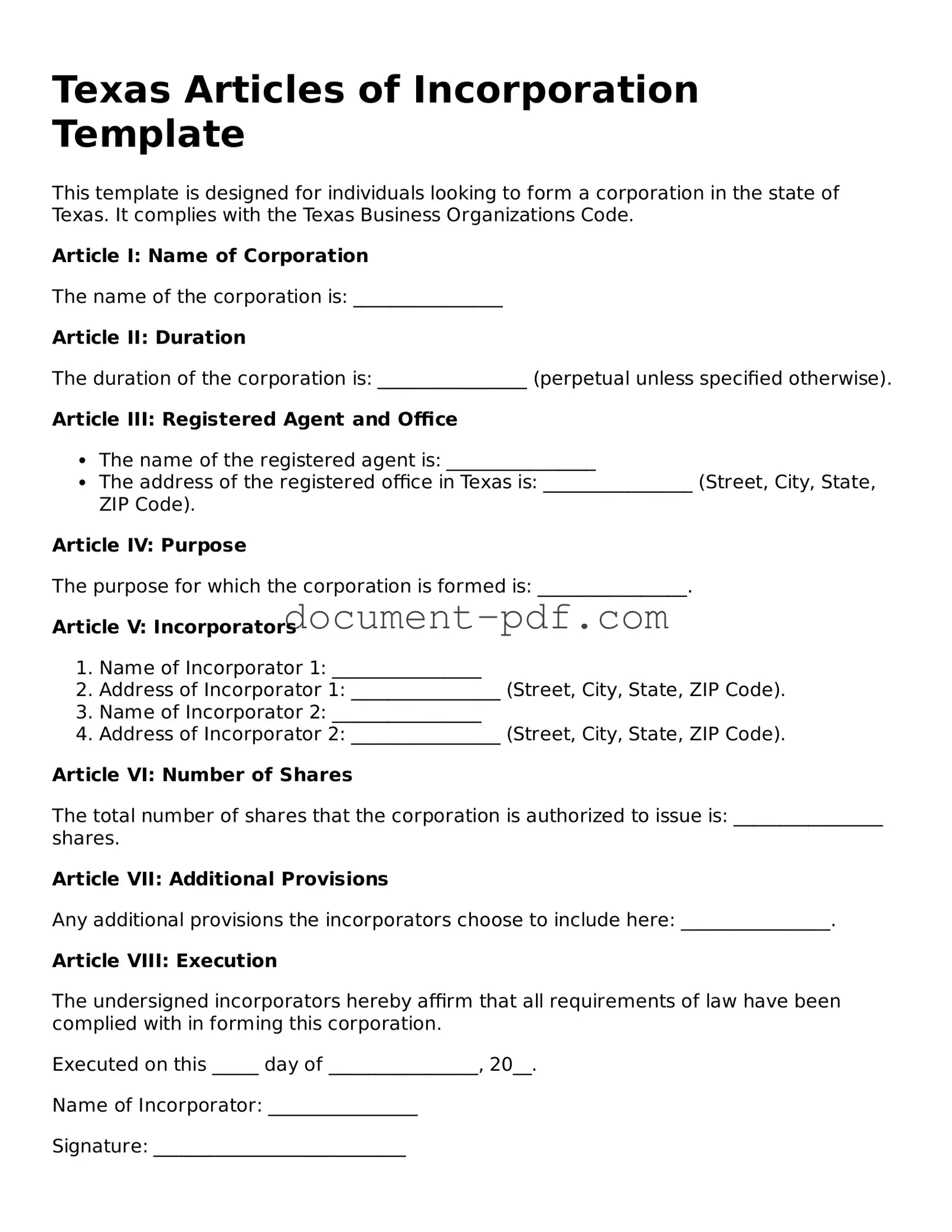

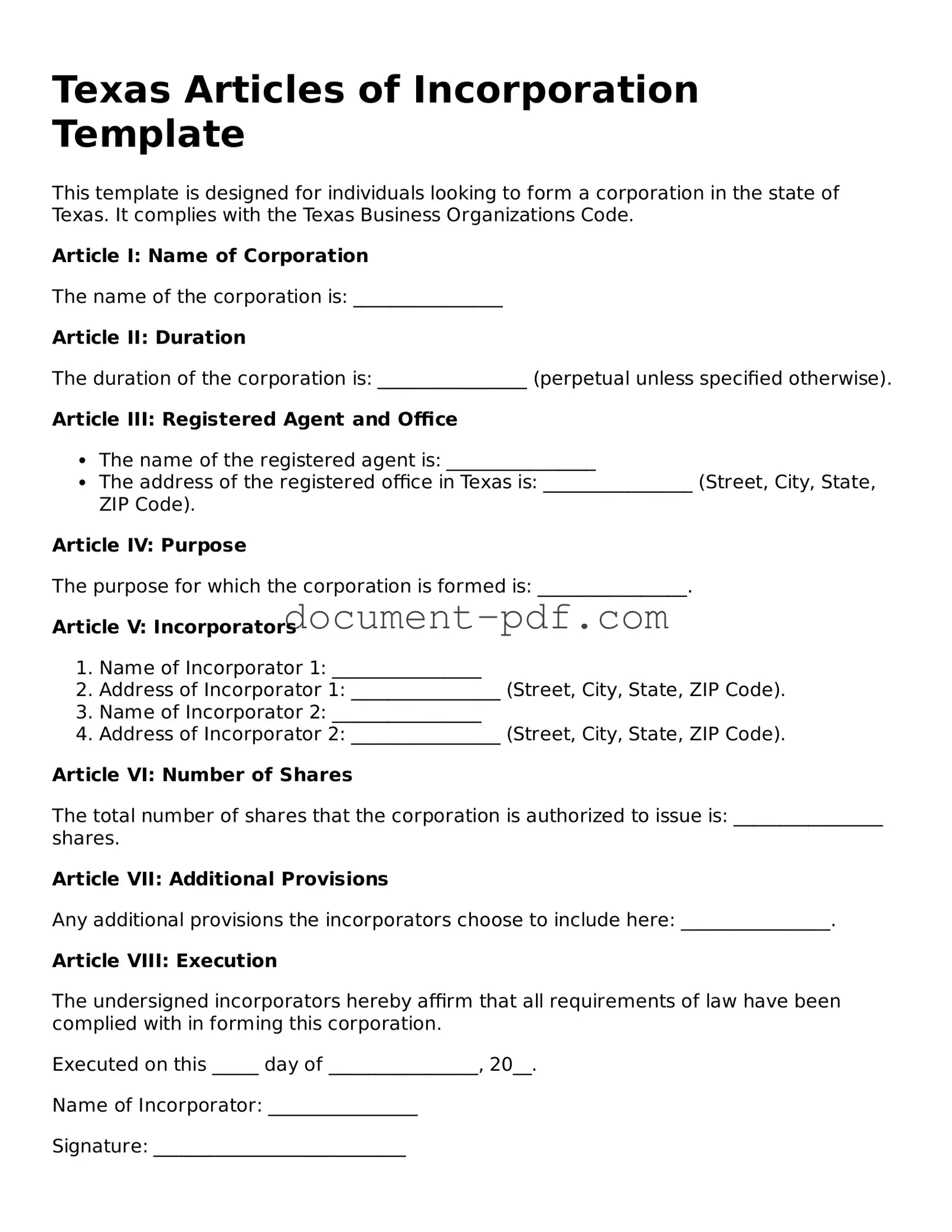

The Texas Articles of Incorporation form is similar to the Certificate of Incorporation used in many other states. Both documents serve the purpose of establishing a corporation and outline essential details such as the corporation's name, purpose, and registered agent. While the specifics may vary by state, the fundamental function remains the same: to legally create a corporation that can operate within the respective jurisdiction.

The Texas Certificate of Formation functions similarly to the Articles of Incorporation. This document outlines the basic structure and purpose of a corporation. It includes essential information such as the corporation's name, duration, address, and the identity of its registered agent. By filing a Certificate of Formation, a business officially establishes itself in the state. This document serves as the foundational blueprint for a corporation, ensuring that it complies with state laws and regulations. For those managing motor vehicle transactions, understanding the Texas PDF Templates can also be vital in ensuring proper delegation of motor vehicle-related responsibilities.

Another document comparable to the Texas Articles of Incorporation is the Articles of Organization, which is used for limited liability companies (LLCs). Like the Articles of Incorporation, this document is filed with the state to formally establish the entity. It includes information about the LLC’s name, address, and management structure, offering a clear framework for the business's operations and legal standing.

The Corporate Bylaws document also shares similarities with the Texas Articles of Incorporation. While the Articles establish the corporation, the Bylaws outline the internal rules governing the corporation's operations. This includes details on how meetings are conducted, how directors are elected, and the responsibilities of officers. Both documents are crucial for the effective functioning of a corporation.

The Statement of Information is another document that bears resemblance to the Texas Articles of Incorporation. While it is typically required on an annual basis, it serves to provide updated information about the corporation to the state. This document often includes the corporation's address, names of officers, and other relevant details, ensuring that the state has current information about the entity.

