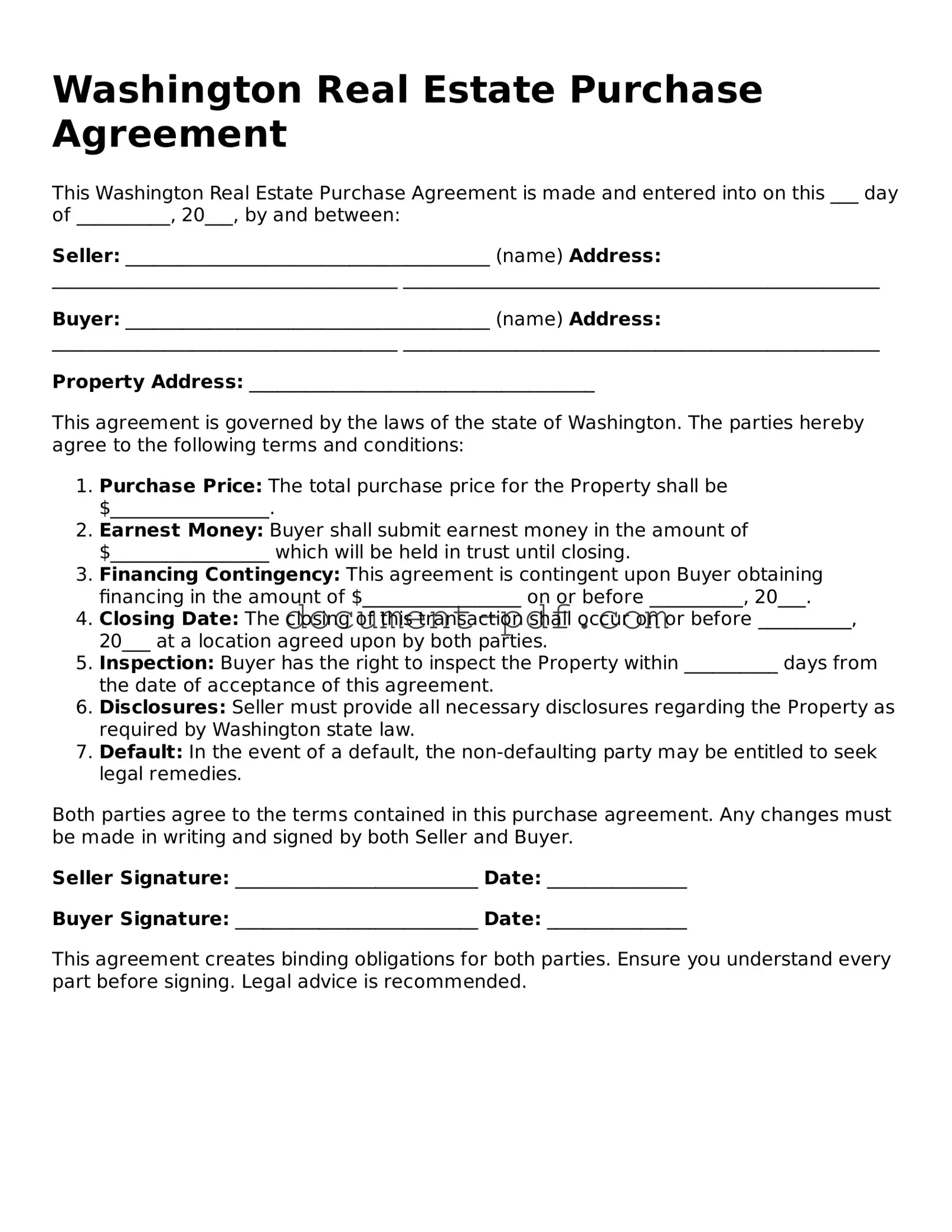

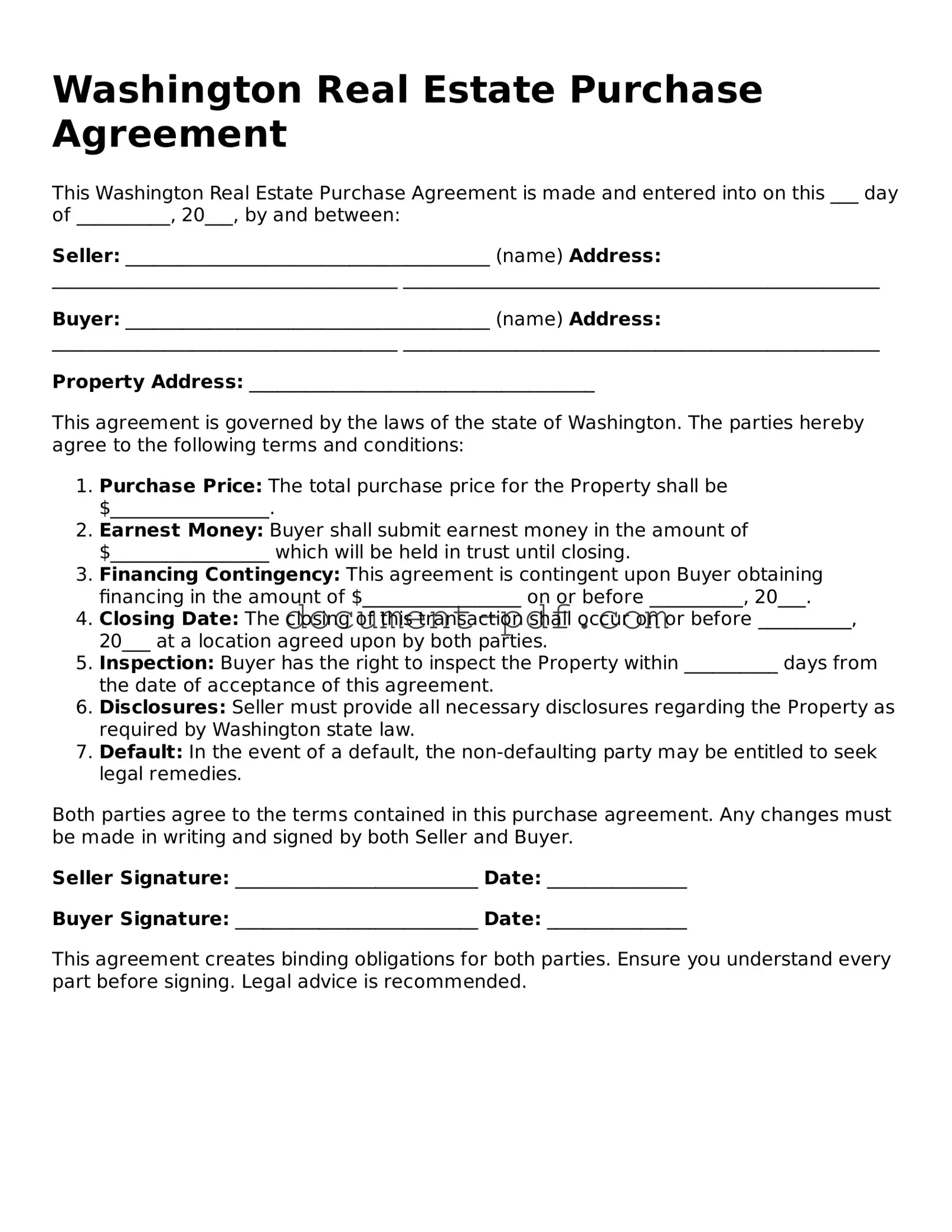

The Washington Real Estate Purchase Agreement form shares similarities with the Residential Purchase Agreement. Both documents are designed to outline the terms of a real estate transaction, including the purchase price, financing details, and contingencies. They serve as a legally binding contract between the buyer and seller, ensuring that both parties understand their obligations and rights throughout the process.

Another document akin to the Washington Real Estate Purchase Agreement is the Commercial Purchase Agreement. While tailored for commercial properties, it also specifies the terms of sale, including price, closing dates, and any contingencies. Both agreements aim to protect the interests of the buyer and seller, though the commercial version addresses unique considerations relevant to business transactions.

The Lease Agreement is another related document. While primarily used for rental situations, it outlines the terms under which a property is leased, including duration, rent amount, and responsibilities of both parties. Like the purchase agreement, it establishes a clear understanding between the involved parties, though it focuses on temporary occupancy rather than ownership transfer.

The Option to Purchase Agreement is similar in that it gives a buyer the right, but not the obligation, to purchase a property at a specified price within a certain timeframe. This document is often used in conjunction with a lease, allowing tenants to secure the option to buy while they occupy the property. It shares the goal of defining terms and protecting the interests of both parties.

A Seller Financing Agreement also bears resemblance to the Washington Real Estate Purchase Agreement. This document outlines the terms under which the seller provides financing to the buyer, detailing the loan amount, interest rate, and repayment schedule. Both agreements serve to clarify the financial aspects of the transaction, ensuring that all parties are aware of their financial obligations.

