The Payroll Check form is similar to the Direct Deposit Authorization form. Both documents serve the purpose of facilitating employee compensation. While the Payroll Check form is used for issuing physical checks, the Direct Deposit Authorization form allows employees to receive their pay directly into their bank accounts. This modern approach streamlines the payment process and ensures that employees have immediate access to their funds without the need to visit a bank.

Another document closely related to the Payroll Check form is the W-2 form. The W-2 form summarizes an employee's annual wages and the taxes withheld from their paychecks. Similar to the Payroll Check form, it provides essential information regarding compensation. However, the W-2 form is issued at the end of the year for tax purposes, while the Payroll Check form is used for regular payroll disbursements throughout the year.

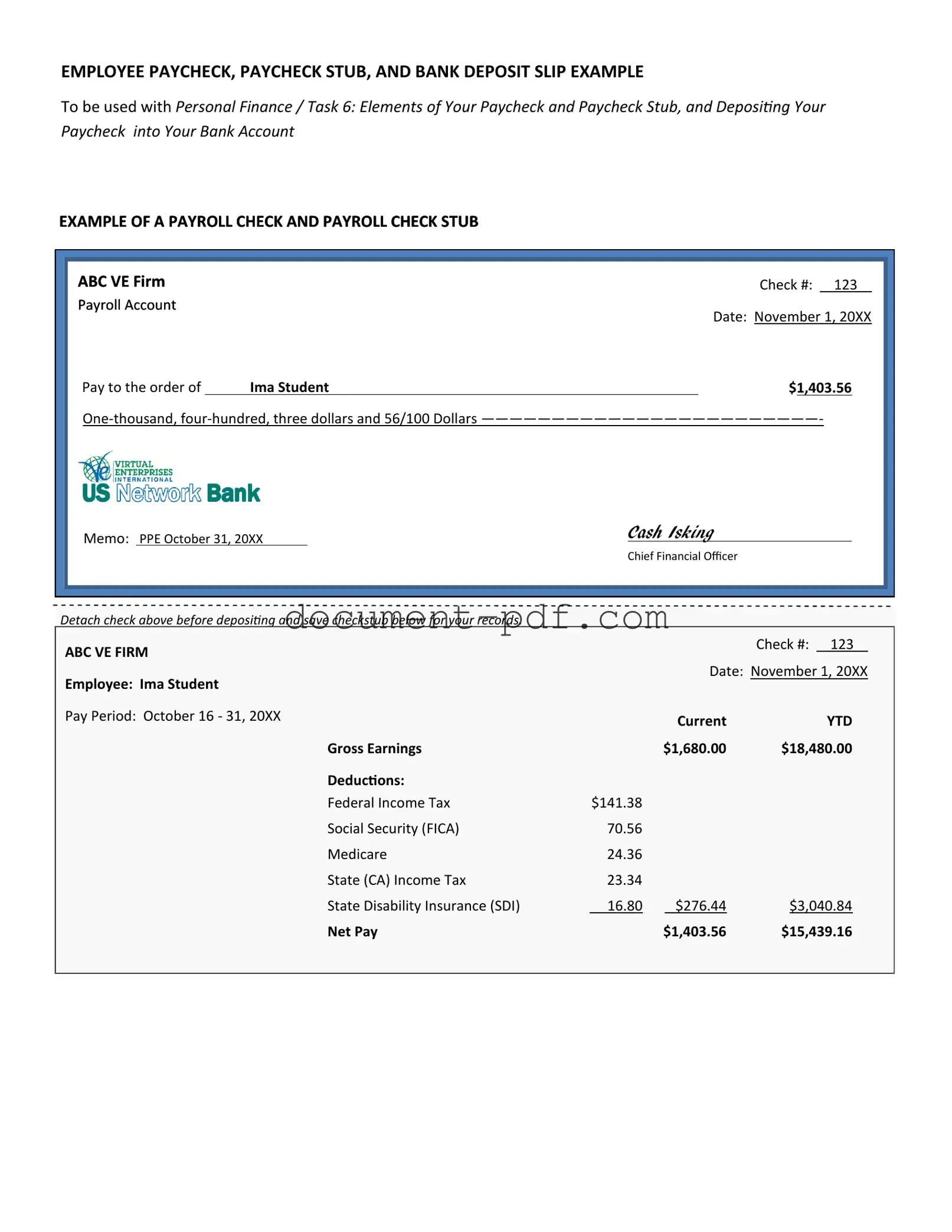

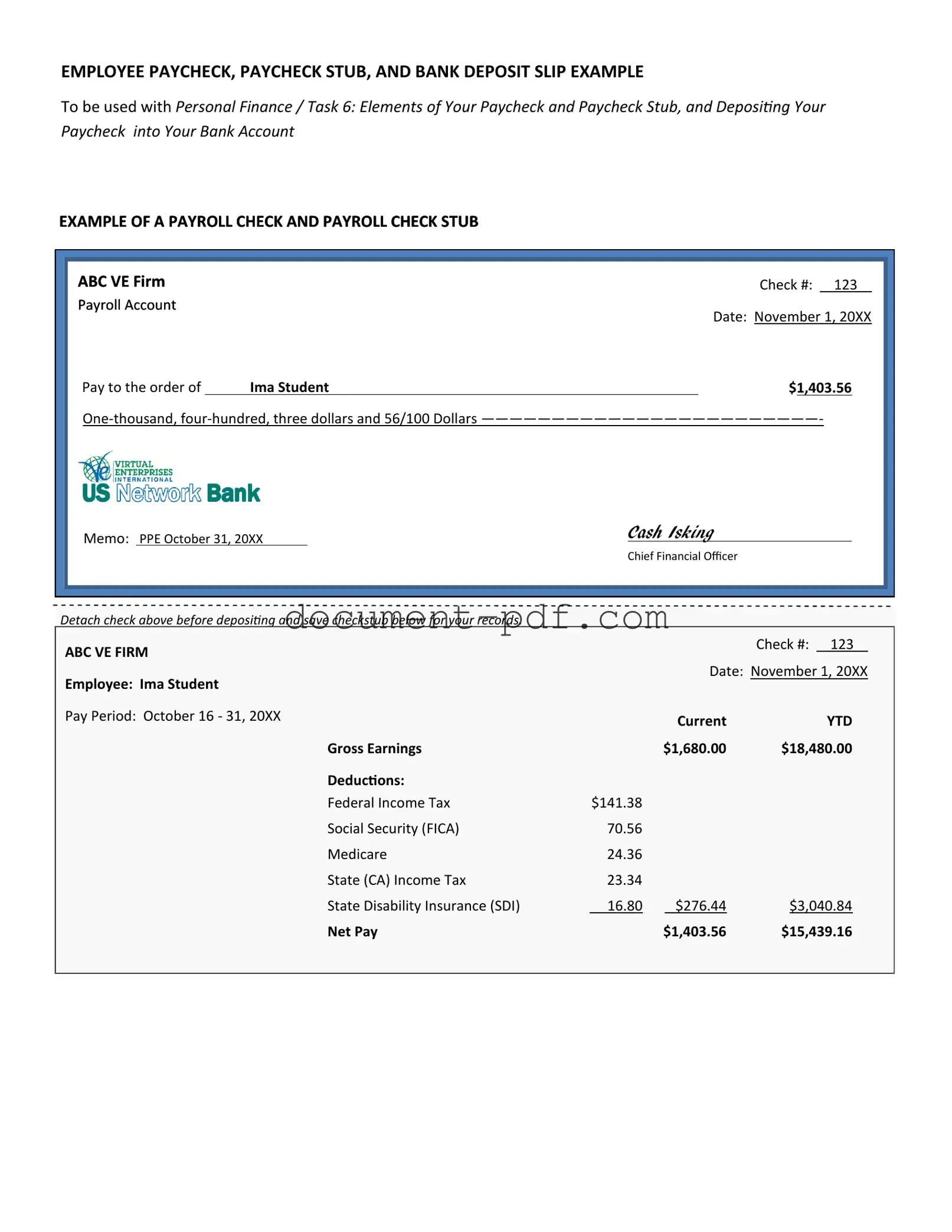

The Pay Stub is also akin to the Payroll Check form. A pay stub accompanies each paycheck and details the breakdown of an employee's earnings, deductions, and net pay. While the Payroll Check form indicates the total amount being paid, the pay stub provides transparency and clarity regarding how that amount was calculated, including taxes and other deductions.

The Employee Compensation Agreement shares similarities with the Payroll Check form as well. This document outlines the terms of an employee’s pay, including salary, bonuses, and other compensation-related details. While the Payroll Check form is a transactional document for each pay period, the Employee Compensation Agreement serves as a foundational document that establishes the overall compensation structure for the employee.

