The Living Will is a document that, like a Power of Attorney, allows individuals to express their wishes regarding medical treatment in the event they become unable to communicate. Both documents serve to protect personal autonomy and ensure that an individual’s preferences are honored. While a Power of Attorney typically designates someone to make decisions on behalf of another, a Living Will specifically outlines the types of medical interventions one does or does not want, focusing on end-of-life care.

The Healthcare Proxy is closely related to the Power of Attorney, as it grants someone the authority to make healthcare decisions on behalf of another person. This document is particularly important in situations where an individual cannot voice their preferences due to illness or incapacitation. Like a Power of Attorney, a Healthcare Proxy ensures that a trusted person is in charge of making critical medical choices, thereby aligning healthcare decisions with the patient’s values and wishes.

A Durable Power of Attorney is another document that shares similarities with the standard Power of Attorney. The key distinction lies in its durability; this document remains effective even if the individual becomes incapacitated. This ensures that there is a continuous line of authority for financial and legal matters, providing peace of mind that decisions will be made consistently and in accordance with the individual’s best interests.

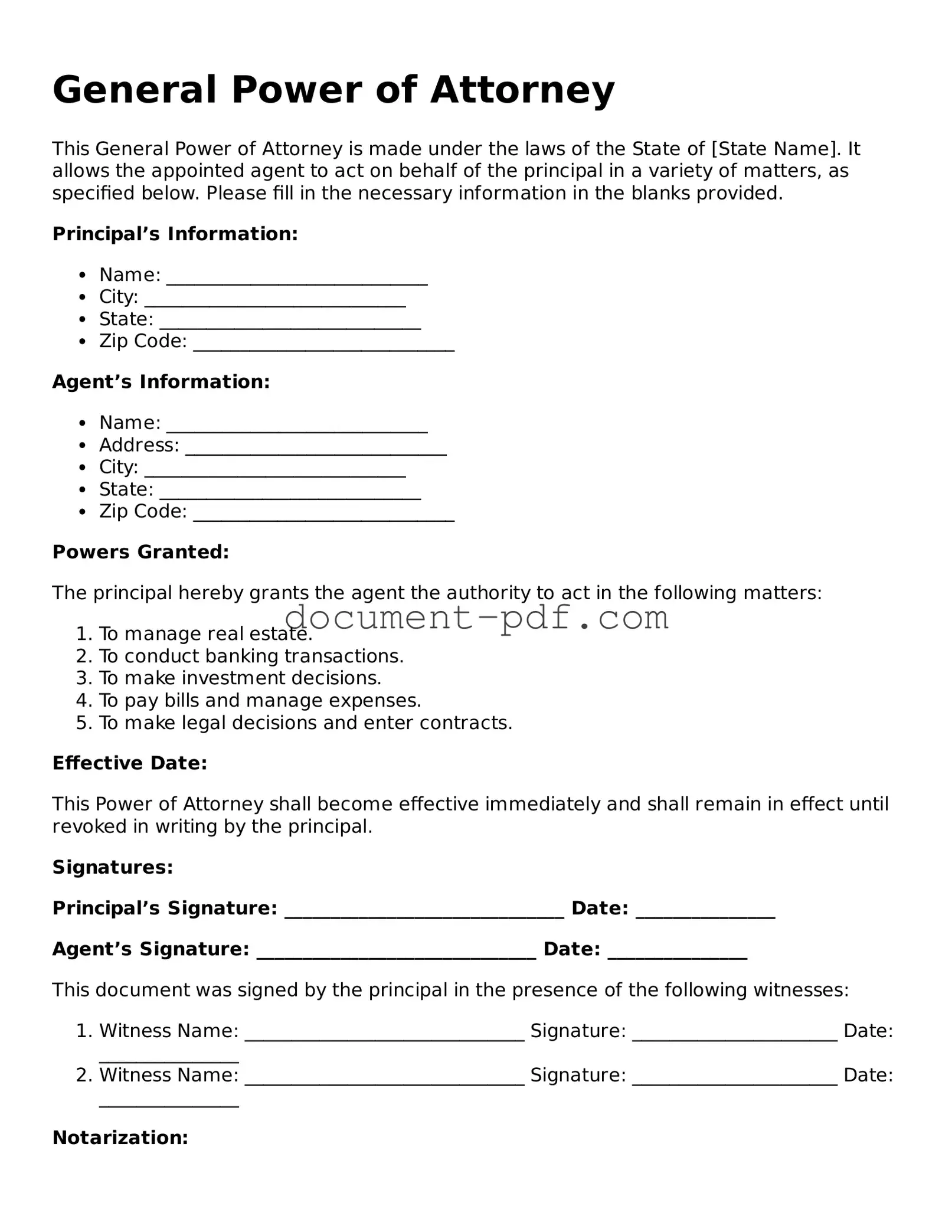

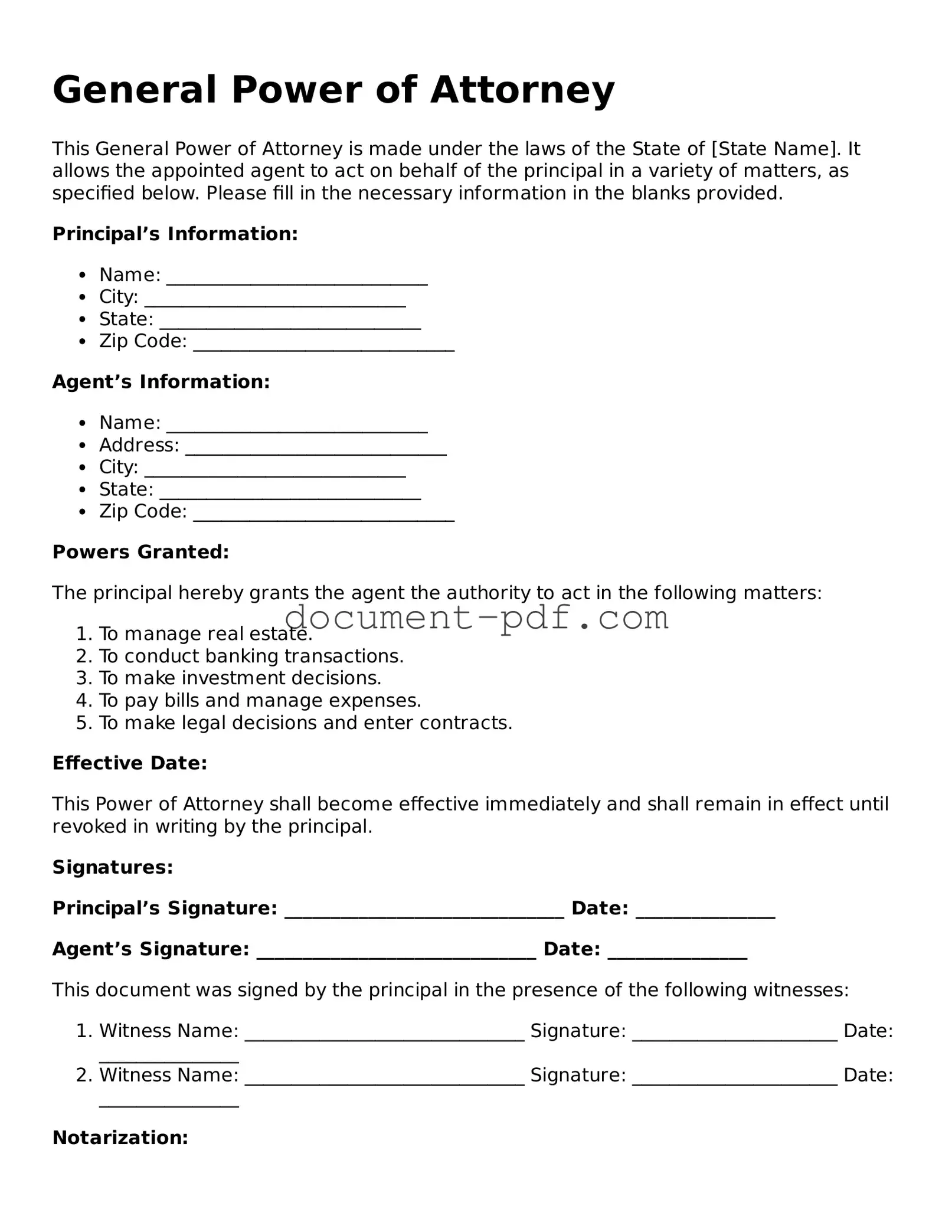

The Financial Power of Attorney focuses specifically on financial matters, allowing an appointed agent to manage financial affairs on behalf of the principal. Like a general Power of Attorney, this document grants authority to make decisions regarding banking, investments, and property. It is essential for individuals who want to ensure their financial interests are protected, especially if they anticipate being unable to handle these matters themselves.

The Advance Directive is a broader category that encompasses both Living Wills and Healthcare Proxies. It allows individuals to outline their preferences for medical treatment and designate someone to make decisions on their behalf. Similar to the Power of Attorney, an Advance Directive aims to ensure that a person's healthcare choices are respected and that their values guide medical decisions, even when they cannot advocate for themselves.

