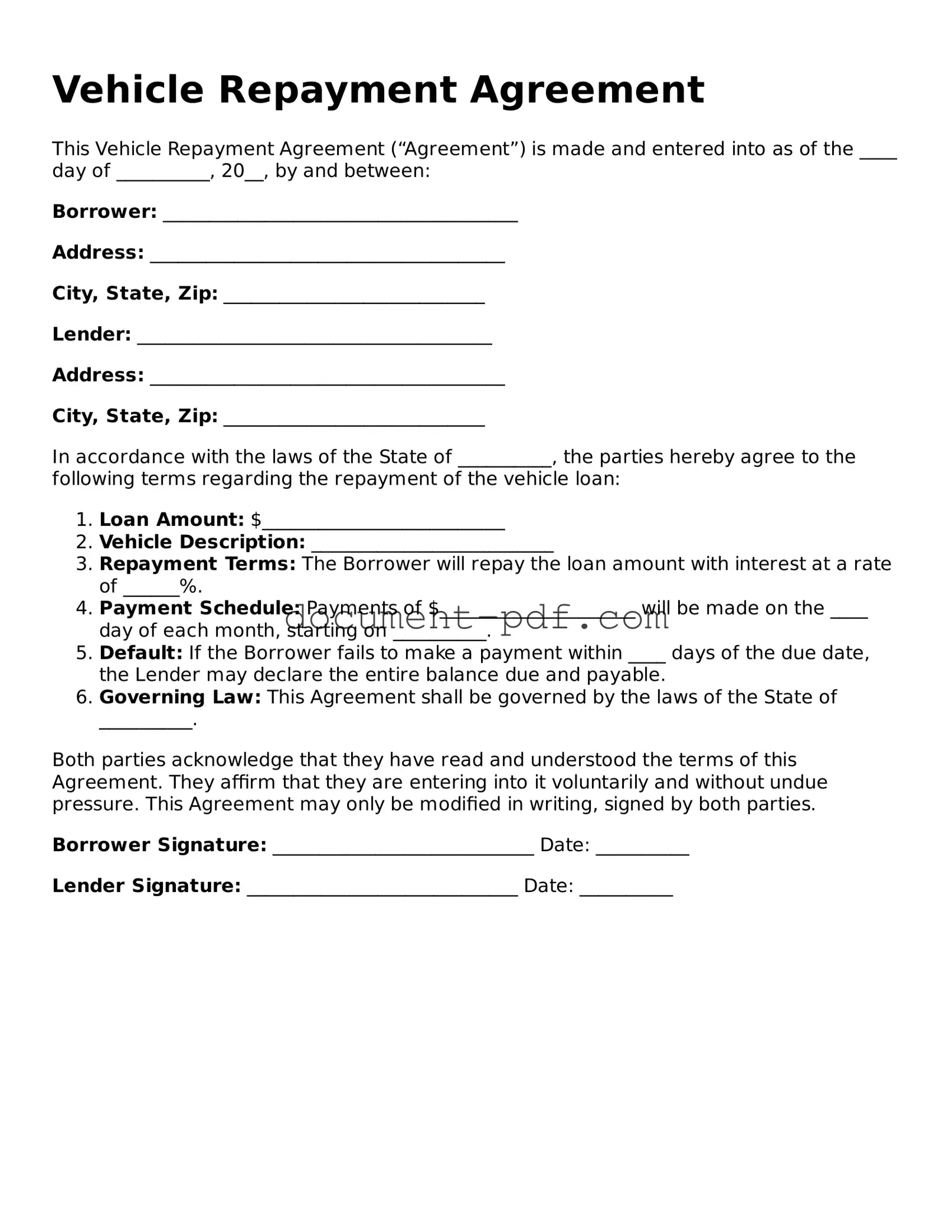

Attorney-Approved Vehicle Repayment Agreement Document

The Vehicle Repayment Agreement form is a legal document that outlines the terms and conditions under which a borrower agrees to repay a loan secured by a vehicle. This form is essential for both lenders and borrowers, as it helps clarify the obligations of each party and provides a clear framework for repayment. To ensure compliance and protect your interests, consider filling out the form by clicking the button below.

