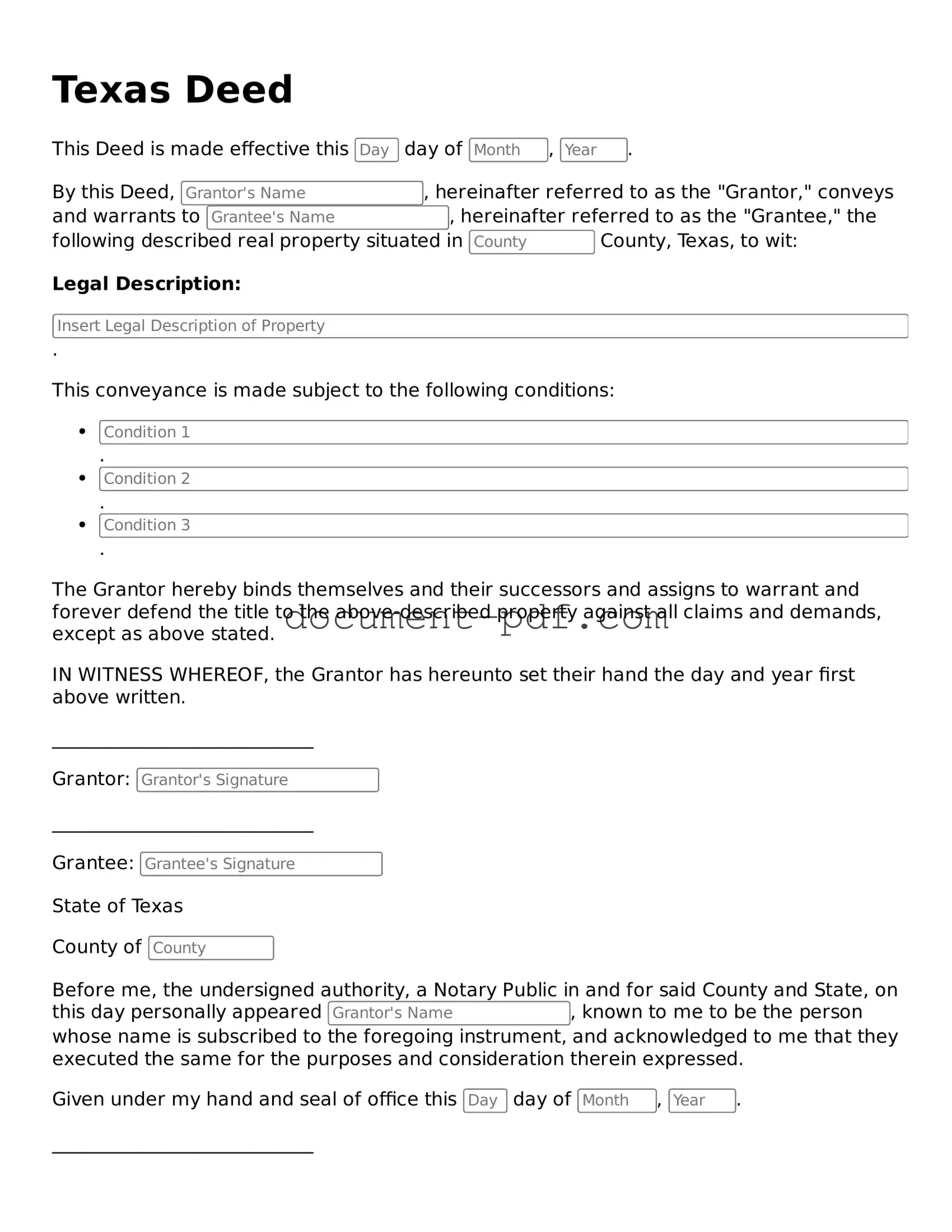

Attorney-Verified Texas Deed Template

A Texas Deed form is a legal document used to transfer ownership of real property in the state of Texas. This form outlines the details of the transaction, including the parties involved and the property description. To ensure a smooth transfer process, consider filling out the form by clicking the button below.

Access Deed Editor Here

Attorney-Verified Texas Deed Template

Access Deed Editor Here

Finish the form without slowing down

Edit your Deed online and download the finished file.

Access Deed Editor Here

or

Click for PDF Form