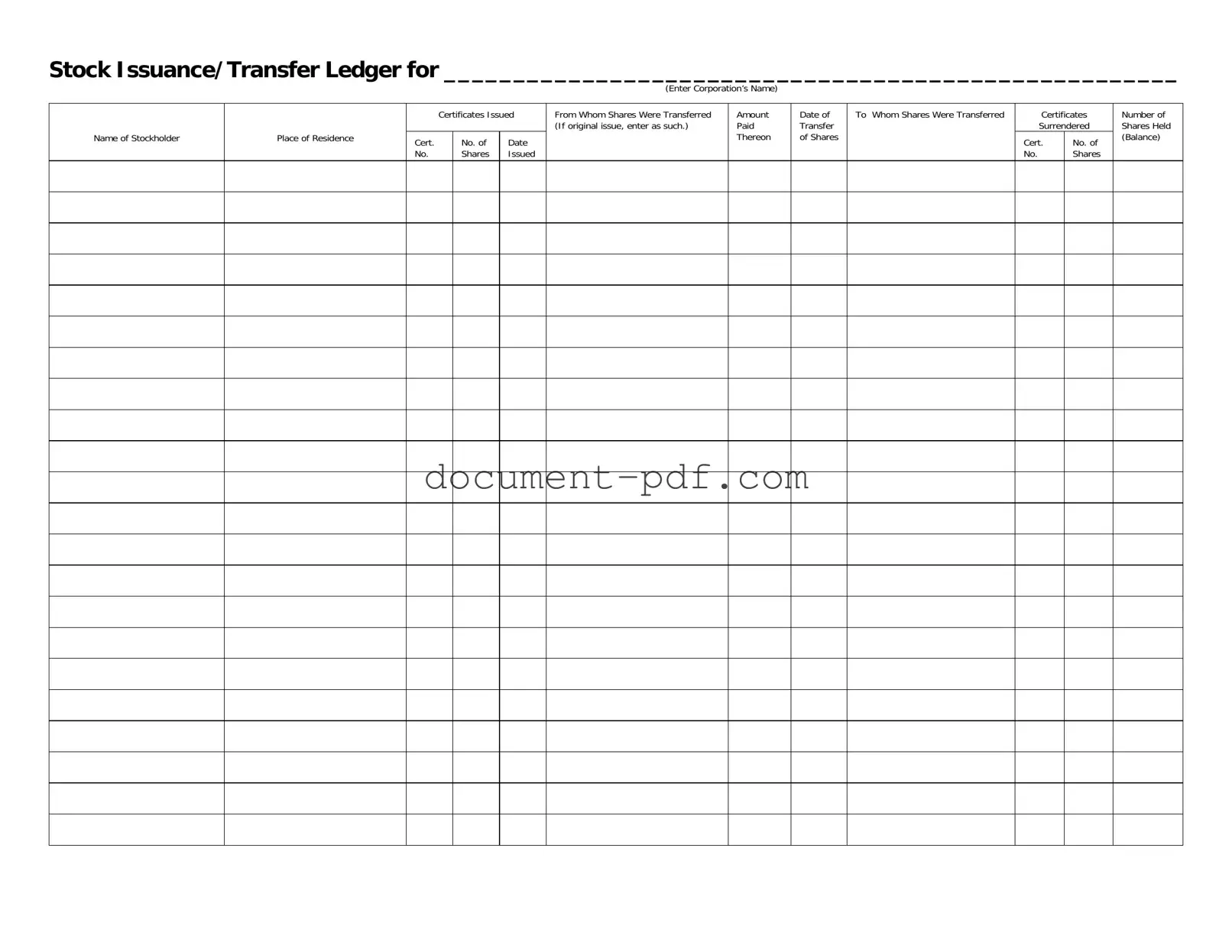

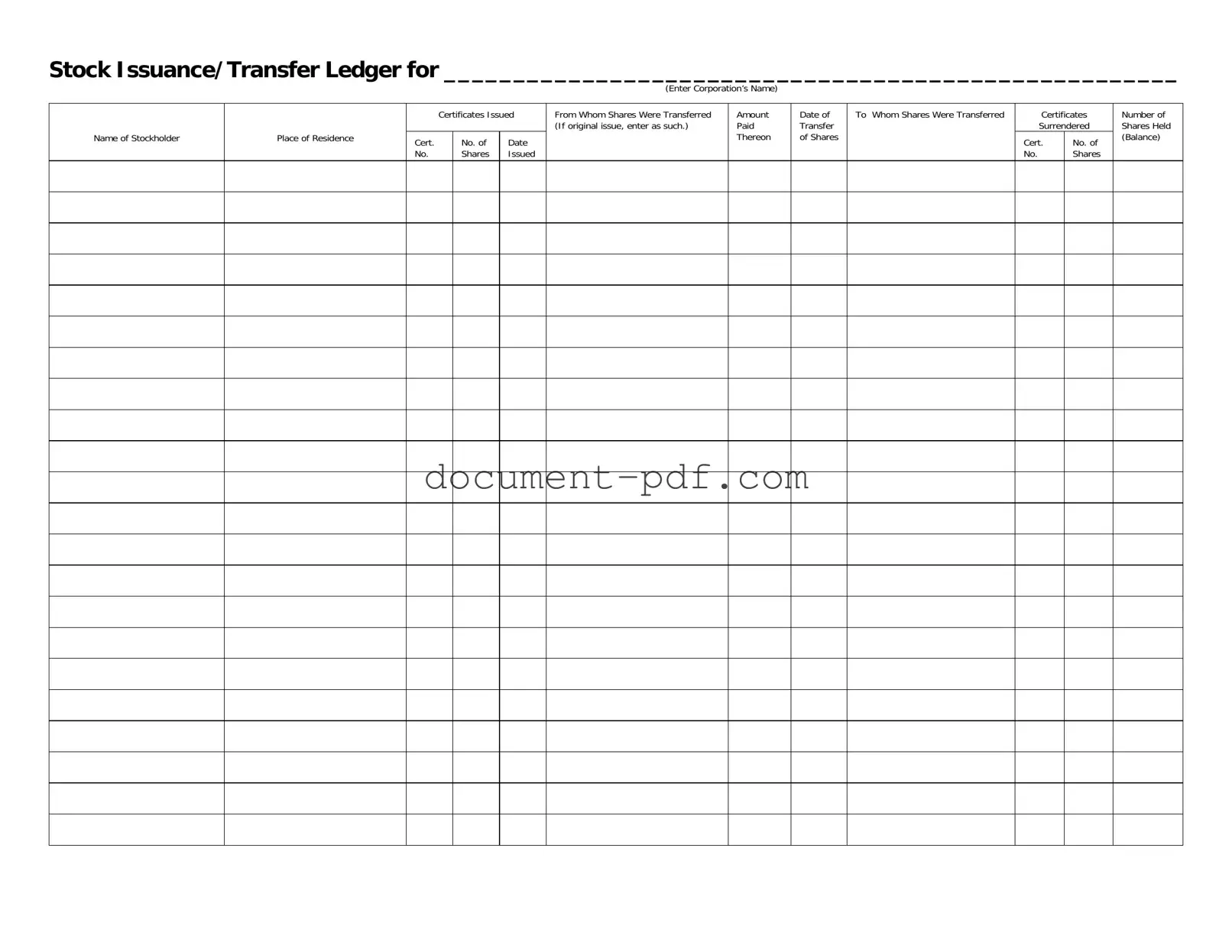

The Stock Transfer Ledger form shares similarities with the Shareholder Register. Both documents serve as official records of stock ownership within a corporation. The Shareholder Register lists all shareholders, their addresses, and the number of shares owned. This document is crucial for maintaining an accurate account of who holds shares, similar to how the Stock Transfer Ledger tracks the issuance and transfer of shares, ensuring that ownership records are up to date and reflecting current shareholders.

Another document akin to the Stock Transfer Ledger is the Stock Certificate. While the Ledger records transactions and ownership changes, the Stock Certificate serves as tangible proof of ownership. It typically includes the shareholder's name, the number of shares owned, and the corporation’s details. The certificate is often issued when shares are first acquired, paralleling the Ledger’s role in documenting these initial issuances and subsequent transfers.

The Corporate Bylaws also bear resemblance to the Stock Transfer Ledger, albeit in a different capacity. Bylaws outline the rules governing the management of a corporation, including how stock transfers should be handled. They establish the framework within which the Stock Transfer Ledger operates, ensuring that all transfers are compliant with corporate policies and legal requirements, thus supporting the integrity of the Ledger.

