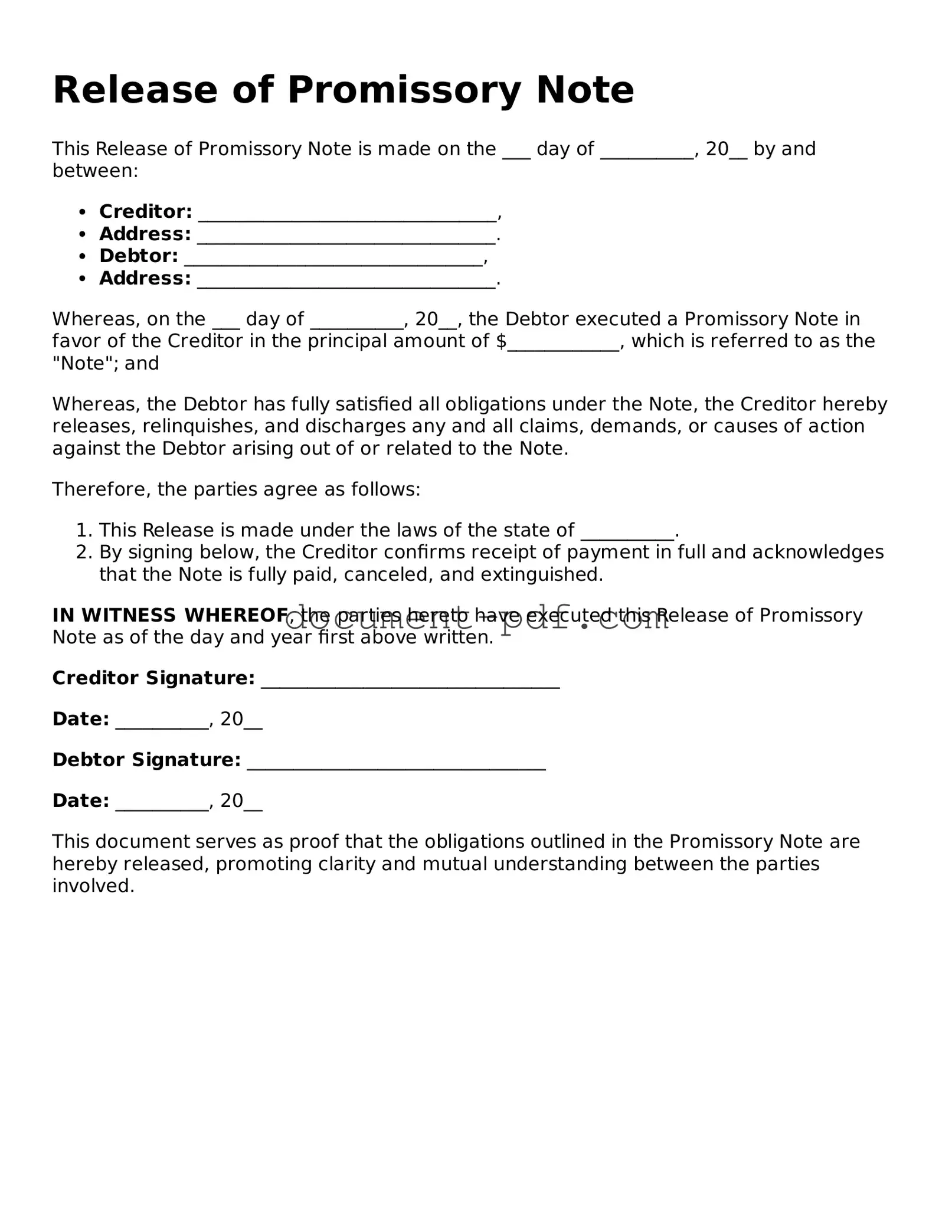

Attorney-Approved Release of Promissory Note Document

A Release of Promissory Note form is a document that officially acknowledges the repayment of a loan and releases the borrower from any further obligations. This form serves as proof that the debt has been settled, providing peace of mind to both parties involved. If you need to complete this process, fill out the form by clicking the button below.

Access Release of Promissory Note Editor Here

Attorney-Approved Release of Promissory Note Document

Access Release of Promissory Note Editor Here

Finish the form without slowing down

Edit your Release of Promissory Note online and download the finished file.

Access Release of Promissory Note Editor Here

or

Click for PDF Form