A loan agreement is a document that outlines the terms and conditions of a loan between a lender and a borrower. Like a promissory note, it specifies the amount borrowed, the interest rate, and the repayment schedule. However, a loan agreement often includes more detailed provisions regarding collateral, default consequences, and other legal obligations. This makes it a more comprehensive document for larger loans or complex arrangements.

A mortgage is a specific type of loan agreement used to secure a loan for purchasing real estate. Similar to a promissory note, it requires the borrower to repay the loan amount with interest. However, a mortgage also involves the property itself as collateral. If the borrower defaults, the lender has the right to foreclose on the property, which adds a layer of complexity not found in a standard promissory note.

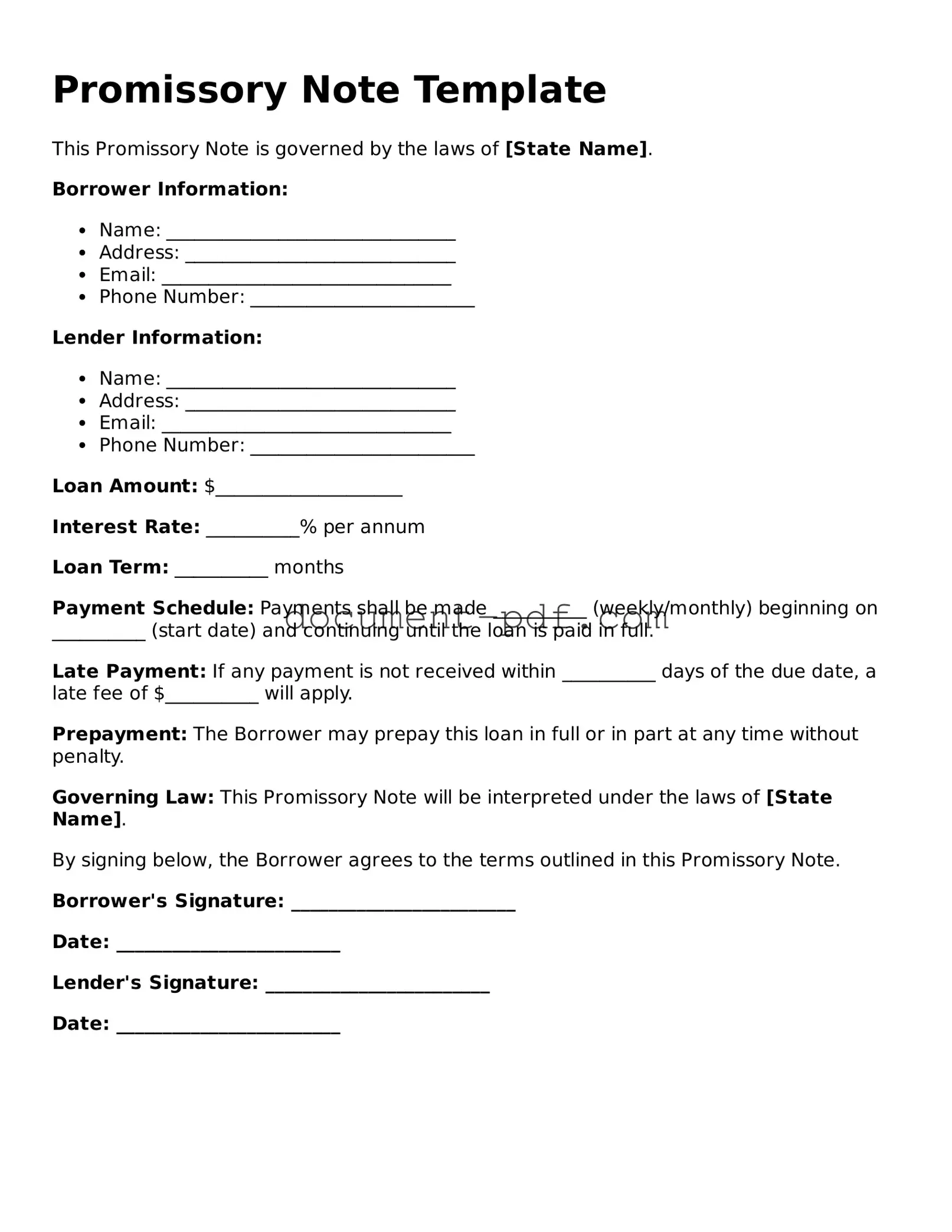

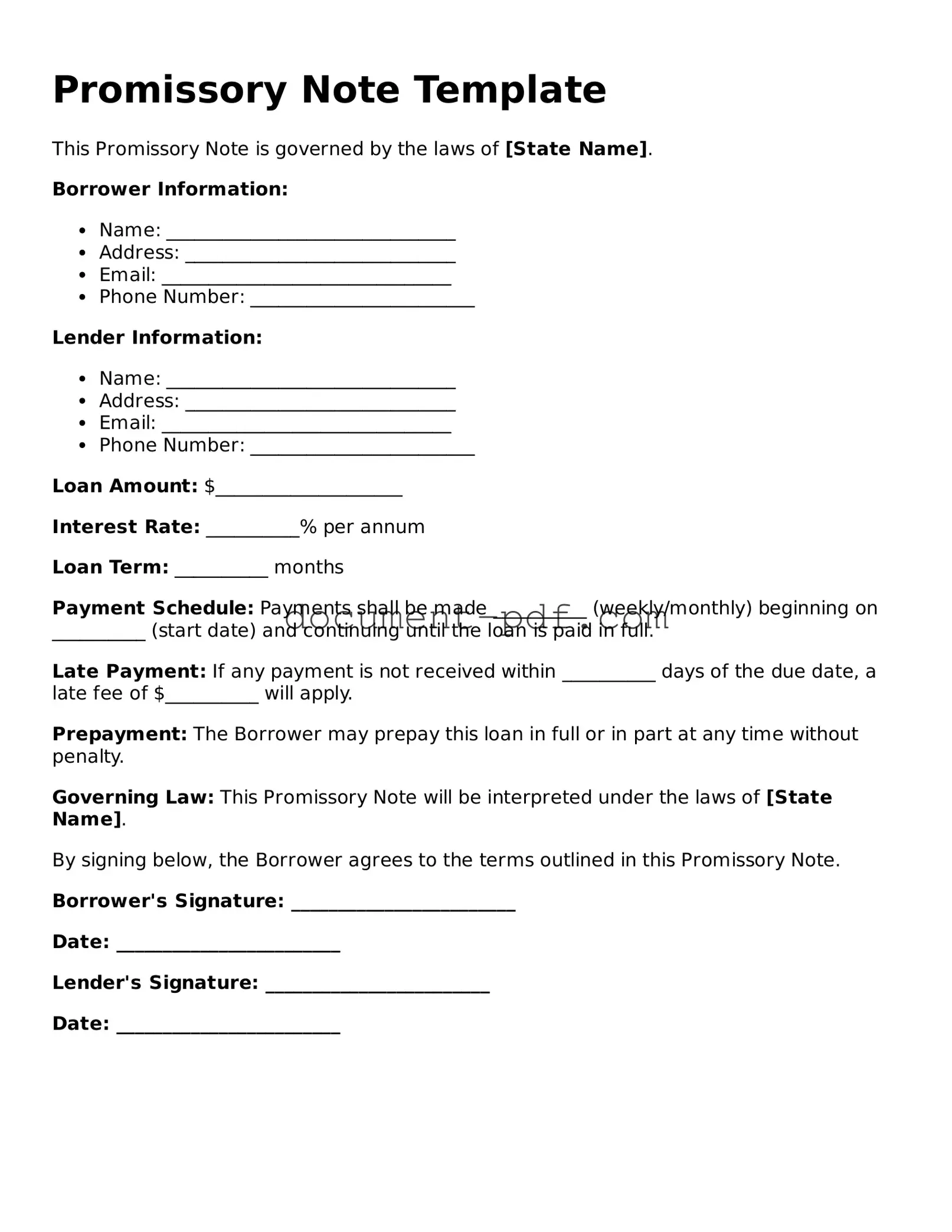

For those looking to navigate the intricacies of financial agreements, it is essential to understand various documentation types including promissory notes. Whether dealing with a loan, mortgage, or lease, clearly defined terms assist in maintaining transparency between parties. Additionally, resources like the pdfdocshub.com can provide valuable information regarding related forms and documents necessary for secure transactions.

A credit agreement is another document that outlines the terms of a credit arrangement between a lender and a borrower. It shares similarities with a promissory note in that it details the loan amount, interest rate, and repayment terms. However, credit agreements typically cover revolving credit lines, such as credit cards, where the borrower can draw on the credit limit repeatedly, unlike the fixed amount of a promissory note.