Understanding various documents related to stocks is crucial for maintaining clarity in ownership and transactions. For example, the New York Room Rental Agreement is similar in that it outlines the responsibilities of tenants and landlords, eliminating ambiguities in rental agreements. For anyone seeking guidance on similar legal documents, resources such as New York PDF Docs can be invaluable.

The Minutes of Meetings document is another related form. These minutes often capture decisions made regarding stock transactions, including approvals for share transfers or issuances. Just as the Stock Transfer Ledger records the details of these transactions, the Minutes provide a historical context and authorization, reinforcing the legitimacy of the actions recorded in the Ledger.

The Form 10-K, an annual report filed with the SEC, can also be compared to the Stock Transfer Ledger. This comprehensive report includes information about a company's financial performance and stockholder equity. While the Ledger tracks individual share transfers, the Form 10-K aggregates this data to provide a broader picture of ownership and financial health, emphasizing the importance of accurate record-keeping for stakeholders.

Lastly, the Stock Option Agreement is similar in that it relates to the ownership of shares. This agreement outlines the terms under which employees can purchase company stock at a predetermined price. While the Stock Transfer Ledger records actual transfers of shares, the Stock Option Agreement sets the stage for future transactions, detailing the rights and obligations of both the company and the option holder, much like the Ledger documents the outcomes of those rights when exercised.