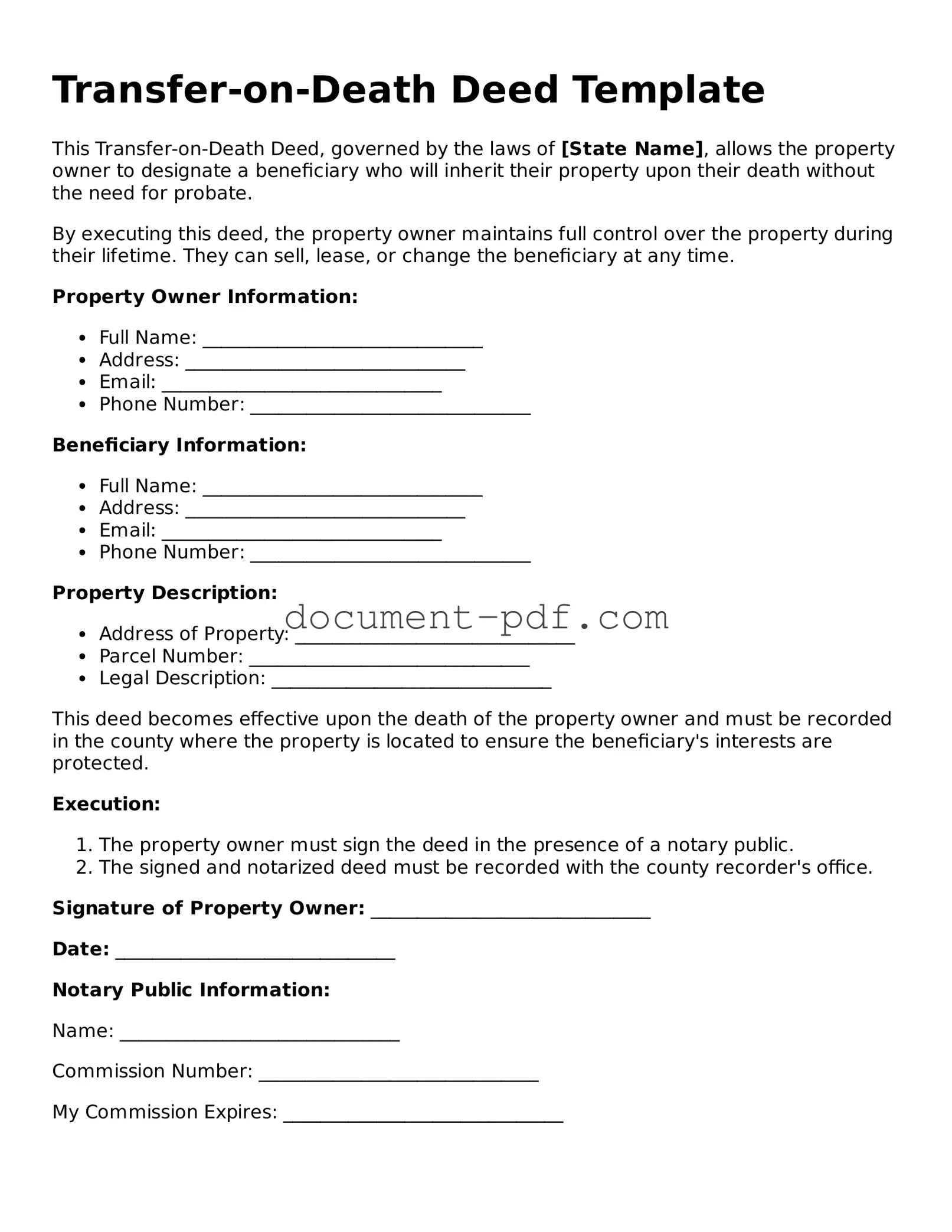

Attorney-Approved Transfer-on-Death Deed Document

A Transfer-on-Death Deed is a legal document that allows property owners to transfer their real estate to designated beneficiaries upon their death, bypassing the probate process. This form provides a straightforward way to ensure that your property goes directly to your chosen heirs without unnecessary delays. Ready to simplify your estate planning? Fill out the form by clicking the button below.

Access Transfer-on-Death Deed Editor Here

Attorney-Approved Transfer-on-Death Deed Document

Access Transfer-on-Death Deed Editor Here

Finish the form without slowing down

Edit your Transfer-on-Death Deed online and download the finished file.

Access Transfer-on-Death Deed Editor Here

or

Click for PDF Form