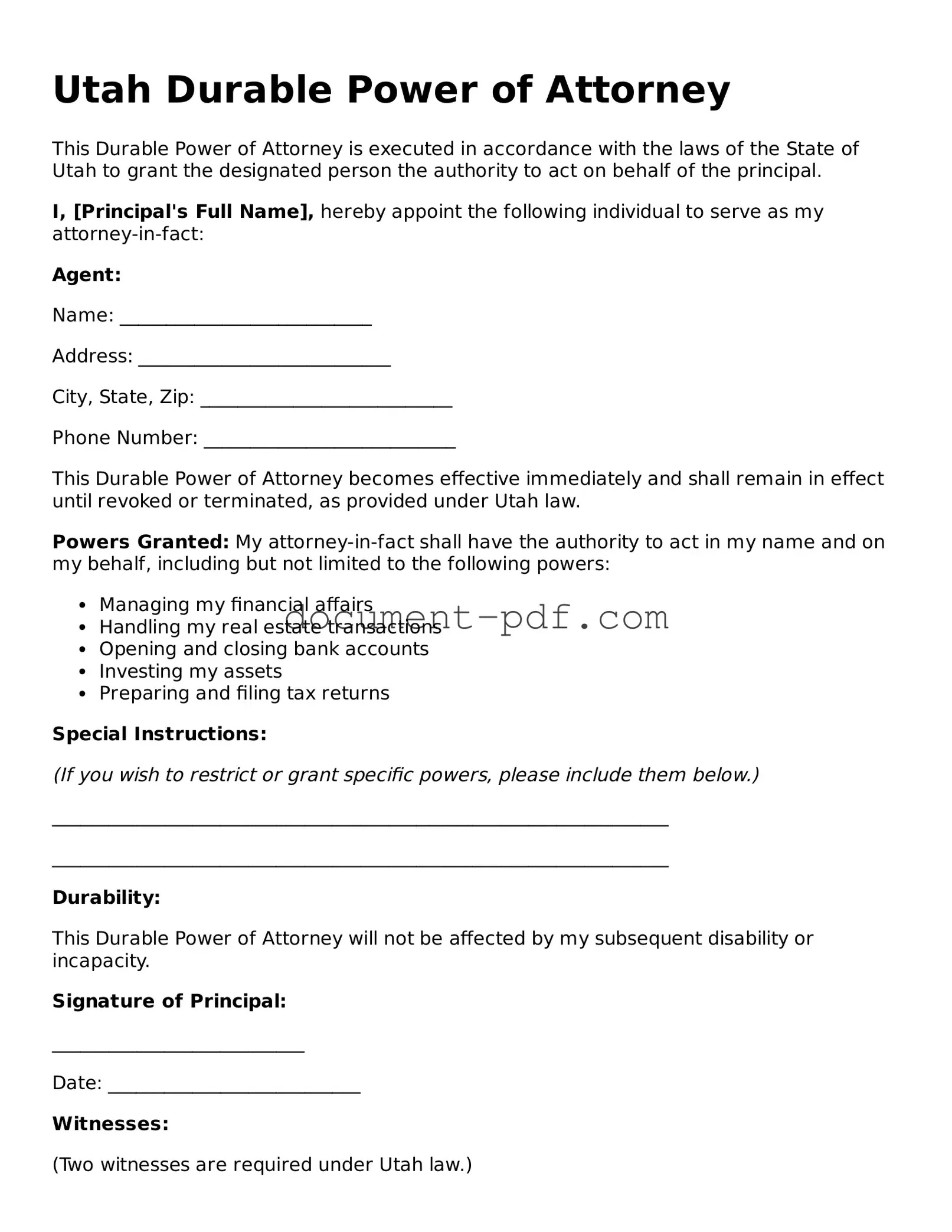

Attorney-Verified Utah Durable Power of Attorney Template

A Durable Power of Attorney form in Utah is a legal document that allows an individual to appoint someone else to make decisions on their behalf in financial or medical matters, even if they become incapacitated. This form ensures that the appointed person can act according to the individual's wishes, providing peace of mind for both parties. To get started with the Durable Power of Attorney form, click the button below.

Access Durable Power of Attorney Editor Here

Attorney-Verified Utah Durable Power of Attorney Template

Access Durable Power of Attorney Editor Here

Finish the form without slowing down

Edit your Durable Power of Attorney online and download the finished file.

Access Durable Power of Attorney Editor Here

or

Click for PDF Form