Access Vehicle Repayment Agreement Editor Here

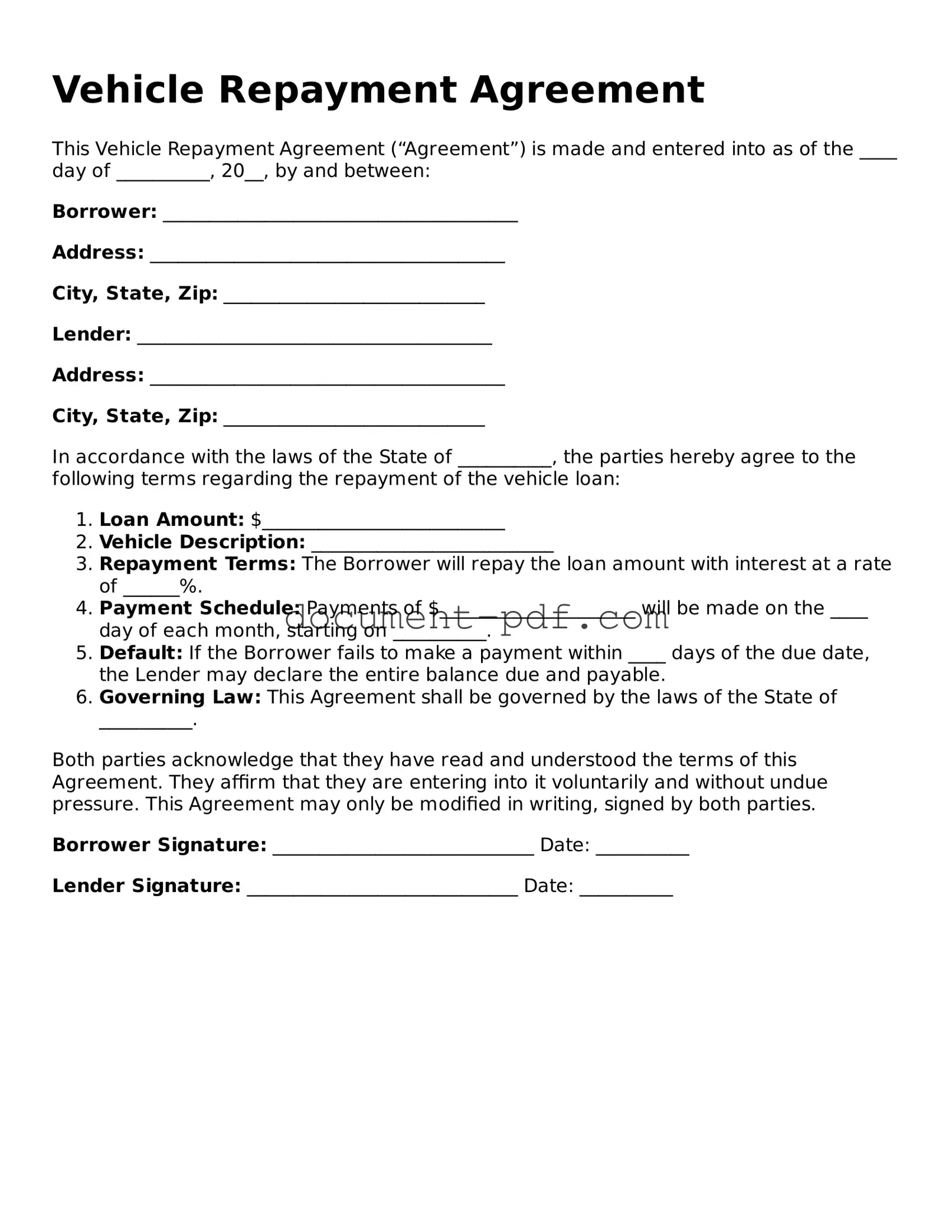

Attorney-Approved Vehicle Repayment Agreement Document

Access Vehicle Repayment Agreement Editor Here

Finish the form without slowing down

Edit your Vehicle Repayment Agreement online and download the finished file.

Access Vehicle Repayment Agreement Editor Here

or

Click for PDF Form