An IOU, or informal acknowledgment of debt, serves as a simple way for one party to recognize that they owe money to another. While it is less formal than a promissory note, it shares the fundamental concept of documenting a debt. An IOU may not include specific terms like interest rates or repayment schedules, making it less binding and more casual.

A lease agreement is similar to a promissory note in that it often involves regular payments over time, typically for renting property. Both documents outline payment terms, including the amount and frequency of payments. However, a lease agreement also includes additional details regarding the use of the property, responsibilities of both parties, and terms for termination, which are not typically found in a promissory note.

A personal guarantee is a document in which an individual agrees to be responsible for the debt of another party. It shares similarities with a promissory note in that it establishes a financial obligation. However, a personal guarantee usually serves as a secondary assurance for the lender, ensuring that if the primary borrower defaults, the guarantor will repay the debt.

A bond is a financial instrument that represents a loan made by an investor to a borrower, typically a corporation or government. Like a promissory note, a bond involves the borrowing of money with a promise to repay it, along with interest. However, bonds are generally issued in larger amounts and can be traded in secondary markets, making them more complex than a simple promissory note.

A letter of credit is a document issued by a financial institution guaranteeing payment to a seller on behalf of a buyer, provided certain conditions are met. While it serves a different purpose than a promissory note, both documents involve financial commitments. A letter of credit is often used in international trade, providing assurance to sellers that they will receive payment, similar to how a promissory note assures lenders of repayment from borrowers.