The Counteroffer form is another related document. It is used when one party makes changes to the original terms of the purchase agreement. This document allows for negotiation and modification of terms, similar to how the purchase agreement establishes initial conditions for the sale. Both documents are essential in facilitating communication and agreement between the buyer and seller.

In addition to the aforementioned real estate documents, individuals may also need to consider the Power of Attorney form, especially if they wish to delegate authority for legal and financial matters. A crucial resource for understanding the nuances of these forms is New York PDF Docs, which provides comprehensive information that can help clarify the responsibilities and implications involved in granting such powers.

The Real Estate Disclosure Statement is also comparable. This document requires sellers to disclose known issues with the property, such as structural problems or environmental hazards. While the purchase agreement focuses on the sale terms, the disclosure statement ensures that buyers are fully informed about the property's condition, promoting transparency in the transaction.

The Title Insurance Policy is another important document related to real estate transactions. It protects the buyer from potential disputes over property ownership and ensures that the title is clear. While it does not outline the terms of sale, it is often considered alongside the purchase agreement to provide security and peace of mind for the buyer.

Lastly, the Closing Statement is similar in that it summarizes the financial aspects of the real estate transaction at closing. It details all costs, fees, and credits associated with the sale. Like the purchase agreement, the closing statement is a critical component of the transaction, ensuring that both parties understand the final financial obligations before the transfer of ownership occurs.