For individuals seeking compensation for damaged or lost electronic devices, understanding the necessary forms can be a vital aspect of the claims process. The Asurion F-017-08 MEN form is specifically designed for this purpose, ensuring that users can submit the required information to expedite their claims effectively. To learn more about such resources, you can visit PDF Templates Online for helpful insights and templates.

The Trust is a legal arrangement that holds assets for the benefit of a beneficiary. While it serves a different purpose than a Power of Attorney, both documents involve the management of an individual’s affairs. A Trust can provide a mechanism for financial management and distribution of assets, whereas a Power of Attorney designates someone to make decisions on behalf of another, whether financial or health-related. Both serve to protect the interests of individuals and their beneficiaries.

The Will is a document that outlines how an individual wishes to distribute their assets upon death. While it does not grant decision-making authority during a person’s lifetime, it shares the goal of ensuring that a person's wishes are honored. Both a Will and a Power of Attorney are essential components of estate planning, as they provide clarity and direction regarding personal and financial matters.

The Guardianship Agreement is another document that bears resemblance to the Power of Attorney. It establishes a legal relationship where one person is appointed to make decisions for another, typically in cases involving minors or incapacitated adults. While a Power of Attorney can be revoked at any time, a Guardianship is often a more permanent arrangement, requiring court approval. Both documents seek to ensure that the best interests of the individual are prioritized.

The Medical Authorization form allows individuals to grant permission for someone else to make medical decisions or access medical records. Similar to a Power of Attorney, this document is designed to facilitate communication between healthcare providers and designated individuals. It ensures that those entrusted with making decisions can act swiftly and effectively when necessary, particularly in urgent medical situations.

The Authorization to Release Information form is a document that permits the sharing of personal information, often for healthcare or legal purposes. While it does not confer decision-making authority like a Power of Attorney, it serves a similar function by allowing individuals to designate who can access their private information. Both documents emphasize the importance of personal choice and control over one’s own affairs, whether in health or legal matters.