The Foreign Corporation Registration is akin to the Texas Articles of Incorporation when a corporation wishes to operate in a state different from where it was formed. This document allows a corporation to register as a foreign entity, ensuring compliance with local laws. It typically requires information similar to that found in the Articles of Incorporation, such as the corporation's name and purpose.

In addition, the Nonprofit Articles of Incorporation serve a similar purpose for nonprofit organizations. This document establishes the nonprofit's existence and outlines its mission, governance structure, and other essential details. While the objectives may differ from those of a for-profit corporation, the process of formal incorporation is fundamentally similar.

The Partnership Agreement can also be compared to the Texas Articles of Incorporation, especially in the context of business formation. Although it is used for partnerships rather than corporations, it serves to outline the structure, roles, and responsibilities of the partners involved. Both documents aim to provide a clear framework for the business's operation and governance.

The Certificate of Formation is another document that aligns closely with the Texas Articles of Incorporation. In some states, this term is used interchangeably with Articles of Incorporation. It similarly includes foundational details about the corporation and is filed with the state to officially create the entity. The requirements and structure may vary slightly, but the purpose remains consistent.

The Business License is another document that, while not directly equivalent, is related to the operational aspects of a corporation. After incorporation, businesses often need to obtain licenses to operate legally. This document is essential for compliance with local regulations and can be seen as a step that follows the incorporation process, ensuring that the business adheres to local laws.

Lastly, the Assumed Name Certificate, also known as a DBA (Doing Business As) registration, is relevant for corporations that wish to operate under a name different from their registered name. While it does not establish the corporation itself, it is a necessary document for branding and marketing purposes. It ensures that the public is aware of the business's identity, similar to how the Articles of Incorporation establish the legal identity of the corporation.