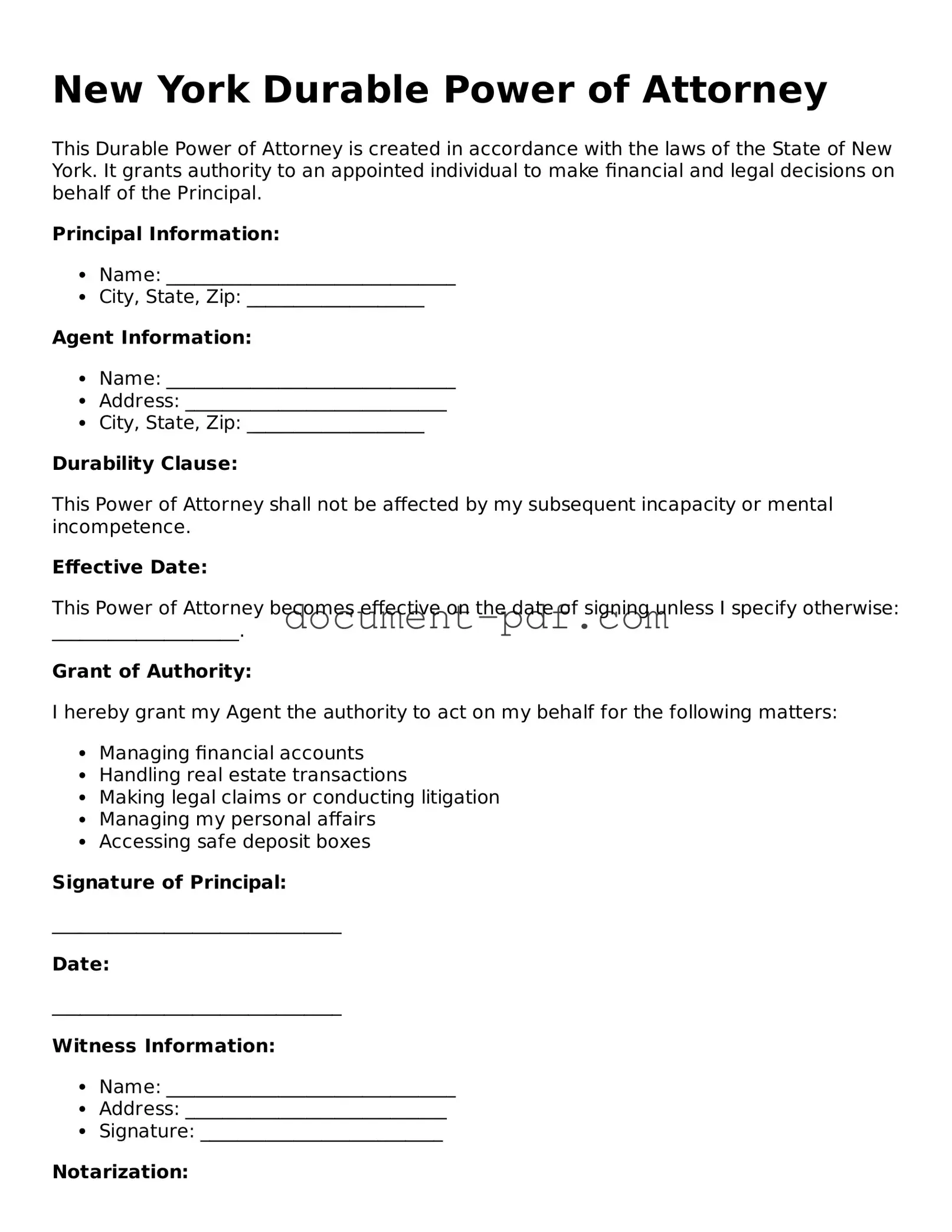

The Durable Power of Attorney (DPOA) form is often compared to a General Power of Attorney (GPOA). Both documents allow one person to act on behalf of another in financial or legal matters. However, the key difference lies in the durability of the authority granted. While a GPOA typically becomes invalid if the principal becomes incapacitated, a DPOA remains effective even if the principal can no longer make decisions for themselves. This makes the DPOA a vital tool for long-term planning.

Another similar document is the Healthcare Proxy. This form allows an individual to designate someone to make medical decisions on their behalf if they become unable to do so. Like the DPOA, the Healthcare Proxy is about granting authority to someone trusted. However, the focus of the Healthcare Proxy is specifically on health-related decisions, while the DPOA covers broader financial and legal matters.

The Living Will is also related to the Durable Power of Attorney, as both deal with decision-making in times of incapacity. A Living Will outlines a person's wishes regarding medical treatment and end-of-life care. It does not appoint someone to make decisions but rather provides guidance on the individual's preferences. This document complements a Healthcare Proxy, ensuring that the appointed agent understands the principal's desires.

A Revocable Trust shares similarities with the DPOA in that both allow for the management of assets. A Revocable Trust can help avoid probate and manage property during the grantor's lifetime. However, unlike a DPOA, which is primarily about granting authority to act, a Revocable Trust is a legal entity that holds and manages assets. It can be altered or revoked by the grantor at any time, offering flexibility in estate planning.

The Financial Power of Attorney is another document closely related to the Durable Power of Attorney. Both allow an agent to handle financial matters on behalf of the principal. The Financial Power of Attorney may be limited to specific financial tasks or accounts, while the DPOA is typically broader in scope. This distinction can be important when considering the extent of authority one wishes to grant.

Understanding the various legal documents such as the Durable Power of Attorney, Healthcare Proxy, and Living Will is vital for effective estate planning. With documents like the Texas PDF Templates, you can ensure that your wishes are documented and upheld, providing clarity and support for your loved ones in times of need.

A Medical Power of Attorney is similar to the Durable Power of Attorney in that it allows someone to make decisions on behalf of another. However, this document specifically pertains to medical decisions rather than financial or legal matters. It is crucial for individuals who want to ensure that their healthcare preferences are respected, particularly if they cannot communicate their wishes.

The Guardianship document is another related concept, although it involves a court-appointed individual rather than a chosen agent. Guardianship is established when a person is deemed unable to manage their affairs. In contrast, a Durable Power of Attorney allows individuals to choose someone they trust to manage their affairs without court intervention. Both serve to protect individuals, but they operate through different mechanisms.

The Advance Directive is a broader category that includes both the Living Will and the Healthcare Proxy. It allows individuals to outline their preferences for medical treatment and designate someone to make healthcare decisions. While the Durable Power of Attorney focuses on financial and legal matters, the Advance Directive is centered on healthcare, making it an essential part of comprehensive planning.

Lastly, the Will is another important document in the realm of estate planning. While a Durable Power of Attorney is effective during a person's lifetime, a Will takes effect upon death. Both documents are essential for ensuring that an individual's wishes are honored, but they serve different purposes. The DPOA addresses who will manage affairs while the individual is alive, whereas the Will outlines how assets will be distributed after death.