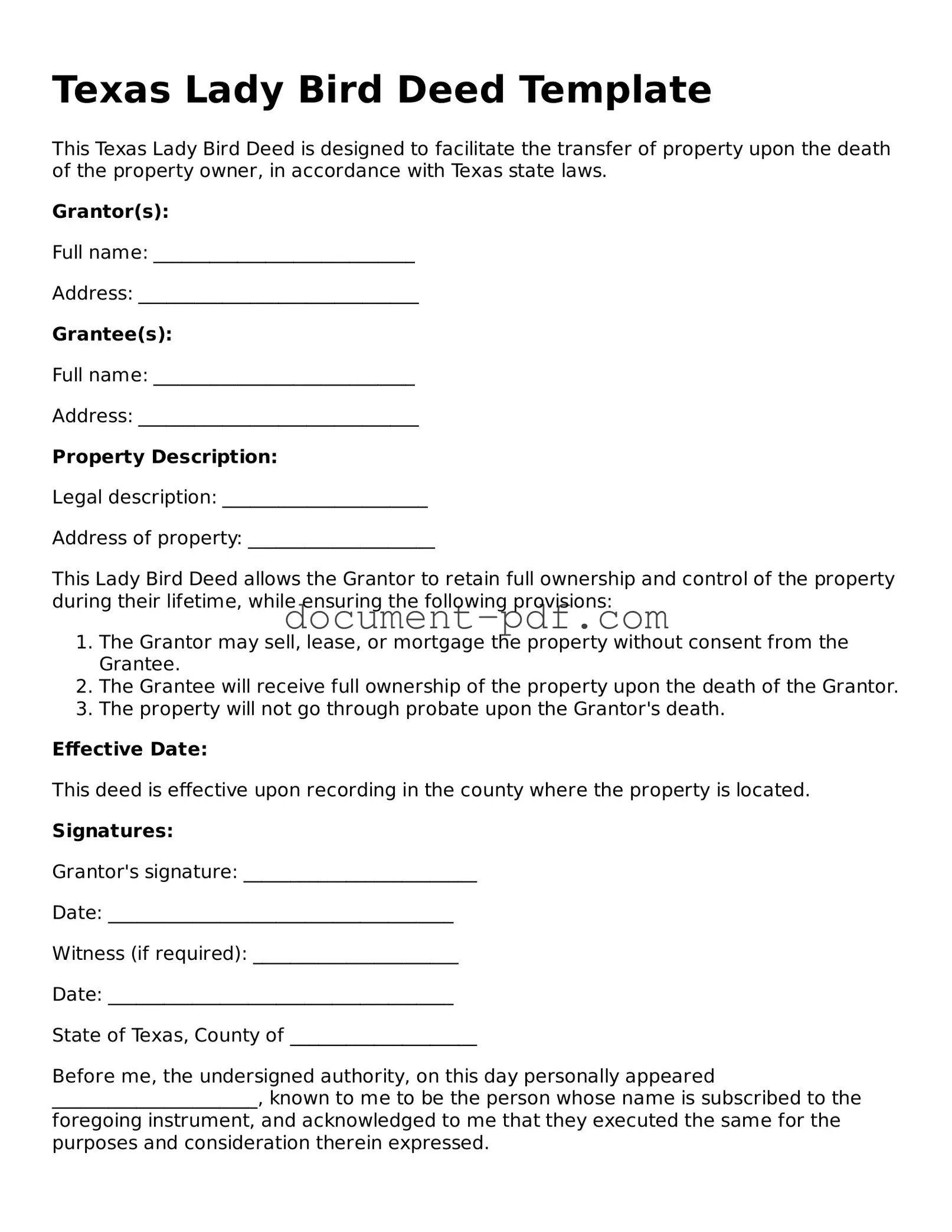

Attorney-Verified Texas Lady Bird Deed Template

The Texas Lady Bird Deed form is a legal document that allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. This type of deed provides flexibility and can help avoid probate, ensuring a smoother transition of property ownership. To learn more about this form and how it can benefit you, consider filling it out by clicking the button below.

Access Lady Bird Deed Editor Here

Attorney-Verified Texas Lady Bird Deed Template

Access Lady Bird Deed Editor Here

Finish the form without slowing down

Edit your Lady Bird Deed online and download the finished file.

Access Lady Bird Deed Editor Here

or

Click for PDF Form