The Time Card or Time Sheet is another document that relates to the Payroll Check form. These documents track the hours worked by an employee, serving as the basis for calculating wages. The Payroll Check form relies on the accurate reporting of hours from the Time Card to ensure that employees are compensated fairly for their work. Both documents are essential for maintaining accurate payroll records.

Similar to the Payroll Check form is the Payroll Register. This document serves as a summary of all payroll transactions for a specific period. It lists each employee's gross pay, deductions, and net pay. While the Payroll Check form is focused on individual payments, the Payroll Register provides a broader overview of payroll expenses for the entire organization.

The 1099 form also bears resemblance to the Payroll Check form, particularly in the context of independent contractors. While the Payroll Check form is typically associated with employees, the 1099 form is issued to freelancers and contractors to report their earnings. Both documents are crucial for financial reporting and tax purposes, ensuring that all parties comply with tax regulations.

For those seeking to understand the importance of official documentation in financial transactions, it is beneficial to explore various forms like the Payroll Check and related documents. Among these resources, the Texas PDF Templates provides valuable tools for both landlords and tenants, ensuring clarity and compliance in rental agreements and eviction processes, similar to how payroll documents uphold transparency and accountability in employee compensation.

Lastly, the Employment Offer Letter can be compared to the Payroll Check form. The offer letter outlines the terms of employment, including salary and benefits. While it sets the stage for the employee's compensation, the Payroll Check form is the actual manifestation of that compensation in practice. Both documents are vital in the employment relationship, ensuring clarity and understanding between employer and employee.