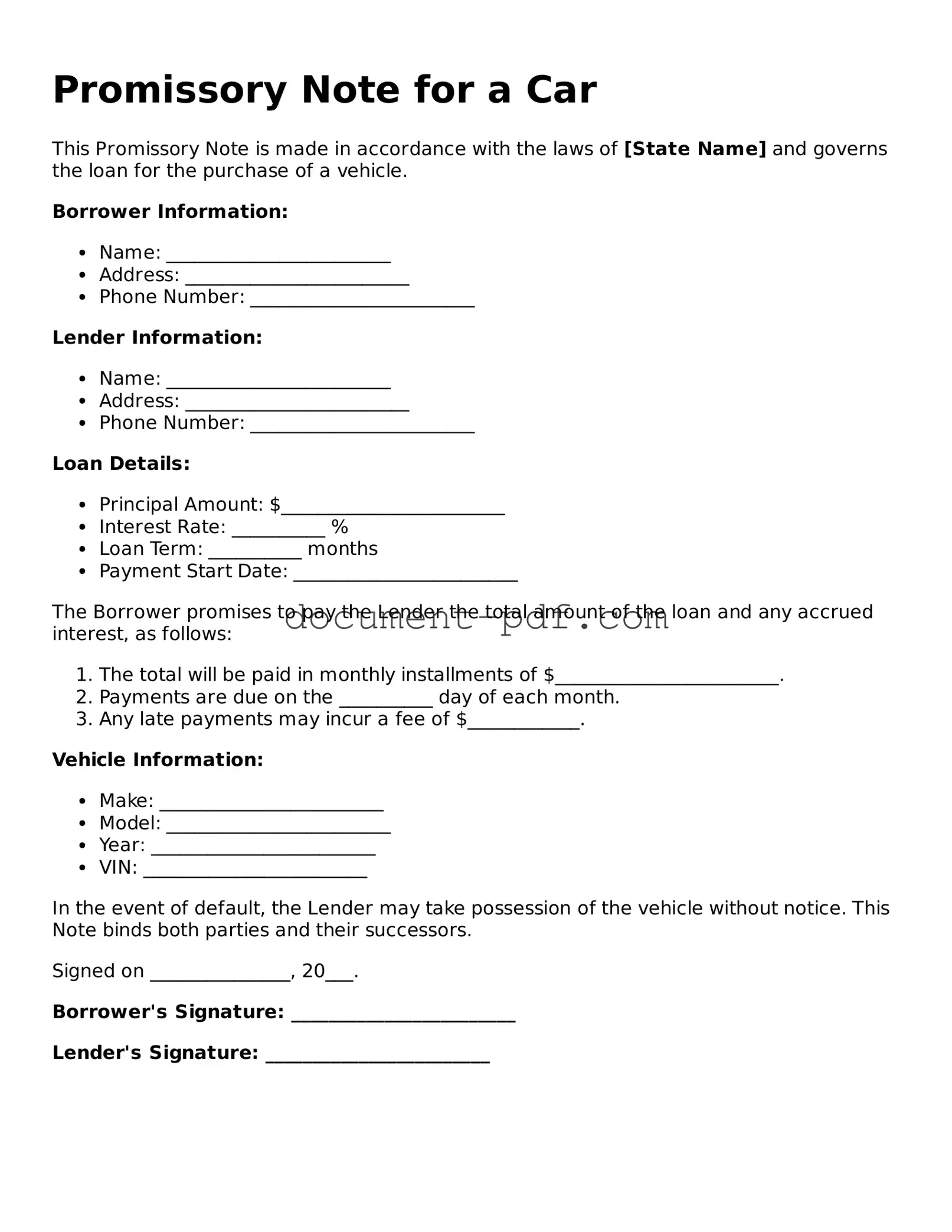

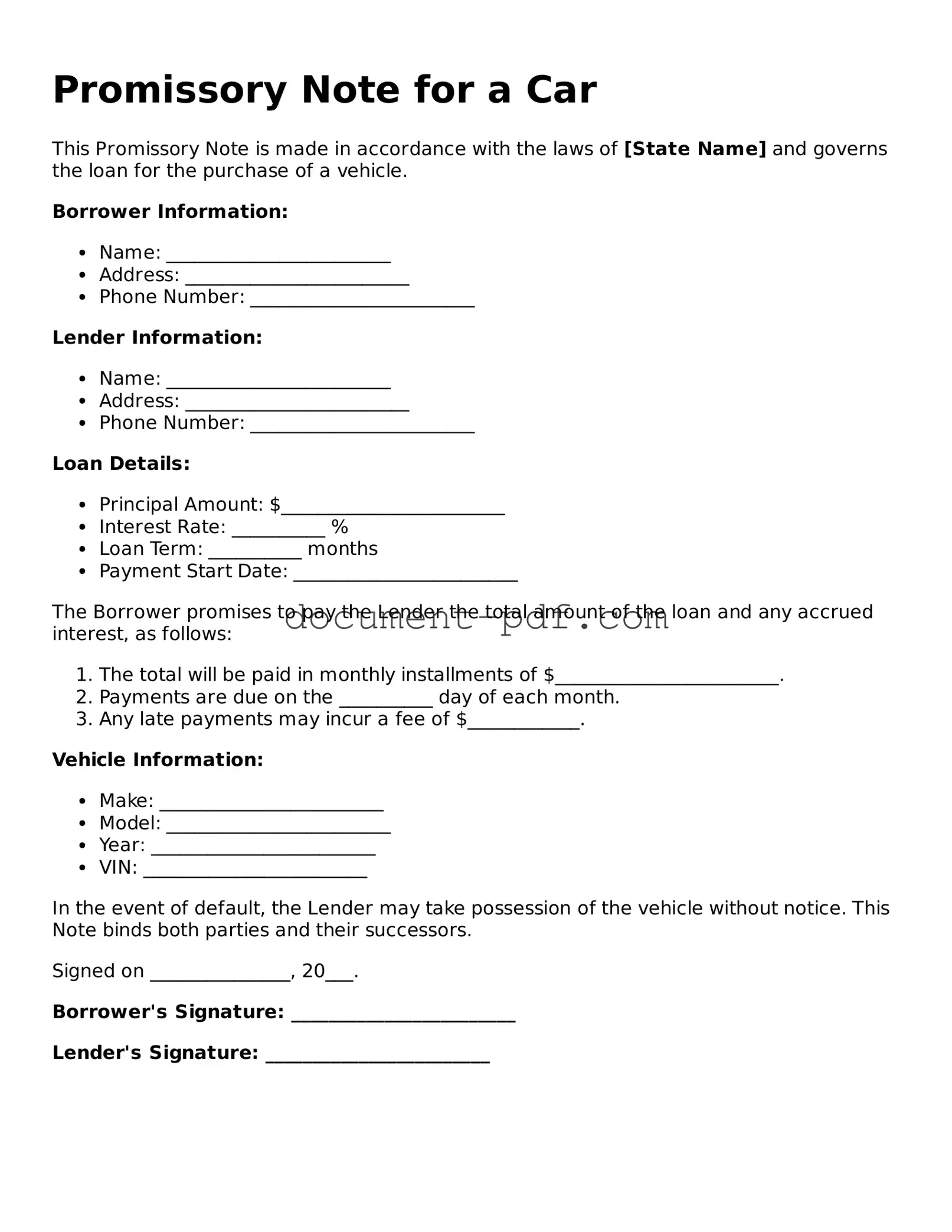

A Loan Agreement is similar to a Promissory Note for a Car in that both documents outline the terms of borrowing money. In a Loan Agreement, the lender and borrower agree on the amount borrowed, the interest rate, and the repayment schedule. This document can cover a wider range of loans, including personal loans and mortgages, while a Promissory Note specifically pertains to the financing of a vehicle. Both documents establish a legal obligation for the borrower to repay the loan under the specified conditions.

A Sales Contract for a Vehicle shares similarities with a Promissory Note for a Car, as both involve the sale and financing of a vehicle. The Sales Contract details the terms of the sale, including the purchase price, vehicle identification number (VIN), and any warranties. While the Promissory Note focuses on the repayment of borrowed funds, the Sales Contract serves as proof of the transaction and outlines the responsibilities of both the buyer and seller. Together, they ensure a clear understanding of the sale and financing process.

When dealing with a loan agreement, it's essential to understand the various types of documents that can formalize the relationship between a borrower and lender. For instance, a Promissory Note is crucial for detailing the obligation to repay borrowed funds. For those in Maryland seeking to create such agreements, you can find templates and additional resources at All Maryland Forms, ensuring you complete your documentation effectively.

An Installment Agreement is another document that resembles a Promissory Note for a Car. This agreement allows a borrower to pay for a vehicle in installments rather than in a lump sum. Like the Promissory Note, it specifies the total amount financed, the interest rate, and the payment schedule. The Installment Agreement is particularly useful for buyers who prefer to spread out their payments over time. Both documents serve to protect the interests of both the borrower and the lender.

A Lease Agreement for a Vehicle is also comparable to a Promissory Note for a Car, though it serves a different purpose. While a Promissory Note represents a loan for purchasing a vehicle, a Lease Agreement outlines the terms for renting a vehicle for a specified period. It includes details such as monthly payments, mileage limits, and maintenance responsibilities. Both documents create a financial obligation, but they cater to different needs—ownership versus temporary use.

Finally, a Title Loan Agreement bears similarities to a Promissory Note for a Car, as both involve using a vehicle as collateral for a loan. In a Title Loan Agreement, the borrower secures a loan by providing the vehicle's title to the lender. The terms of repayment, including interest rates and payment schedules, are clearly outlined. Both documents aim to protect the lender's investment while providing the borrower with necessary funds, although the risks associated with title loans can be higher due to the potential loss of the vehicle.